A few months ago, news came out about 2 offers where you could get either 50,000 ThankYou points or 50,000 American AAdvantage miles for opening up a Citigold checking account and meeting a few minimal requirements.

If you hadn’t heard about it or haven’t yet completed it, it does seem to still be ongoing. Miles to Memories has a great walkthrough of how to open up your Citigold checking account. The relevant codes are

- 50,000 AAdvantage miles – 42ERCWNQU6

- 50,000 ThankYou points – 42ERCZ42PY

But the real bonus is that in ADDITION to the 50,000 miles or points, Citibank will let you initially fund your checking account with a credit card!

Drama trying to even OPEN my Citigold checking account

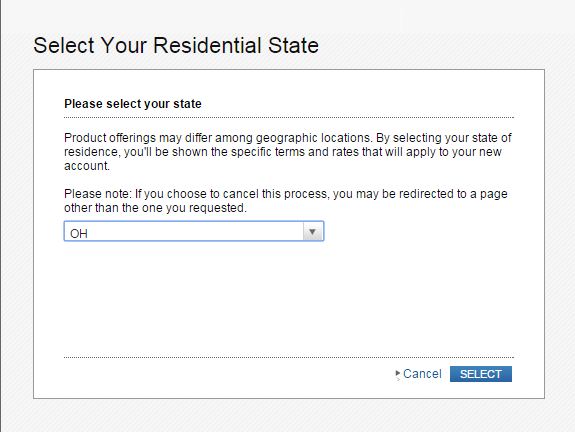

Going to the Citi website, you’re prompted to pick your state

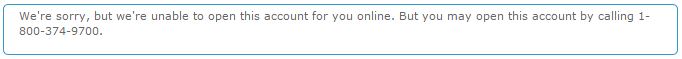

When I put in my state (Ohio), I kept getting this error

I’m not sure why that was, or why it one day finally started to work, but eventually they let me in and I was able to open the account. The important thing is that you do NOT want to try and fund it online – just choose to do that later.

I did that, but when my account was still not set up the next day, I called back in (1-800-745-1534), and the phone rep told me that somehow the application did not go through, so I applied (again).

Trying to fund my account, take 1

Trying to fund my account, take 1

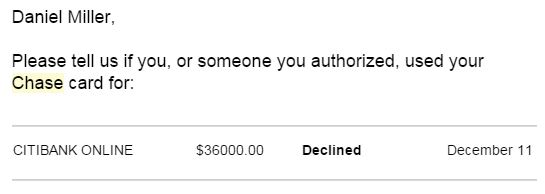

My first try was with my Chase Freedom card, because it has the largest credit line. I called in to Chase and let them know that I would be making a large “purchase” and was on the phone for what seemed like 100 years as they notated my account. I verified that it would show as a purchase rather than a cash advance, and asked them to lower my cash advance limit to $0, just in case.

Then I called in to Citibank checking and gave them my Chase Freedom card information. The lady told me that it would attempt to fund the next morning at 5:30 a.m.

The next morning, I get an email from Chase:

Guys! I thought we covered this!

A few more hours on the phone and it turned out that

- Chase processed it as a Cash Advance anyways

- They did NOT lower my cash advance limit to $0

- But the cash advance limit was set to $7500, so this transaction was declined

- Calling in to alert the bank to a large purchase seems to do nothing

In the end it was good that it was declined, since the cash advance fees on $36,000 would have been way more than I would want to pay

Trying to fund my Citigold checking account, take 2

Reviewing the list of which banks count checking account funding as a purchase vs. cash advance, I decided to go with my Bank of America Alaska Airlines card. Reading the Miles to Memories post about combining Bank of America credit limits, I took my 3 Alaska Airlines cards and put all the credit limit on to one of them. It was a very painless phone call – quite easy to do.

Citibank’s new checking account funding department is closed on the weekends, so I will give it a try again on Monday.

Wish me luck out there!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

You should read data points on what citi will code as cash advance. Chase cards have been known to be put through as CA.

Barclay, bofa, and citi cards go through as purchases so you should be good with the Alaska card, unless it gets declined

Yeah – I actually did read that but obviously didn’t read it very well 🙂

Yes this is all true, however, caution, the citi business card does not work.at all! Also you need to make sure you have the AA platinum card. Reports indicate citi denied and changed bonus to thank you points unless you have the AA card.

I used my Alaska card to find my Citi bank account. It took a couple days but eventually it went through and was coded as a purchase.

A word of advice, get a confirmation in writing from Citi of the terms of your bonus. They tried to deny me the miles and I had to dig up a bunch of evidence to show them the terms of their own promo.

Citi now says I’ve met the terms and the miles are supposed by 12/29, so we’ll see if they actually do it.

This Citi bank account has been a huge hassle and I can’t wait to cancel it!

Right – that’s on my list to do but I have not yet sent them a SM

Sorry, if you hate me after this one, but I’d never attempt to use a CC to fund a checking account. Just rotate some savings money around and move it back into savings after getting the points.

Not surprised banks make it harder and harder to artificially generate revenue where there is none…

I don’t hate you of course! (But I do disagree with you, though I always think it’s best for everyone to only do what they themselves feel comfortable with)

You may want to make sure that the Alaska will go thru first time. I’ve read some reports that BOA says it automatically declines on first charge and there is nothing you can do.

Those citi people won’t budge either. You only get a max of 3 tries. This entire process is a pain in the ass but the great payoff is funding with a credit card. I honestly couldn’t care less about the checking bonus at this point if it makes it that’s gravy.

A word of advice, don’t try to buy a money order at Walmart with the MasterCard check card. Just do a venmo payment to someone. They kept locking up my card at Walmart and ended up being a wasted day. I got written confirmation that the venmo counted as the debit purchase and it was so easy.

Final piece of advice, just roll with the punches. Getting funded is 90% of the battle in my opinion.

Thanks – I’m not quitting now! I feel like I’m almost there! Plus, once this works then I have to “make” my wife sign up for one too 😉

I call bofa to transfer the lines of credit on my 5 cards and they told me if I want it down to $200/$500 from $5k line on my signature they will have to downgrade my cards then if I transfer the line of credit it may or may not do a credit inquiry so I’m a bit confused why by you it didn’t do a inquiry? And how am I not guaranteed a credit inquiry when I transfer my lines?

Same thing happened to me too from Bank of America. I couldn’t combine my credit lines without a hard pull and couldn’t reduce credit limit below 5k on each card.

Not all cards from Citi, Barclay and Bank of America work. I am telling from experience. Barclay Wyndham card doesn’t work but Arrival does. Citi Premier and Prestige work. BAC Alaska air works.

You have only 2 shots to fund with a credit card. That’s what I read and then I was directly told that when my first attempt didn’t go through. So make it good.

I got it funded with my Arrival +, set CA to zero, and called to warn about a large purchase. No problems. The miles posted very quickly. That was November and I have confirmed with multiple CSR’s that I have met the requirements of debit transactions and bill pays. My debit transactions included one gift card purchase at WAG (pin debit), one BUXX load, and one Serve load. My bill pays were to Barclays and Amex. One CSR told me that I could downgrade my account at the end of December (this month) and still get the bonus. I am now awaiting the outcome.

You guys are doing great. I’ve not even gotten that far. Couldn’t do it online so called, thought it was set up but never got a confirmation email, so called again (multiple transfers — to new accounts, to status of opening, etc), no record of the account, so started again. Big question then of whether I am “eligible” for that code. They will check on this and call me back (that was 10 days ago). All this after I cleared my Alaska card to use for the deposit…. may never happen. I wanted to get the $100 reduction on the Prestige card annual fee….