So all these signup bonuses are good, right? They are probably the #1 source of getting points, but it can take some careful planning to make sure that you actually MEET all the requirements for earning the bonuses.

Credit card companies are not quite as bad as rebate companies as far as just denying valid cases, but you do need to make sure that you meet the requirements laid out, especially if you do a “churn” where you apply for several cards at once (like I did back in January 2013).

Different people have different ideas for the best way to track it. My “system” probably deserves a post to itself, but basically I have a spreadsheet with several tabs that I used to track spending, card login info, bonuses, etc.

- The Basics

- How does signing up for credit cards affect your credit score, Part 1

- How does signing up for credit cards affect your credit score, Part 2

- Meeting spending totals on credit cards

- Tracking signup bonuses (and making sure you GET them!)

- Earning miles through shopping portals

- The truth of the travelers's triangle: The relationship between time, price, and location

- Begin with the end in mind

On the “bonuses” tab, I make a column for each card I signup for, I mark the expected bonus, the spending requirements, and the time-frame to make that spending. I have a row for the month, and each month when I get my credit card statements, i mark the balance as achieved spend for that card. I also have a row for “Not on Statement yet” spend, for cases where a deadline is coming up in between statement dates.

This has worked for me almost every time. Only one time has it come back to bite me. Carolyn had an offer for 50,000 American Express Membership Rewards points after spending $1,000 in 3 months. At the time, I had several other bonuses I was tracking and this one just slipped my mind. I had put about $500 on it but by the time I realized the deadline was coming up, I missed it by one day.

Lots of times companies will work with you if you’re close, but Amex would not budge. Several online chats and phone calls later, I got nothin. That stinks. Membership Rewards are also a transfer partner of British Airways, so those 50,000 points could have gotten turned into 5 roundtrip tickets to New York, with some left over!

I almost did the same thing again with my recent Southwest card. I applied for and was approved for the card on October 7, 2013, with a signup bonus of 50,000 Rapid Rewards points for spending $2000 in 3 months. Because I was angling to get the Southwest Companion pass in 2014, I didn’t want to put any of my spending on the card until the new year. But when Jan 1 hit, I lollygagged around and when the 7th came, I was still short a bit. I put some spend on the card with Amazon Payments, but late in the day on the 7th that transaction (which was enough to put me over the $2000 spend) was still showing as “Pending”.

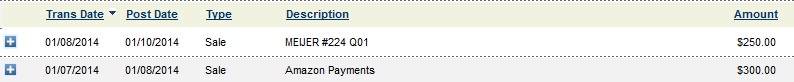

Not wanting to leave it to chance, I went out and bought a bunch of gift cards, but those too showed up as pending. Eventually the first cleared with a “Transaction Date” of Jan 7th but a “Post Date” of Jan 8th.

You can see that my late night Meijer run ended up with a transaction date of the 8th, even though the purchase was made on the evening of the 7th. I talked with Chase a few times but nobody I talked to seemed to know anything definitive one way or the other.

You can see that my late night Meijer run ended up with a transaction date of the 8th, even though the purchase was made on the evening of the 7th. I talked with Chase a few times but nobody I talked to seemed to know anything definitive one way or the other.

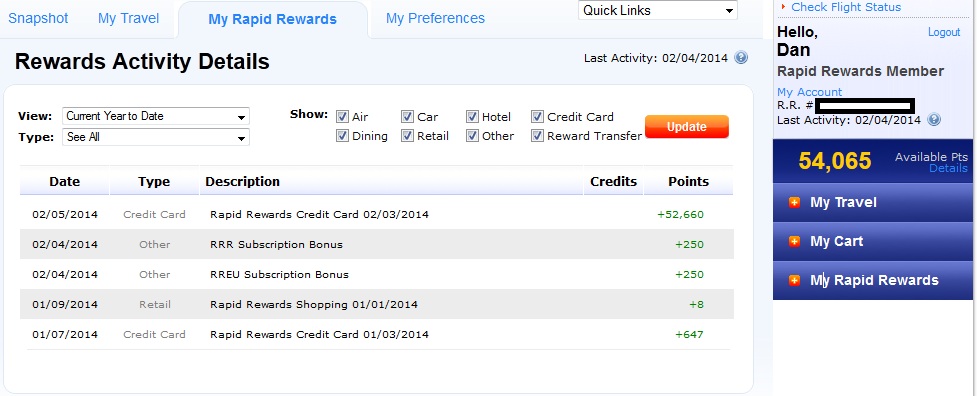

I had periodically checked Chase a few times and then this afternoon…. BOOM!

Bonus posted! You can see my 50,000 point bonus there on the top line and the total of 54,000 posted. I’m (almost) halfway there to the 110,000 points needed to get the companion pass, which is probably the single-most valuable thing out there!

Bonus posted! You can see my 50,000 point bonus there on the top line and the total of 54,000 posted. I’m (almost) halfway there to the 110,000 points needed to get the companion pass, which is probably the single-most valuable thing out there!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan I love your posts. I am a newby so I have three questions: First is the amazon payments transfer still working? Secondly does Southwest count the 50k points for a new card as points towards a Companion pass or they just posted as bonus points? And lastly I signed up for the chase Sapphire and Barclaycard both of which waive their first year fee. I intend to cancel at 11 months .Once I cancel will they take my points away? This question really relates to other cards as well.Thanks, Norm

I have the same question as norm above. Many of the cards waive the first year fee but still give you the perk if you meet the spending requirements. What are the repercussions, if any, to canceling a card after you have secured the sign on bonus? Continuing paying > $100 annual fee on multiple cards after the sign on bonus does not make financial sense.

Randy – I pay the annual fees on very few cards – I’ve even wrote a post on this a couple of months ago – 4 cards I pay the annual fee on. As for canceling a credit card, you might like this post – Is it bad to cancel a credit card?

Missed my companion pass by buying too much to early-got the bonus is December instead of January with other points . ARGGGGG!!! Neither SWA nor Chase VISA would budge. I might try for a third SWA VISA just on principle!