I recently was booking a surprise trip for my wife and I. After consulting the comprehensive guide on the cheapest airport taxes and fees in the Caribbean, we ended up deciding on a trip to Puerto Rico. But the way that the airline schedules worked out, our flight to San Juan (connecting through Baltimore) left from Dayton (an hour away) at the annoyingly early time of 6:00 a.m.

- [VIDEO] Preparing for a surprise trip

- Keeping the secret in a secret trip - planning the trip

- Hotel Review: Fairfield Inn Dayton North

- Using Barclay Arrival miles on small transactions under $25

- #SouthwestHeart Scavenger Hunt January 2015

- Why it pays to check the Chase Ultimate Rewards mall before transferring points

- Hotel Review: Hyatt House San Juan

- Touring the Condado region of San Juan, Puerto Rico

- Old San Juan: a UNESCO World Heritage Site

- Navigating the Old San Juan Trolley

- Update on Southwest TV on Android devices

- Updating my travel maps

- The ledger: Total trip cost breakdown

I knew that getting up at 3 a.m. to drive an hour and then go to the airport was not going to be fun (getting up at 4 a.m. was not much fun either), and since we had our babysitter coming by on Wednesday night anyways, I decided to get a night at a hotel up near the Dayton airport

(SEE ALSO: Bartering airline miles for Babysitting)

Which Dayton hotel to choose

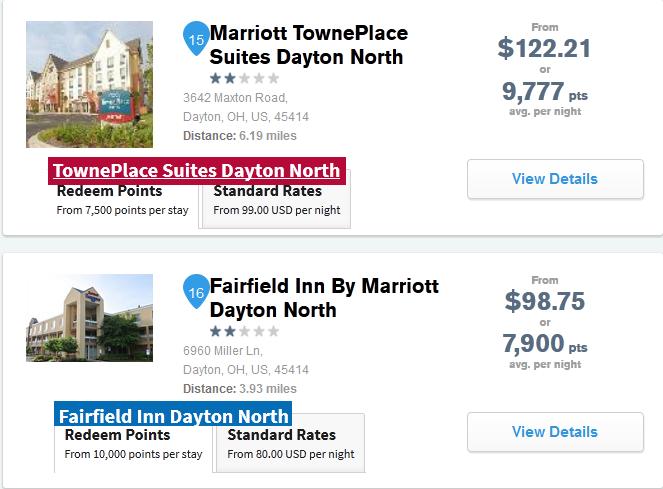

There were a couple of hotels to choose from, but I ended up wanting to decide between the Marriott TownePlace Suites Dayton North and the Fairfield Inn by Marriott Dayton North. Both are Marriott properties, which means that they would transfer from Chase Ultimate Rewards.

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

Before I transferred my points though, I clicked through to the Chase Ultimate Rewards mall to check out the prices.

Comparing the Chase Ultimate Rewards mall with transferring points

I’ve included the cash price and the Ultimate Rewards price (on the right) with the cost in points from the hotel’s website (at the bottom)

You’ll note that because I was using the Ultimate Rewards mall while having a Chase Sapphire preferred card, which means that I get a 25% bonus, which is why a $98.75 hotel only costs 7900 Ultimate Rewards points.

I’m not sure why the Standard rate listed on the hotel website is so much lower than the cash rate that the Ultimate Rewards mall rate, but you can see that in the case of the Fairfield Inn the cost in Ultimate Rewards is quite a bit lower (7900 points) than if I were to transfer my points to Marriott and book through Marriott (10,000).

In the end, even though I could have gotten into the TownePlace Suites by transferring 7500 points, we stayed at the Fairfield Inn

(SEE ALSO: Hotel Review: Fairfield Inn Dayton North)

Earning points

Note that in both cases, you won’t earn any Marriott points for your stay. Even though you’re paying “cash” when booking through the Ultimate Rewards mall, it goes through to the hotel’s system as an Expedia rate, and therefore is not eligible for earning miles. I’d assume the same for counting towards elite status, though I’m not sure about that.

Comparing both options with paying cash

Now there are some that will argue that in situations like this, you should just pay cash instead, rather than burning valuable Chase Ultimate Rewards at only 1.25 cents per point, and if you’re one of those people I can’t argue with your logic.

My defense would be that if you’re points rich and cash poor, it can still make sense. Realistically I have more points than I have real-life time to use them, and so for me, that’s still a good redemption. After all, the best redemption is the one that gets you where you want, when you want to get there!

I have also paid through the Chase Ultimate Rewards mall when booking a rental car

(SEE ALSO: Avis changing the car rental price when I add my Wizard number)

(SEE ALSO: Update! I finally get Avis to stop its dirty trick on me!)

What about you? Have you ever booked travel through the Chase Ultimate Rewards mall instead of transferring points?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I definitely have done this before! A few years ago I had a lot of Chase UR points to the point where I didn’t know what to do with them so I booked a few hotel rooms and flights through them.

I also check ultimate rewards mall’s rate on the merchant hotels.com since I’ve seen them to be 8x at times (normally it’s 3-4X).