KEY LINK: Chase United℠ Business Card – Earn 125,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $99. (click ‘Business Cards’ on the top to see the business card)

We all like flying here at Points With a Crew. And we like saving money. That’s why you’re here. If you’re in the market for a new business card, the Chase United℠ Business Card is a great option!

Chase United℠ Business Card Review – The Details

Here’s a link to the welcome offer on the Chase United℠ Business card!

- Earn 100,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $99.

- Earn 2 miles per $1 spent on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting.

- Priority boarding for the cardholder and their companions on the same reservation

- Free first checked bag for the cardholder and one companion on the same reservation (when you use this card to book the fare)

- No foreign transaction fees

- Two United Club Passes annually

- Get one-year complimentary DashPass, a membership for both DoorDash and Caviar that provides unlimited deliveries with $0 delivery fees and lower service fees on eligible orders. After that, you are automatically enrolled in DashPass at the current monthly rate. Activate by 12/31/24.

- Purchase protection, auto rental insurance, trip cancellation insurance, lost luggage insurance, and bag delay insurance

- $0 intro annual fee for the first year, then $99

What can you get with all those miles?

A lot!

United has a great mileage program. While it won’t always provide astronomical value, it’s a great currency and consistently ranks near the top for airline loyalty. There are a few things I love about the MileagePlus, but the best part is the United Excursionist Perk. Although not quite as good as United’s old routing rules, the Excursionist Perk still allows you to get and extra one-way/open jaw flight in the middle of your roundtrip. So if you book a roundtrip from Newark to Brussels, for example, you can put an extra city in your itinerary at no cost. A roundtrip from Newark to Brussels costs the same as a trip from Newark to Brussels, then Brussels to Paris, then Paris to Newark.

Although United no longer has an official award chart, you can still get one way flights in within the continental US for as low as 10,000 or 12,500 miles (or sometimes even lower). That’s up to 7 one-way flights with this bonus! Or if you’d rather go big…book a one-way business fare to Asia or Europe with these miles! United also shines as a Star Alliance partner. There are some fantastic uses of United miles for partner awards all over the globe.

The Real Benefit of the Chase United℠ Business Card

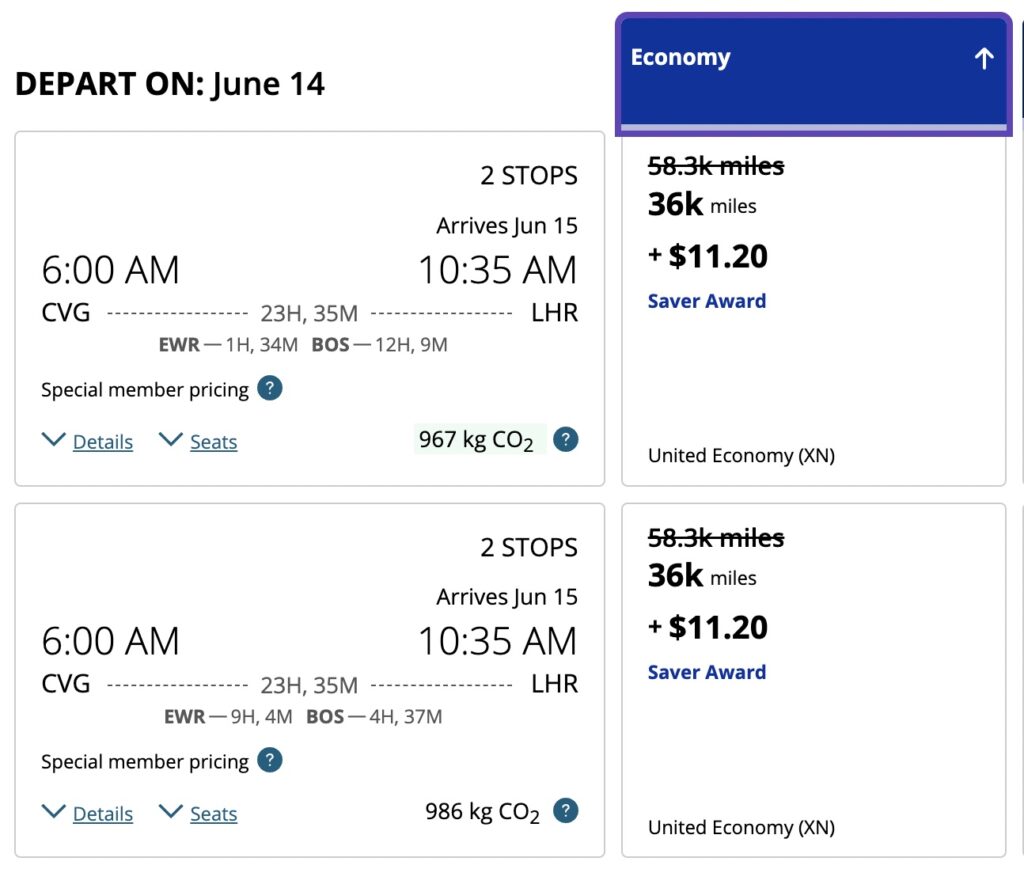

I signed up for this card a few months ago and I have been enjoying one particular perk – the increased award availability. United gives better award availability to elite members and people who hold one of their cobranded credit cards, like the United Business card. It’s not uncommon to see things like this when searching for award availability on United.

The crossed out price is the “regular” price while the lower price is only shown to elite members and people who have a United credit card. Just make sure that you’re logged into your MileagePlus account when searching. This has already saved me a few times. I got the card initially because of the waived annual fee the first year, and I’m considering keeping it when the annual fee is charged on my anniversary.

(SEE ALSO: 13 cards I’ll consider paying the annual fee on)

Other Ways To Get United MileagePlus Miles

Keep in mind that Chase Ultimate Rewards points transfer 1:1 to United MileagePlus miles, as long as you have a premium Chase card. So if you’re trying to get United miles, here are a few other cards you can get that will help:

- Chase United℠ Explorer Card – Earn 80,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $95. Read our full review here.

- Chase Sapphire Preferred® Card – Earn 100,000 bonus points after $5,000 in purchases in your first 3 months from account opening. $95 annual fee. Read our full review here

- Ink Business Preferred® Credit Card: Earn 90,000 bonus points after you spend $8,000 in your first 3 months. $95 annual fee. Read our full review here.

The Bottom Line

KEY LINK: Chase United℠ Business Card – Earn 125,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $99. (click ‘Business Cards’ on the top to see the business card)

So a few things to remember – first the United Business card will be subject to Chase’s 5/24 rule. And you may have a business even if you might not think that you do.

If either of those conditions apply to you, you are likely to be out of luck on this particular offer.

Will you be applying for the United Business card? Let us know in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I think the no annual fee title is a little misleading given that is actually just waived for the first year.

That’s fair – I’ll tweak the headline

Headline days 75,000 miles but text says 50,000

Are you sure you have the latest version of this post? We periodically update this post as the offers change.

Currently, I see it as 50,000 miles everywhere in the post and the title says “United℠ Business Card Review – now with 1st year waived annual fee”

If I book a United flight with LifeMiles and hold a United Business card, are there any benefits extended to the booking? Does it matter if the United Business card is used to pay the $5.60 fee? Mostly curious about free baggage.

I have received free baggage on American when booking with Avios and holding the AA credit card.

Thanks!

I think the timing on this one is a little off considering the bloodbath devaluation that United just nailed loyalists with this last week. If United had hiked the signup bonus by 100% to keep up with the devaluation this might be okay but that’s not how Kirby operates.

Hi Dan. When I clicked on the link for the card it took me to The Points Guy. Is this an error, or are you affiliated with TPG?

Thanks for asking Jacob – I do run some of my credit card affiliations through The Points Guy / Red Ventures – thanks for your support if you apply for a card through that link!

The same thing can be achieved with the no annual fee United Gateway card, which has no AF. Other than sign up bonus, this card has poor value. Sure you can pair with a personal card to get 5K miles annually but they simply don’t justify for the AF unless you value United Miles more than 2 cpp.

Also, this business card is lacking the no-AF downgrade option like it’s counterpart personal card.