Yesterday I got an alarming Tweet

Changes coming to the Arrival+? What do you guys think? @Drofcredit @PointsWithACrew @milestomemories http://t.co/IOh0VuEkW0

— Credit Card Nirvana (@creditnirvana) July 1, 2015

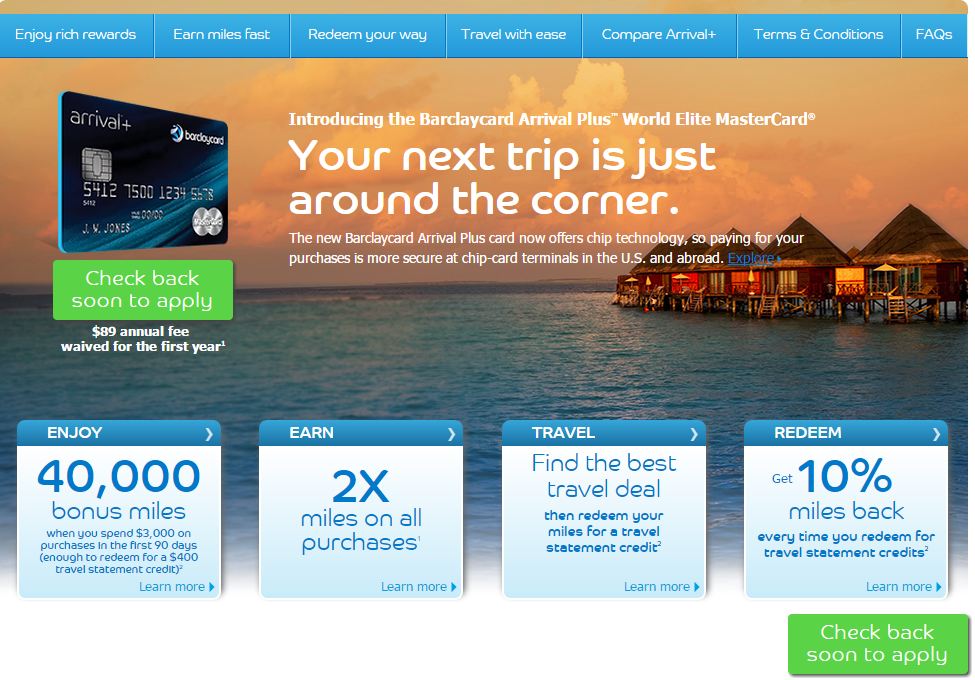

Credit Card Nirvana was talking about the Barclay Arrival+ page, which has changed to remove the link to actually apply

The hypothesis was that the landing page was taken down because Barclay was making changes to the Arrival and Arrival+ cards. Sadly, that does appear to be true. I first read about it on Travel Codex, and Miles to Memories also has some analysis. Mommy Points also spoke with the VP for Barclaycard US and has some good information. Here’s the bad news:

Redemption bonus dropping from 10% to 5%

Currently you get 10% back on all Barclay Arrival redemptions. As an example, I used 11,366 Barclay Arrival points to offset the $113.66 I paid to Avis to rent our car for our recent trip. Then I got 1,137 points back, making my net cost only 10,229 miles.

(SEE ALSO: Using Autoslash to save a ton on your next rental car)

Of course, since we’re a 2 (rental) car family, I had to do that twice…

Now I’d only get 568 points back – this means each dollar spent is only worth 2.1% instead of 2.2% With the number of no annual fee cards that give 2% cash back, it’s hard to justify the Arrival anymore.

No more TripIt Pro subscription

TripIt Pro comes complimentary with the Barclay Arrival card, but will no longer.

Minimum redemption going from $25 to $100

Currently, you can redeem for as low as 2500 Arrival miles – that will be changing to 10,000 Arrival miles or $100. While there are some tricks to redeeming for purchases under the minimum amount, this is still a major bummer. Clearly Barclay is hoping for people to be less likely / able to redeem their miles.

Changes to what counts as “travel”

And by “changes”, you know they’re not going to be good! It’s not clear what exactly will count and not count, but any reduction in what is available to redeem is not good.

These changes took effect yesterday (July 1st) for all new applicants (though I’m not sure how you could apply since the landing page is not working). Current customers will see these changes the statement AFTER their next annual fee hits. Ours just hit a few months ago, so we have about 9 months under the “old” rules.

I think that this is a major gutting of the program, and I will likely be canceling my card once the annual fee hits.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I was afraid that the changes would be for the worse…

Do you think it’s still worth holding on to the no-fee Arrival card? I noticed the different points-back rate the other day, and started wondering what was up… was hoping it was just a glitch…

Depends on your situation. Given how much Barclay doesn’t like churners, you want to save your Barclay “slots” for better cards IMO

My annual fee just posted on my statement on 6/30 (to be paid in the next couple weeks). Does this mean I get basically a full year with the old rules?

That’s my understanding but the exact terms and conditions are still being learned

Will these changes affect those who already have cards? Or will this only affect new customers who sign-up with new agreements?

As I understand it, you will still play under the old “rules” until your next annual fee hits. At that point, you will change to the new model.

Thanks for sharing this post. We were looking at switching to the Barclays card after we return from our next vacation. We were able to almost completely fund a long term vacation with both airline points and credit card points. Still on the look out for a better accruing points card on our return. Have you looked into the Capitol One Venture card? Thanks!

It depends on where you’re looking to go. Generally speaking, my philosophy is if you’re not spending money to meet a signup bonus, it’s time to open more cards 🙂