I cannot think of a more contentious debate in the miles & points blogosphere than “what’s the true value in cents per mile of redeemed awards?” Well, maybe “are Delta SkyPesos actually valuable”, but that’s a question for another day. 🙂

In all seriousness, the debate over redemption value has launched endless blog posts, and comment section fights, and forum arguments, and on and on…at least, until recently. Much of the rancor has gone out of talking about redemption values. And do you know why?

With the introduction of dynamic pricing, the major US airlines have provided absolute cash values for your miles. That means you always know exactly what your miles are worth when you spend them. And that knowledge is now very important when deciding whether to use them or wait to cash them in.

Cash Price vs. “What Would You Pay”

The two sides of the cents per mile redemption debate have drastically different viewpoints. One side says points are worth the quoted cash value they replace. For instance, if an economy class ticket costs $500 and takes 25,000 miles, then the miles are worth 2 cents each ($500.00 / 25,000 = $.02). You see this a lot with premium travel bloggers who tout huge cash values for their award trips.

The other side says points are worth exactly what you’d pay in cash for the flights or hotel room. If a business class award ticket to Australia uses 100,000 miles, and you’d never pay more than $1,000 to travel to Australia in a lie-flat seat, then your miles are worth 1 cent each ($1,000.00 / 100,000 = $.01). Cash price doesn’t matter to these people.

Personally, I’ve always thought both sides are right, and wrong. Cash prices, especially for luxury travel, are often inflated and unrealistic even for the wealthy. On the other hand, if the “price you’d pay” would never be offered (you’ll never see $1,000 business class round trips from the U.S. to Australia), then that makes redemption values theoretically worthless, as you’d never find actual value.

You may only want to pay $500 to sit here, but that doesn’t mean they’ll ever sell it for that price.

I think points’ and miles’ values are somewhere in the middle: they are worth what you’d pay plus the extra happiness or need you receive from redeeming them. That’s why the value of points and miles is so personal: only you can decide what that “extra” value is.

Cents Per Mile and Dynamic Pricing

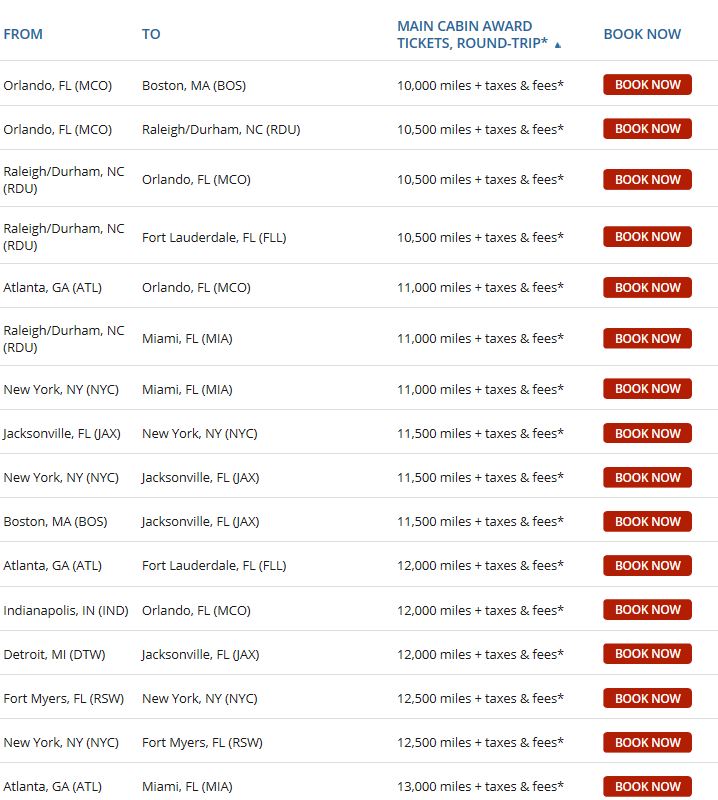

Over the past few years Delta, United, and now American Airlines have all introduced “dynamic” award pricing for their flights. Hilton has done the same with their hotels. Alaska Air has both a chart and a range of award prices, and Marriott is inching that way with peak pricing. Southwest Airlines has long used Rapid Rewards points as a substitute for cash.

Dynamic pricing is simply tying the points cost of an award to the cash price of the fare/hotel night. That means award prices are always changing, as cash prices fluctuate in real time.

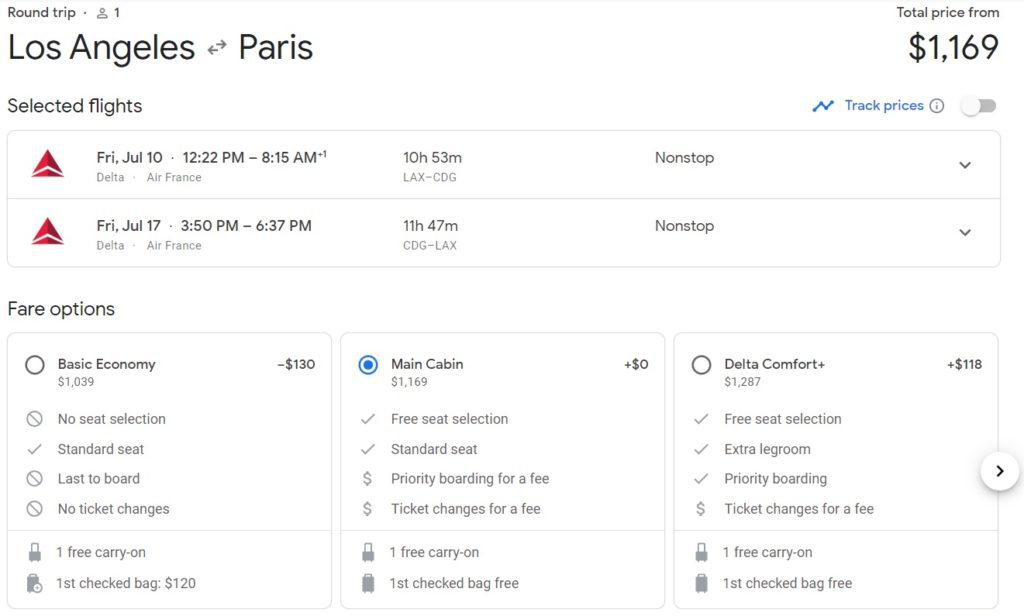

Interestingly, that price fluctuation means you now always know the exact value of your miles for any specific flight. But that’s only once you open “Schrodingers box” and look at the exact flights you want. For example, here is an economy trip from Los Angeles to Paris in summer on Delta. First the cash price, typical for high season.

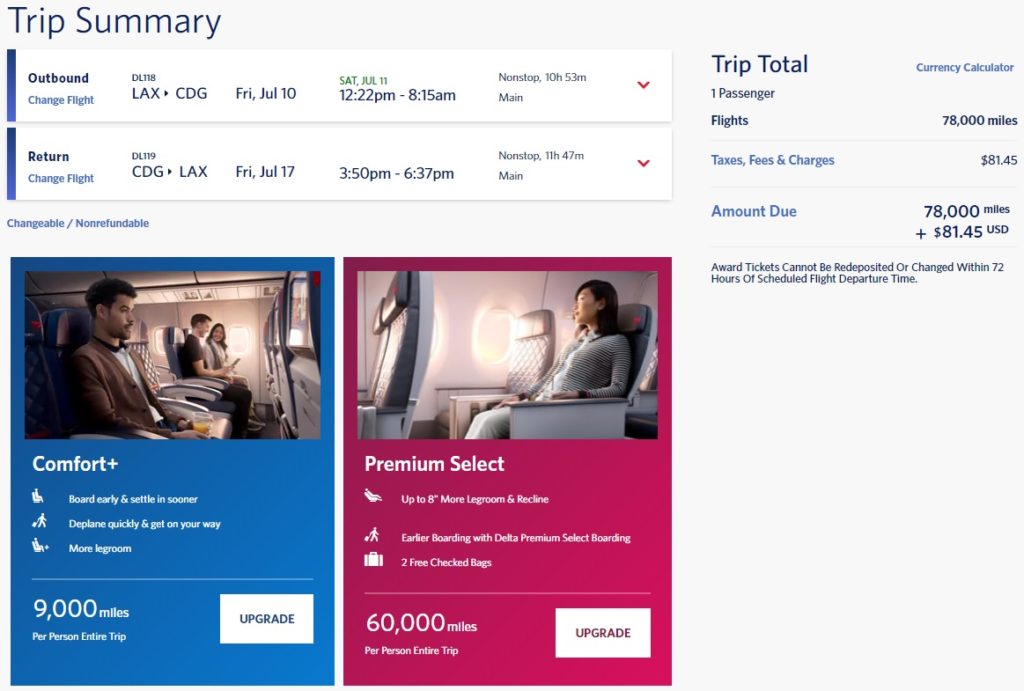

The same flights are also available with Delta SkyMiles, plus taxes and fees.

With award charts and fixed award prices, you would generally pay the same price for all the flights between the cities, for any date, no matter the cash price. You could know the “cents per mile” for any flight at one point in time when you searched, but since cash prices fluctuate constantly you could only estimate the value as those prices changed. Now, with dynamic pricing, you know precisely what your miles are worth at any time, with simple math.

In the above example, the SkyMiles are worth 1.4 cents per mile.

$1,169 – $82 = $1087.00

$1087.00 / 78,000 = $.014.

You can do the same easy equation for any redemption. In general, with the exception of sales and specials, economy fares for domestic airlines fall within a specific range. That is: you’ll generally find your miles worth 1.3 – 1.8 cents per mile for coach flights.

Why Does Cents Per Mile Matter?

Now that you know exactly what you’re getting for your miles and points, why does it matter? Because now you know for certain whether you’re receiving a good value for your miles.

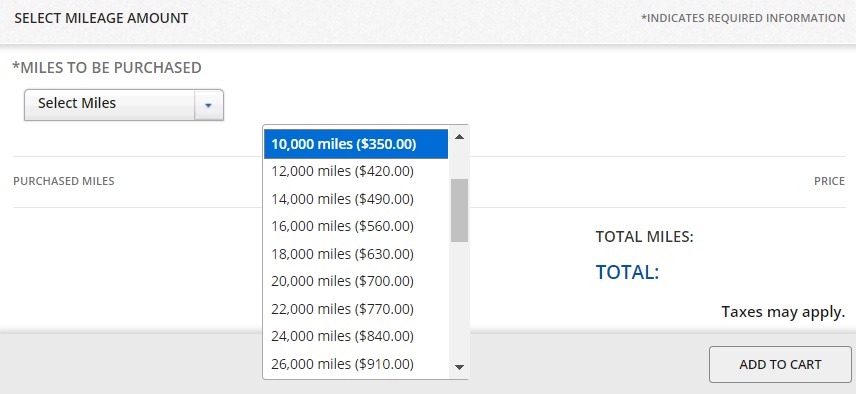

For instance, people often wonder if they should buy miles outside of a sale? Delta’s miles cost 3.5 cents each normally; American’s and United’s prices are similar. If you’re getting less than half of that value when redeeming them, then don’t buy the miles! Even on sale for around 2 cents each they still cost more than they’re worth for many redemptions. Just buy the flight instead (and earn a few miles).

You also have a clearer understanding of your credit card choices. Much of the value of points and miles is now with overseas frequent flier programs. The easiest ways to tap into those are with transferable points credit cards. If the awards you want generally give you 1.4 cents per mile, maybe you should apply for a Chase Sapphire Preferred instead of a United MileagePlus card? or an American Express Membership Rewards card versus a Delta AMEX?

And of course knowing the absolute value of miles means you can make better choices if you have the opportunity. Most people don’t maximize their miles, as we’ve seen time and time again. Once you do, your miles will go a lot further…or you’ll go a lot more comfortably.

Conclusion

Points and miles redemptions in most US frequent flier programs are now worth the exact cash price. The luxury travel bloggers won, at least when talking about US carriers’ flights.

However, the question for members of those programs is now purely subjective: are you happy to use your points at the stated value? As I said before, only you can answer that question. But now you don’t have to guess, you can say for sure that the value is good or bad with the exact cents per mile value.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Perhaps do an article on why airlines will be in deep financial trouble in 2020, as they no longer can sell billions of miles to credit card companies (because nobody wants a miles that is just worth $0.01).

LAX-CDG on these same days is available for $816 on Norwegian, so the miles are worth only 0.941, not 1.4 cents.

In reply to ED above. Maybe, maybe not. Only a small percentage of bank card customers are savvy like you and me. They still get thousands (millions?) that have no idea what the value is and often never even use their miles. Good example. Talking to brother recently and he has a trip booked for fall on WN. He was mad at himself because he got the wrong card – UA card 3 years ago. He has been building miles all this time and will not even use it. The idea of getting another card is beyond his comprehension, even though we knows we fly around the world in biz all the time for free.