A month or so ago, I talked about three varieties of cash back style cards – Barclay Arrival, Citi ThankYou Rewards and CapitalOne Venture. It’s actually one of my more popular posts, and I continue to believe that these types of cards are best for most people to use when they’re not trying to meet spending requirements or in places where they earn at least a 3x category bonus.

I recently became aware of a pretty good signup offer for the US Bank FlexPerks card, which is a similar style of card. Typically the offer is for 20,000 bonus points after spending $3500 in the first 4 months of the card. They have a promotion going with the Winter Olympics where you could earn additional points based on the number of medals that the US Olympic team won.

I forget what the actual formula was that they used, but who cares about that – all we want to know is the final answer!!! :-).

As you can see, those 28 medals turned into 7,450 extra points. Now this is a limited-time offer – you do have to apply and be approved by March 7th – so only about another week to apply.

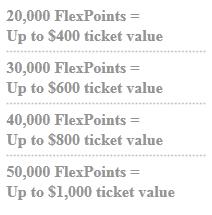

But what can 27,450 FlexPoints get you? Well, the annoying thing about FlexPoints is that you have to reach an exact level to redeem them. So a $400 airplane ticket costs you 20,000 Flex Points. But a $401 airplane ticket costs you…. 30,000 Flex Points. Ugh. Contrast this to something like the Barclay Arrival Card, where it would be 40,000 for the $400 ticket and 40,100 for the $401 ticket.

But what can 27,450 FlexPoints get you? Well, the annoying thing about FlexPoints is that you have to reach an exact level to redeem them. So a $400 airplane ticket costs you 20,000 Flex Points. But a $401 airplane ticket costs you…. 30,000 Flex Points. Ugh. Contrast this to something like the Barclay Arrival Card, where it would be 40,000 for the $400 ticket and 40,100 for the $401 ticket.

As a side note, am I the only one annoyed with the differing redemption values for these cards. I mean, can we decide whether we earn 2 points per 1 cent spent, but then each point redeems for 1 cent (Barclay) or do we earn 1 cent for each 1 cent spent, but each point redeems for 2 cents (Flex Points). I mean, they’re mathematically the same, but it’s annoying trying to remember which is which….

Note that when I (and the US Bank website) talk about redeeming for up to $400 “ticket value” – you have to book it through their travel portal. I believe it’s powered by Travelocity so it should typically find as good a deal as anywhere else.

You’ll notice that since you have to redeem in 10,000 point increments, a 27,450 point bonus isn’t THAT much better than a 20,000 point bonus. But, since you have to spend $3500 on the card to get the signup bonus, that will actually put you over the 30,000 point threshold, meaning that it will be good for up to a $600 ticket value. Obviously this does best when the ticket is as close to $600 as you can make it.

You’ll notice that since you have to redeem in 10,000 point increments, a 27,450 point bonus isn’t THAT much better than a 20,000 point bonus. But, since you have to spend $3500 on the card to get the signup bonus, that will actually put you over the 30,000 point threshold, meaning that it will be good for up to a $600 ticket value. Obviously this does best when the ticket is as close to $600 as you can make it.

So what do you think? I plan on getting this card in my next churn – what about you?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Can you use this card for travel related expenses or just flights? i.e. hotels, resorts, Disney tickets ,etc.?

I was actually wondering the same thing and I THINK that it is only for flights. It looks like you have to go through their travel portal, and as I understand it it only does flights.

I tried to get into the portal, but you only can access it if you’re already a customer.

That’s another reason this card isn’t as good as the Barclay Card, but still a free $600 is better than a kick in the pants 😛

Thanks for the detailed description! We just got the card (x2) but haven’t met spend yet. I hope it’s easy enough to redeem for the flights…we will see!

You’ll have to let me know when you find out! I plan on applying for the card probably within the next week (deadline is March 7th!!)