Reader Jana writes in to say

Since we are spending 3 weeks overseas this year I am looking to add a credit card that does not charge foreign transaction fees and has chip and PIN enabled. I am thinking of the Chase Sapphire Preferred Card or the Capital One Venture Rewards card. What do you think?

What is a “chip” (EMV) card?

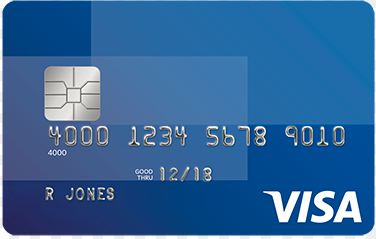

Chip and PIN cards have been commonplace in Europe for several years, but Chip and PIN cards have been coming to the United States over the past few months. Instead of (or in some cases, in addition to) having a magnetic stripe on the back of the card, there is a chip on the front of the card (see image below)

When you’re ready to pay, instead of sliding your card (as you’re probably used to), with a chip and PIN card, you put the card into the reader (with the chip side in the reader), and leave it in there while the reader checks the card (and makes sure you’re authorized).

Many retailers have started rolling out the new chip enabled credit card terminals – I know I’ve seen them at Target for example.

The big reason we’re hearing more and more about chip and PIN cards is that as of October 1, 2015, the fraud burden of liability is shifting. Whereas before all fraud liability rested with the issuing banks, now if there is fraud committed at a retailer who is not using an EMV / chip terminal, the fraud liability is with the RETAILER!

US Chip and Signature enabled cards

Most cards in the US are not Chip and PIN cards, but instead Chip and Signature cards. With a Chip and Signature card, your card has an EMV chip inside it, but after you insert your EMV card into the terminal, you still sign a credit card slip

With a chip and PIN card, after you use the credit card terminal, instead of signing a paper slip, you enter in your 4 digit PIN as your confirmation / authorization

Note that this kind of increased security doesn’t really help you with online fraud

US Chip and PIN cards

The US is still several years behind Europe with Chip and PIN cards, so while there are starting to be more and more cards that have a chip installed, most of them are still chip and signature cards rather than chip and PIN cards.

With our upcoming trip to Europe, I wanted to make sure to get a card that had Chip and PIN functionality. While most places in Europe that take credit cards will do chip and signature, I knew at places like automated ticket kiosks you need a chip and PIN card. And in fact, while we were there, the only time we ended up needing the chip and PIN functionality was adding money to our Oyster card on the London Underground.

Chip and Pin cards with no foreign transaction fees

Many cards charge a fee (usually at least 3%) for any transactions in a foreign currency. So, if you’re heading to Europe, you want to avoid those cards that charge foreign transaction fees!

The only card that many miles and points folks might have that I saw was the Barclay Arrival Plus card. Widely panned when they gutted the rewards system, we still had one (I canceled mine but my wife’s anniversary had already passed so she’s good for another year). It’s still worth getting one for the signup bonus but I wouldn’t put any spend on it – though it comes in handy for its chip and PIN functionality.

Here’s a list of the cards with no foreign transaction fee that I have links for – though there are others. (If you apply for any card through this link, I do receive a commission)

Setting the PIN on my Barclay Arrival Plus Chip and PIN card

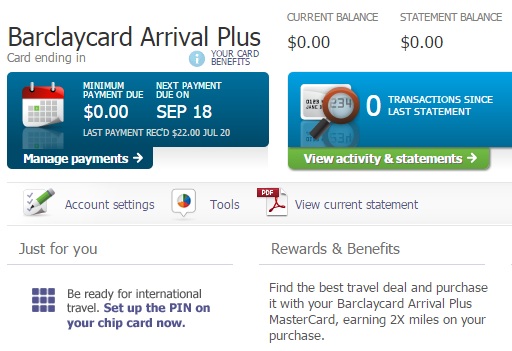

Since the Barclay Arrival Plus card was my only Chip and PIN card, I made sure that it was in my wallet for our trip to Europe, just in case I needed it. Before I went, I went online to setup the PIN. On the main account page, there was a place to set up the PIN

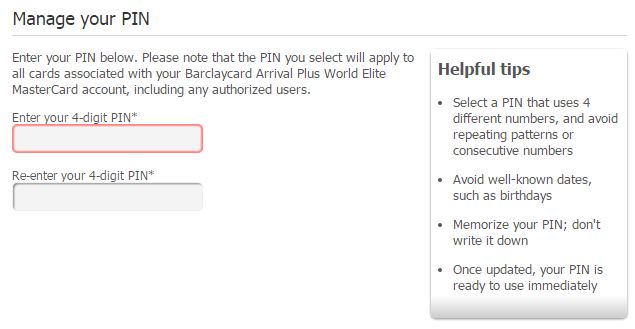

Clicking on that link takes you to the “Manage your PIN” screen

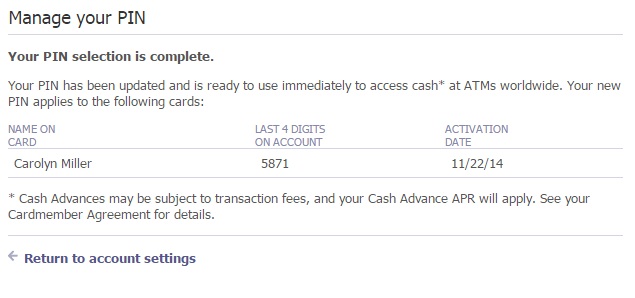

After you enter in your PIN, you get a confirmation page

And that’s it! Your Chip and PIN card is set up to use (and I can confirm that it did work for us in London). With Chip and PIN cards becoming more and more prevalent, you’ll definitely want to become more familiar with what they are and how they work!

Any tips on chip and PIN cards? Leave them in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

My USAA Mastercard is chip and pin, but it has a 1% forex fee so I would only use it when I couldn’t use my CSP. But, it’s a decent card @ 1.5% cash back.

Where did you need a chip and pin for oyster? I used the machine at one of the tube stations as well as the tourist office in paddington station with chip and signature.

My Barclay Arrival Plus neeeded a PIN when I tried to add money at the automated kiosk at the Green Park station of the Underground

The Barclays Arrival is not a true chip and pin, it’s a chip and signature with a pin fallback. I’ve used it in Europe and Asia extensively in the last two years – and it’s almost always required a signature. As another negative, it doesn’t seem to work real well with unattended or non-online terminals (e.g. train tickets).

That is true – when I used it at non-automated places, it did print out a signature paper for me to sign

I used my Chase Sapphire Preferred with chip at kiosks at Tube stations in London to add money to my Oyster card. It didn’t ask for the pin or make any fuss at all. The transactions went through without any additional check. I guess it was because the amount was pretty low (less than 30 pounds from what I remember.)

That’s a good piece of feedback. I wasn’t sure if the Chip and Signature cards (like the Chase Sapphire Preferred) would work at those kiosks so I wanted to make sure that I had one that had chip and PIN functionality

I’ve also used my chase sapphire at unmanned kiosk. I used it to pay for automated parking ticket machine. It went through. Haven’t tried at gas station.

Most place will accept chip & signature, unless incompetent employee doesn’t know how to use machine and refuses.

This is not a chip and pin. It’s a chip and signature. If you use it at a chip terminal you’ll be asked for your signature.

The pin you set is for ATM withdraws.

And I’ve been to the UK and used it all over. Every single time it asked for a signature.

Please do your research before posting.

Thanks for your kind words!

As I have commented on earlier posts, I can only report on my own experiences. It is true that at most places it did print out a paper for my signature, but when I tried to add money at the automated kiosk at the Green Park station of the Underground, it did ask for a PIN (and when I put the wrong PIN in by mistake, the transaction did not go through).

Also, if you look at the screenshot of the Barclay website, it says “Be ready for international travel! Set up the PIN on your chip card now), which makes me think it is more than just for ATM withdrawals

I was just there last week so perhaps things have changed recently?

Actually, it IS a chip and PIN when there’s no possibility of signature. I used it, for example, to fill my tank with gas in Belgium.

I’ve used it extensively in Europe and the U.K. Mostly a signature is required. But at unattended terminals, the PIN works. Thank goodness. But it’s not like the miracle of real chip-and-PIN, which works like a charm all over the world except not in the States. Not many credit cards are much use in Germany, though, where they favour Euro-denominated debit cards.

I believe ALL the cards issued by US banks are, at best, Chip-and-Signature with a Pin fallback if no signature is possible. I have a Wells Fargo Advisors card with no ForEx charges that works that way.

Even these Chip-and-Signature with a Pin fallback cards are rare; most are Chip-and-Signature only. I don’t understand why Banks have taken this practically useless half step. The terminals that are being installed all have pin pads.

There’s a bit of confusion with this, it being still a new feature in the US. The card has to have an EMV chip, obviously, but it also has to have Chip-and-Pin set as one of its preferred verification methods. By now most US cards have chips, but very few of them have Chip-and-Pin in general, much less as their first such method. That’s in large part because most of our stores don’t do pins, some of them haven’t even turned chip-and-signature on yet, that is they don’t do chip at all.

Being that I’m very familiar with it, I know that Prepaid REDcard for instance will do pin at first attempt if the store register is also set to do so (at Target for instance). If the pin option is not available at a particular POS, it will complete the purchase with one of the other two methods (chip-and-signature or magnetic strip).