These offers are now expired – see this page for the current top credit card offers

Last week, I wrote about how Citibank was changing the rules for people applying for one of their credit cards. Previously you were ineligible for a new signup bonus if you had opened or closed that card within the past 24 months. Now you’re ineligible if you’ve open or closed ANY card within that “family” of cards.

Here’s an example. Say you had closed a Citi American Airlines personal card 8 months ago

- Old rules: You’d still be eligible for the Citi American Airlines executive card (and the Citi Business card)

- New rules: You’re now ineligible for a new signup bonus on the executive card (and the American Airlines Personal card as well). Rules on who is eligible for the business cards are still unclear as far as I can tell

A reprieve! The new rules don’t start until August 28th

Afterwards, it seemed like we got clarification that the new rules did not go into place until August 28th. I shared my strategy in that post to talk about which cards my wife and I were planning on applying for. Citibank only allows 1 application per week (the recommendation on Flyertalk is 2 every 8 days). So if you wanted to apply for 2 cards, you needed to have applied for one by last Friday or Saturday.

My wife applied for a Citi Prestige (I already had one and her recently closed Citi Premier card would make her ineligible for the Citi Prestige for another 24 months under the new rules). I was waiting for the Chase Sapphire Reserve application to go live on Sunday and didn’t want to risk having a recent application on my credit report

(SEE ALSO: Chase Sapphire Reserve vs Amex Platinum vs Citi Prestige)

(SEE ALSO: Who should do a Chase Sapphire Reserve application (and who shouldn’t apply))

Her Citi Prestige application was sent to pending. And while I normally advise against calling into the reconsideration line (SEE ALSO: Citi reconsideration phone numbers), this time I thought it was prudent. She called in and was approved!

My Chase Sapphire Reserve story does not have a happy ending so far, as I am well over the Chase 5/24 guideline / rule and when I called in to my local branch, I was not pre-approved for that or any other offers.

What Citi cards to apply for today

The 3 main “families” of Citi cards are

- ThankYou cards (Premier, Prestige). The AT&T Access More card earns ThankYou points but is considered its own family.

- American Airlines (AA Gold, Platinum, Business, Executive)

- Hilton HHonors (HHonors and HHonors Reserve)

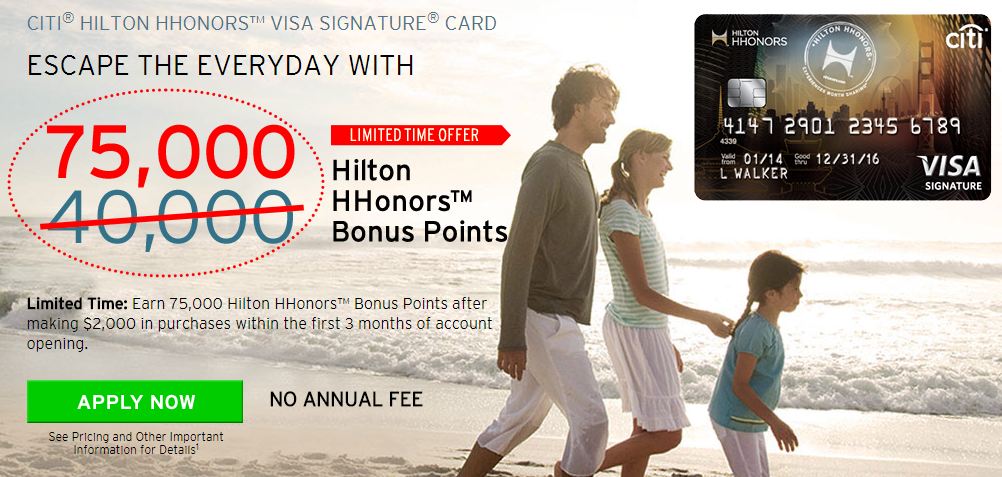

Most of the cards have the typical amount of bonus, but the Hilton HHonors card has a current bonus of 75,000 Hilton points, which is higher than its typical bonus of 40,000 Hilton points.

That 75K offer expires August 31, 2016, though if you’ve already opened or closed the card within the past 24 months, you won’t be eligible. Starting tomorrow (the 28th), if you’ve opened or closed EITHER this car OR the Hilton Reserve card, you won’t be eligible, so if you have a recent Hilton Reserve card and NOT the Citi Hilton card, this would be a good one to get.

While I can not link directly to any specific credit card application, if you would like to apply for one and support Points With a Crew, you can find most of them on our top credit card offers page

Bottom line: If you want to follow the current rules and best practices for signups, today’s the last day to apply under the new rules.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Just approved for Citi AA gold, already have the platinum. Let’s hope I still get the 25k bonus, otherwise it’s another wasted hard pull like for CS(R).

Applied for the Citi AA business card on August 21 got approved but was denied bonus miles due to already received bonus miles from a personal citi AA Platinum card back in May. Rep told me bonus miles are linked to my AA FF miles number and can only get 1 bonus every 24 month…spoke with 2 different agents.

Just a little confusing to get this e mail the day the promo expires??

For Citi Hilton card, I have visa signature bonus received in Aug. 2015, if i keep the card open and get Citi HH Reserve card next year in Sept’17, do I receive 2 free weekend nights or do I need to first cancel this citi visa signature card,wait 24 months (i.e. Sept. 2018) from closing and then apply to receive 2 free nights?

As I understand the rules, you would NOT need to cancel the card first, and if you do, you’d have to wait an additional 24 months as you mention

At least in my case the rules went into effect on August 27th, one day earlier than the points and miles blogosphere predicted and/or “confirmed” . Unable to get HH Visa signature due to opening HH Reserve less than 24 months.