Way back in 2016 (okay, okay it was just last week), I wrote about a new Citibank credit card application that did NOT have the 24 month exclusionary language

(READ MORE: Citi AA Platinum 50K offer WITHOUT the 24 month language)

The big news about this offer is that looking through the terms and conditions of the application, there was no language excluding the bonus from people that had opened or closed an AAdvantage card within the past 24 months.

You’ll probably recall that a few months ago, Citibank changed their rules so that if you have opened or closed ANY Citi AAdvantage card within the past 24 months, you won’t get a signup bonus. You can see the language on most of their credit card applications – here is what it says on the application page of the public offer

American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than a CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.

(SEE ALSO: Credit card application rules and best practices for each bank)

This 24 month exclusionary language is NOT on the link in this post. My wife and I both applied for the card and were approved (after having to call in and move some credit around.

Update on my Citi AAdvantage card

Even though the Citi rep confirmed that the bonus was on my account, there have been plenty of reports of people still not getting their bonus.

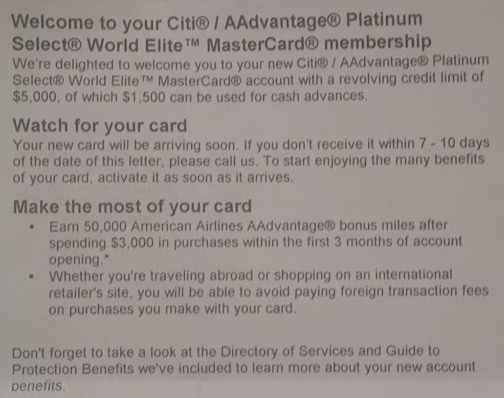

Last night, as I was going out to inspect my mailbox that had been run over by a rogue pizza delivery guy, I noticed I had two letters from Citibank. One to me, and one to my wife, and each one was a welcome letter, confirming the bonus

Neither letter mentions anything about the 24 month language. So while Citi still might try to deny it, at this point, with these letters in hand, I think I would have a pretty good case even if I had to escalate to the CFPB.

I believe the 50K offer I wrote about last week is still available (at least the application page still comes out with no 24 month language), so if you were on the fence last week, maybe this will tip the scales for you

Did you apply for the recent AAdvantage deal? Have you received a similar account approval / welcome letter?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I also applied, moved credit and was approved for the card. And I have not yet received the welcome letter. But my understanding from everything I have read is that if the letter refers to the bonus, then you’ll get it. And if it doesn’t, you won’t. Calls to representatives can result in false information and only increase the odds of the offer being pulled or potentially not honored (although I feel CITI knows exactly what they are doing and offering).

After all the horror stories about the Citi checking bonuses, I am really interested to see how this plays out. I considered applying for the card when the news hit about the app w/o the 24 month language, but I am really skeptical about what Citi’s response will be.

And having to escalate to the CFPB sounds painful.

Yes, I applied and got an instant approval. I received the welcome letter yesterday and I have the same welcome letter like you WITH 50K after $3K spend. Also have the same card opened about 7 months ago. We will see if I get the sign on bonus after meeting spend requirement.

We got offers in the mail from American and my wife applied through the link. We spent the minimum money for the card, but got no notice. Citi through up the 24 month thing. I may make another go at them.