KEY LINKS:

- Southwest Rapid Rewards® Plus Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $69 annual fee

- Southwest Rapid Rewards® Premier Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $99 annual fee

- Southwest Rapid Rewards® Priority Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $149 annual fee

- Southwest® Rapid Rewards® Performance Business Credit Card – Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. $199 annual fee

- Southwest® Rapid Rewards® Premier Business Credit Card – Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. $99 annual fee

Southwest Airlines is one of only a few airlines to offer special fares to one’s traveling companions (called the Southwest Companion Pass), and it is by far the most lucrative out there.

As opposed to other airlines where you can let a companion fly for a reduced amount ($99 or $149), though generally only on a PAID fare, holders of the Southwest Companion Pass can fly their designated companion for FREE (not including the $5.60 TSA fee). The best part is that this is true on AWARD flights as well as paid flights.

Wait… what?!? That seems too good to be true!!

Yeah it kind of does. Frankly, I’m kind of nervous that Southwest will pull the plug on this at some point, but like all things in this game, one just has to play the rules that exist now – as one door closes, another usually opens… Over time since I first wrote this post in 2014, the rules for the Southwest Companion Pass have changed, but it is still a thing that you can do.

And I haven’t even mentioned the BEST part, which is that once you get the Southwest Companion Pass, it is good for ALL of the remaining calendar year AND all of the NEXT calendar year!! So if you earn it in January of 2024 , it’s good all the way through December of 2025!

So, how do you get the Southwest Companion Pass?

By far the most common way to earn the Southwest Companion Pass by earning at least 135,000 Rapid Rewards miles in one calendar year. You can also earn it by flying 100 flights on Southwest though I would imagine if you fly that much, you’re probably pretty close to 135,000 Rapid Rewards miles anyways.

What counts and what does not?

Okay, so how do you get those 135,000 Rapid Rewards points? Well, the following all count as qualifying points

- Bonus points earned from the Southwest credit card as well as any points earned from spending on Southwest branded cards.

- Points earned from shopping at the Southwest Rapid Rewards shopping portal (I once earned 22,000 points in one day of shopping with 19x bonuses)

- Actually FLYING on Southwest (gasp?!)

Over time, Southwest has limited what types of activity counts towards earning the Companion Pass. You can no longer get Companion Pass points from referring friends to cards, or transferring from hotel partners. And you can also not earn the Companion Pass by transferring points from Chase Ultimate Rewards – which stinks because this is by far the easiest way to GET Southwest Rapid Rewards points!!

It’s also worth pointing out that any bonus points you get for signing up for a Southwest account, or points earned for agreeing to get their newsletter also do not count towards the bonus.

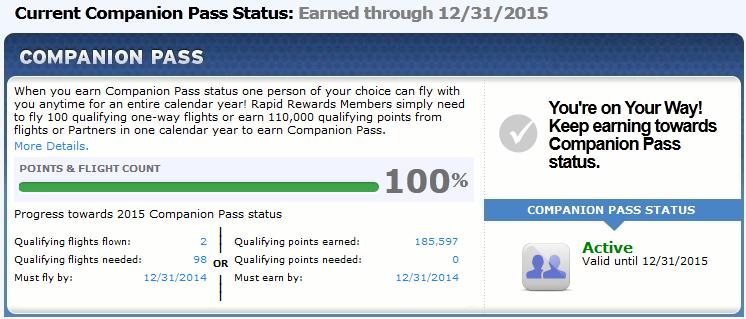

Personally, the Southwest Companion Pass doesn’t work as well for my family of 8, since instead of a “Buy 1, Get 1 Free”, it’s more of a “Buy 7, Get 1 Free”. So the last time I personally earned the Companion Pass was in 2014 – you can see my Southwest Companion Pass status below.

As you can see, I overshot the mark a bit :-). Actually if I had realized how many points I would get in 2014, I might have tried to either spread them account, or credit them to my wife’s account.

How do you use the Southwest Companion Pass?

We first earned our companion pass back in May of 2014, and when it came time to actually USE it, I didn’t feel like Southwest’s website was particularly clear on what to do with it next. So of course I wrote a post about it 🙂

(SEE ALSO: Using your Southwest Companion Pass)

One you earn your companion pass, Southwest will send you an email letting you pick your companion. You can change your Southwest Companion Pass companion 3 times over the life of your Companion Pass, I assume to prevent people from abusing the system.

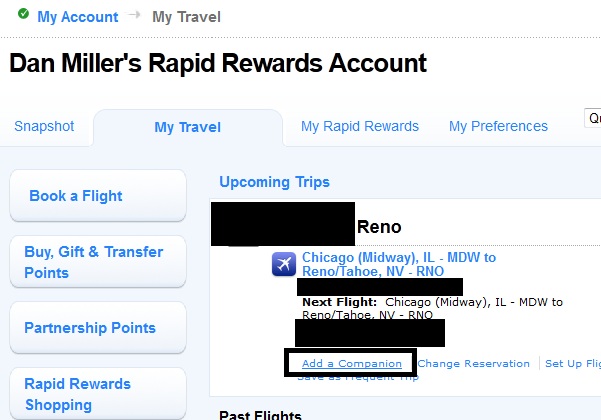

Then, each time you travel, you have to book your OWN travel first – then on your Upcoming Trips page, you’ll be given a link to Add a Companion

How To Earn 135,000 Southwest Points For The Companion Pass

I think by far the best way to earn the 135,000 Southwest Rapid Rewards points for the Southwest Companion Pass is from credit card signup bonuses. Unless you have a lot of Southwest flying (and I mean a LOT), it’s just really difficult to get that many points. There are three Southwest personal cards that you can sign up for:

- Southwest Rapid Rewards® Plus Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $69 annual fee

- Southwest Rapid Rewards® Premier Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $99 annual fee

- Southwest Rapid Rewards® Priority Credit Card – Earn the Southwest Companion Pass® good through 2/28/26 plus 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening. $149 annual fee

Which Southwest credit card is best will depend on what your goals are. If you think that you will benefit from the extra perks of the Premier or Priority cards, you can go for those – otherwise, you might be better off with the Plus card and its $69 annual fee. The rules for getting these cards are that you must be under Chase 5/24, and according to Chase, you are only eligible if “you do not have a current Southwest Rapid Rewards Credit Card and have not received a new Cardmember bonus within the last 24 months”. So you can’t get one of the personal cards if you already have any personal card or have gotten a bonus on any personal Southwest card in the past 24 months.

Note that while the current welcome offers on the personal cards offer a companion pass as part of the welcome offer, that companion pass is only good through February 2026, rather than through December 2026, like it would be if you earned it the traditional way by earning 135,000 Rapid Rewards points.

You are able to get a Southwest personal card if you currently have a Southwest business card (and vice versa)

- Southwest® Rapid Rewards® Performance Business Credit Card – Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. $199 annual fee

- Southwest® Rapid Rewards® Premier Business Credit Card – Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. $99 annual fee

You’ll need one personal card and one business card (generally) to have enough points for the Southwest Companion Pass, unless you have additional points coming in from somewhere. It may make sense to apply for the business card first as many people have reported that it’s easier to get a business card first and then a personal card, rather than the other way around.

The Bottom Line

The Southwest Companion Pass is one of the best travel deals out there – for at least one entire calendar year, your companion flies for free with you on all of your flights (paid and award flights). It takes 135,000 Rapid Rewards points in one calendar year to earn the Southwest Companion Pass, but then you have it for the rest of that year and the entire next year. One of the best ways to get the Southwest Companion Pass is by carefully taking advantage of the welcome offers on Southwest credit cards when they are at elevated levels.

Have you ever earned the Southwest Companion Pass? How has it worked for you? Leave your experience in the comments below

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.