I have written several times before about using Plastiq to pay your rent / mortgage. This is something that I use to pay the mortgages on some of my rental properties. There is a 2% fee for using Mastercards, though Plastiq does offer periodic rate deals.

Personally, I use the Citi AT&T Access More card, which gives 3x ThankYou points on online purchases. The ATTAM card is currently not open for new signups, but there are still ways to get the card.

(SEE ALSO: How you can still get the AT&T Access More card)

Through the end of the year, you can get double points on Plastiq purchases on most American Express cards, because Plastiq is coding as a small business and therefore is eligible for double points through the Amex Shop Small promotion. It will depend on your own personal valuation whether you value 2x Membership Rewards or 2x Starpoints over 3x ThankYou points

Paying mortgages with Plastiq

The one annoying thing about paying my mortgage with Plastiq is that my AT&T Access More card only has a credit limit of $1000. While thankfully I live in the cheap Midwest (so the mortgages on these houses are at least UNDER $1000 / mo), I can only pay one at a time before having to pay off my card in order to pay the next mortgage. From what I’ve been told, I have to wait until the card is 12 months old before Citi can change the credit line on the card.

Changes to Plastiq’s site

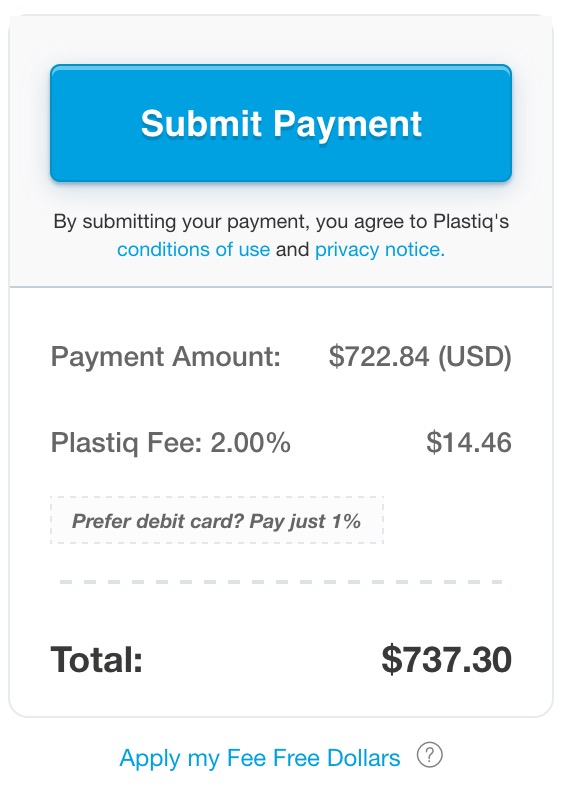

Thanks to readers like you who have signed up for my Plastiq referral link, I have a bunch of “fee free dollars” (FFD). If you are in the same boat as me and have an FFD, one thing you’ll need to watch out for now is that Plastiq apparently has CHANGED their website, so FFD are NOT taken off automatically

In order to apply your Fee Free Dollars, you have to click the blue link to apply them. If you don’t click that blue link, you’ll be charged Plastiq’s fee, even if you have a billion fee free dollars. This feels like a pretty user-unfriendly change to me – at least 95% of the time you would always want to use your FFD on your next payment, so defaulting to not using them seems like a money grab by Plastiq to me

So watch out and be careful out there!

If you haven’t signed up for Plastiq, you will earn $200 fee-free dollars by signing up through my link once you make your first payment of $20 or more, and I will also earn a bonus.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The link to apply your fee-free dollars is right there under the total price before you submit.

And I can actually think of plenty of times you wouldn’t want to use your fee-free dollars. You may be paying someone who will cover the cost of payment. You may be paying a bill for your employer where the fee could be reimbursable. Or you may be paying a business expense where the fee would be deductible. In any of these cases you’ll want to save your fee-free dollars for other, personal expenses.

I realize these scenarios don’t describe cases that everyone runs into. Just suggesting that there are circumstances that others will have where this feature is useful IMHO.

Thanks for the comment Gary – I agree that there are circumstances where you wouldn’t want to use them. Originally (I think) I had written that I couldn’t think of a scenario where you wouldn’t want to use them. Then I changed it to be just that I thought it much more likely that you WOULD want to use them than you WOULDN’T.

As you point out, I think there are scenarios on both sides but the (overwhelming?) majority would favor using them. So I think a more customer friendly way to implement things would be to have them applied by default and give you a link to take them off

My credit limit was raised after 6 months automatically due to the amounts I was spending and paying off each month

“From what I’ve been told, I have to wait until the card is 12 months old before Citi can change the credit line on the card.”

It is actually 6 months. I’ve just tried with my AT&T Access More (which is 5 months old) and I got a message from Citi saying that. And that was even after a screen saying it was going to be a soft-pull. Try it yourself on the Citi mobile app