The Chase Sapphire Reserve has been a long time favorite of the points and miles community. When it first launched in 2016, the 100k Ultimate Rewards sign up bonus was a sweet deal that made it an instant favorite.

Since then it has remained in the upper echelon of premium rewards cards. Chase recently increased the CSR annual fee from $450 to $550 and that led to multiple stories of travelers revisiting the card’s value proposition. The $100 increase in the annual fee was cushioned to a degree by the added LYFT and Door Dash benefits. This is on top of the other benefits that remained intact including Priority Pass Membership, 3x points on travel, 1.5x redemption value when points are redeemed for travel, the $300 annual travel credit and more. At this point, I believe that I will still get enough value out of the CSR to justify the $550 and many others will agree.

Why Do Banks Offer Benefits?

However, we need to keep in mind that Chase is in the business of making money. The CSR is a big part of this strategy. While the CSR card does provide tons of value for travelers, Chase provides this card and the associated benefits because overall the bank makes more in revenue from the card than it pays out in rewards and benefits. To understand how this card and others make money for their issuing banks, let’s take a quick look at a few things that drive credit card revenue.

- Fees from merchants- These are typically 1.5-3.5% of each transaction

- Annual fees

- Interest on unpaid balances (In the points and miles game you should always pay off your cards each month!!)

- Miscellaneous fees- Late fees, balance transfer fees, foreign transaction fees, etc.

Is this CSR Benefit better for Chase or Consumers?

On the opposite end of the spectrum are the costs (what we know as benefits and points) and these are what keeps customers using their card and driving the banks’ revenue. This is where the $300 travel credit of the CSR is so ingenious. Most points and miles bloggers gush over how great the $300 travel credit is because it is “so flexible”.

Did Chase set up this benefit to be flexible in order to benefit their customers? I’ve always thought the $300 travel credit was actually kind of silly. It’s easy to meet the requirements and I have always paid a $450 fee to get $300 back typically within a month or two. I’ve thought and have heard others argue that the CSR true annual fee was $150 (now $250) because of the credit. Fair enough but why even bother to have a credit that I imagine all cardholders will hit?

How the Travel Credit Benefits Chase

This is a clever marketing ploy and a great business decision by Chase. First, I have read countless stories about and heard multiple people tout the CSR as a great card and list the $300 travel credit as a huge perk. Great job on creating advocates for the card Chase! That “salesforce” of happy cardholders has done a great job spreading the CSR gospel.

Secondly, the $300 travel credit doesn’t earn the 3x travel credit like a normal purchase would. This equates to 900 UR points which are worth $9 when redeemed for cash (I hope you are not doing that) or $13.50 when used to redeem travel on the Chase portal. This is the opportunity cost to each of us as a consumer. I think individually most of us say “So what?” and this is where the business acumen of Chase comes into play.

How Much Are We Talking About?

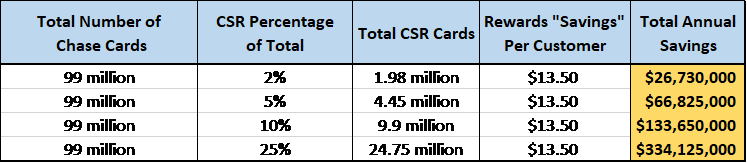

In the 2018 letter to shareholders, Chase shared its business results which included an impressive 99 million debit and credit cards with over $1 trillion in customer purchases. Since there are multiple Chase cards and the company does not break out the numbers for each card individually, it is tough to gauge how many CSR cards there actually are in the wild. With that in mind, these next numbers are estimates of the savings in rewards payouts that Chase keeps each year due to the $300 annual travel credit. I welcome you to add your own! Here is what I did in the table below.

Based on there being 99 million Chase debit and credit cards, and using several hypothetical percentages of that total being CSR cards, I’ve calculated the total number of CSR cards. I then took this number times the $13.50 in rewards “savings” that Chase realizes from not having to pay the 3x points on travel on the $300 travel credit to estimate the total annual savings to Chase from all customers.

As you can see, the cost savings really add up and this is only for one year! Even using extremely conservative estimates of the number of CSR cards issued since the 2016 CSR launch, we are looking at upwards of $100 million in rewards savings for a “benefit” that for most of us is a wash.

A Smart Strategy

My argument is that the $300 travel credit is nothing more than a smart strategy to get people talking about the CSR and to avoid paying the 3x on travel purchases for a portion of each cardholder’s travel purchases each year. I think it is an extremely shrewd tactic from Chase. I hope you think about it next time someone touts the CSR $300 travel credit as a great benefit since it is really costing you $13.50!

What are your thoughts on this analysis? Do you agree, disagree or not care? Let us know in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The increase is not worth renewal which for me comes in September. I am going to downgrade to another Chase card, These cards are getting pricer with diminishing values. I remember when I got my AMEX PLT in 2000 at $350 (?) thinking that was expensive now I am questioning that this year as well. What will be interesting is to see what Sapphire says when I make the call. I charged $78K last year on the Sapphire along

I agree that most of the premium cards are pushing up to my acceptability limit with their annual fees. With the type of spend you are putting on the CSR itseems like you would be a customer they would want to keep. If you have any luck with a retention offer let us know!

The one benefit that you don’t mention is the travel cancellation/interruption and medical insurance. To me, this is the most significant and highest value benefit. We travel extensively and are seniors. The cost of travel insurance alone for a trip to India or Africa or Europe is very high. If you charge your airfare or tour to CSR, the card automatically gives full trip insurance benefits. To us, this is worth thousands per year!

That’s a great point Janine. The card has numerous benefits and I only highlighted a few. The travel and medical insurance benefit is a huge perk!

I get the bulk of my “travel credit” from parking fees. I was stunned to get a credit a few years back from a parking meter charge. I thought that was a goof but since learned that parking (weather at the airport on a downtown street meter) is a covered charge.

I’ve never bothered to check if a non-credited parking charged scored three points per dollar. I guess it would but I’m not that broken up since a dollar credit will always be worth a dollar but points…

FWIW

DLM

Another interesting headline leading to an inconsequential and meaningless story. Are you suggesting I forgoe the $300 credit because I won’t get points worth $13? Yes, it explains why a $300 credit is worth more to Chase than reducing the fee by $300. But how are Cardholders leaving millions on the table? A lower fee is not a choice. This is the last straw for me. Too many stories like this. I am unsubscribing.

Larry, of course leaving the $300 credit on the table would be silly. Rather it’s interesting that collectively with the number of CSR cardholders surely in the millions and each of those people “losing” $13.50 per year Chase is saving millions of dollars in rewards each year by offering a “credit” that is really worth less than face value. It’s not much to each individual person but makes a really big difference when millions of cardholders are aggregated. It’s a lot when you dig into the numbers.

Seriously? If you’re nitpicking about $13.50, then you shouldn’t be carrying a premium credit card.

Is Chase actually making that money? Or are they just not paying that out to you in rewards? There’s a difference. You aren’t paying them $13.50 in additional fees.

I don’t think I’d call it nitpicking as much as pointing out how beneficial the “benefit” is to Chase when you look at the number of cardholders that agree with you and say “It’s only $13.50 so no big deal.” I still find value in the card and am keeping it at least through the next year. If Chase isn’t paying out the rewards then it is certainly a lowered expense for them as a whole. Either way I thought it was an interesting detail to share!

I’ve come to the same realization about the travel credit. It’s paying $300 and getting positively zero points for it. My mantra is “I won’t spend a dollar unless I get a point or a mile for it…” Yet here, I’m doing just that! They used to give the points for that spend, but last year changed it. (Maybe it was the year before.)

For me the only real value I get from this card is the priority pass membership (as it includes non lounge locations). It’s really just any standard visa card. All of the special perks are handled by a company other than Chase. I still think AmEx is the true king as everything they offer is handled by them.

Outside of the PP membership, I’m really looking for some other reason to keep this card and not just downgrade it to the preferred. Their new benefits are 100% useless to me (door dash has massive mark ups on everything they deliver – do the math). The Lyft thing I really don’t know how useful that is. These new ‘benefits’ seem to be just tiny bits of useless fluff. My opinion anyway. Forfeiting 900 points for the privilege of now paying $550…I don’t know…

I’m canceling / downgrading mine when the a/f comes due in June. That means I won’t have any ultra-premium cards any more (or PP access!) I may end up picking up one more at some point here before then

I’ve been on the fence on keeping it into the future too. Luckily I don’t have to make the decision until next February as my af just posted and at $450 it was easily worth keeping with the new benefits “free” for the first year.

Although mentioned by Janine above, the one benefit rarely otherwise mentioned is the trip insurance. I took a few expensive trips while my aged mother was living in an assisted living facility and could have gotten seriously ill or passed at any time. Those trips dictated insurance coverage and to get that covered for essentially free was really big. Going forward I don’t need to even consider whether it is worth it to pay that extra charge when putting it on the CSR.