Okay so here’s the basics of how this stuff works. Airline miles (or hotel points, bank rewards, or other similar things) are generally thought to be worth 1-2 cents each. Some more, some less, depending on the airline / hotel / bank.

- The Basics

- How does signing up for credit cards affect your credit score, Part 1

- How does signing up for credit cards affect your credit score, Part 2

- Meeting spending totals on credit cards

- Tracking signup bonuses (and making sure you GET them!)

- Earning miles through shopping portals

- The truth of the travelers's triangle: The relationship between time, price, and location

- Begin with the end in mind

Just like with anything, the idea is to buy low and sell high. Or in our case, earn points for a small upfront cost, and use them for travel expenses with a much higher value. How do we do that? Well, answering that question could take weeks if not months and is not only the subject of blogs, but entire INDUSTRIES. Still, I’ll give a small idea. What else were you expecting from a post titled “The Basics”!?!?! 😀

Buy Low

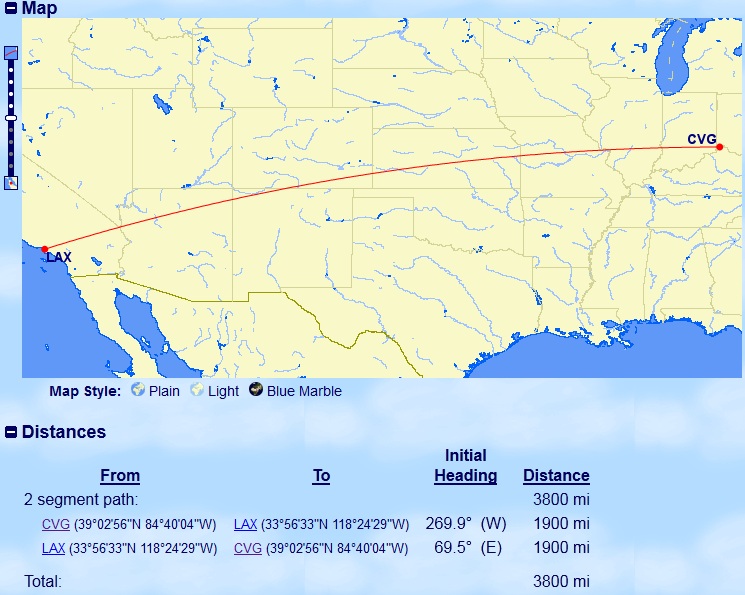

The “old” way to get miles was, you know, ACTUALLY FLYING. 😀 Sometimes I forget about that – that’s why they call them “miles”. You get 1 mile for every mile (what they call ‘butt-in-seat’) that you fly. So, as an example, back in 2012 (before I was smart) I flew CVG-LAX-CVG.

From Cincinnati to Los Angeles is a nice even 1900 miles. So I earned 3800 miles for that flight. Now, I paid $320 for that flight, so in a sense I “bought” those 3800 miles at a rate of 8.4 cents per mile (cpm). We’ve already talked about how miles are worth between 1 and 2 cents, so obviously paying 8 cents for a mile is crazy, and had I flown that flight for the purpose of earning miles, that would be ludicrous. Now there are people that still do what they call “mileage runs” (flying only to earn miles) but generally a “good” mileage run is one where you might pay 3-4cpm. Why would you pay 3-4 cents for something that is only worth 1-2 cents? There are actually some reasonable reasons to do that but usually it is to earn “elite” status on airlines, which, for folks with “a crew” is almost never worth doing (if it’s ever worth doing at all)

The easiest way to get cheap miles is credit card signups

Look at it – for a $99 annual fee, you can earn 50,000 points on Southwest Airlines, which is “buying” them for 0.19 cpm (or about 40 times less than if you flew from CVG-LAX). You just conjured enough points for 2 roundtrip flights (and actually probably more, depending on how you spend your points)!!

There are also other ways to get miles at a reasonable rate, such as shopping through airline / hotel “shopping portals”, or promotions that are offered, that I’ll cover in a separate post/

Spend High

The other half of the strategy is to spend high. Even though these points are nominally “worth” 1-2 cents, there are many ways that you can strettttch their value. One example is the Southwest Companion Pass, where you can take a companion along for free. So our 50,000 points actually become 100,000 points. Or if you have the Club Carlson Visa card, the last night of any award stays is free. My wife and I used that on a recent trip to Miami. We paid 28,000 points for 1 night at a Country Inn and Suites, and the 2nd night cost us nothing! Considering we earned 85,000 points just for signing up for that credit card, that’s a pretty good deal!

The other way to do that is by taking advantage of airline award charts. I just did a sample search on United for some Pacific travel. From Guam to Auckland, New Zealand, and then from Sydney, Australia to Tokyo, Japan.

Spending 42,500 miles instead of $8,947.50 gives a value of over 21 cents per mile! Now, to be fair, this isn’t a completely fair example 1) because I didn’t want to spend the time to match the exact flights and 2) because if you were wanting to pay for this flight, you wouldn’t just take the first paid fare you came across (as I did) but instead would shop around for a better deal. Still, this IS an accurate depiction of a very real phenomenon.

So, what did we learn? Get your points cheaply, and spend them where they’ll have the most value.

A final word of caution. Points are what we like to call a “deflationary” currency.

There is no central bank or international monetary standard. Example – Southwest Rapid Rewards points were worth a fixed 1.67 cents. So our 50,000 points we earned up above were worth $835 towards flights. A few months ago, Southwest sent out a press release, waved a magic wand, and POOF! All points are now worth 1.43 cents. So our $835 became $715. $120 just up in smoke! This is not an isolated incident – Hilton, United and several others also announced major devaulations just in this past year.

That is why our mantra is “Earn and burn.” Don’t hoard points – as you earn them, make sure and spend them and get out there and see the world!

This post is part of our Beginner’s Guide – so if you liked this, and want to learn more – make sure to read the rest of the articles in the Beginner’s Guide

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Ok, you’ve got my attention Dan. We’re planning to take our four kids to Germany this spring–a big, huge one-time family adventure now that the youngest is old enough to appreciate and remember it, and the oldest is not so old that we’ll mess up his summer job, etc. Jeff will already be there with a group of his students, so we’re looking at five round-trip tickets to Berlin. We have a few Delta miles accrued, but not enough for a ticket, so I was just going to find the best deal I could and fork over the cash. Show me a better way!

All right Harmony – that sounds like a challenge and if there’s one thing that I like, it’s a challenge :D. Look for a blog post next week with some ideas.

Followup post answering Harmony’s question – Reader Request: Family of 5 to Berlin

I came over from your post on Budgets Are Sexy, thank you.

I have a question about the Southwest Companion Pass. My partner and I both have SW Rapid Rewards cards, and both got the 50k miles (they dropped their rewards to 20k for almost a year, but we waited and got the 50k again).

According to SW, you get a Companion Pass (1 pass, right?) per 100 1-way flights OR earning 110k points ($1/1 point on most purchases). So you have to fly/spend a TON to get one free ticket. But you say the companion ticket is like turning 50k into 100k – which sounds like you get a free companion pass every flight, not once a year. Is this just a result of having 8 people in your family, or am I reading this wrong?

Thanks!

If you get the Companion Pass (which requires that ONE person get 110,000 points in one calendar year, not split up between 2 people), then for the rest of that year AND the entire year after, any flight that you fly on, your companion flies free.

You might be interested in the following posts

What is the Southwest Companion Pass (and how to get it)

Using your Southwest Companion Pass

San Juan expenses: How much did my “free” trip cost? – we used the Companion Pass on our getaway trip to Puerto Rico

Thank you for sharing all of this info. I just came across your website today. I really want to learn how to find low round trip airfare for my family of 4. I live in MD and my family lives in TX and so far I have only been able to go home and visit once in almost 15 years and we drove because airfare was too expensive along with a rental car. I miss my family terribly and need an affordable way to visit thanks again.

I’ve just discovered your site- it’s a bit like opening Aladdin’s Cave! We are retired travel junkies, but sadly, not living in the US means we get very few miles on our credit card so any suggestions on saving on travel are very welcome.

Thanks so much

When you stated your mantra is ‘Earn and Burn’ before the airlines devalue your miles. You failed to mention that if the airline is going to devalue their miles they must, by law, give you a notice period before the devaluation takes effect. Once you become aware of the impending devaluation date you will have that period of time to use your higher valued miles to make a reservation and use them BEFORE the devaluation takes effect.

In theory maybe, but I’ve seen too many unannounced devaluations to put a lot of stock in that

We are going to austrailia in October can you recommend an airline comfortable for 15 hours trip?

Best would be to sign up for [followemail] or join our miles and points Facebook group, rather than corresponding over comments on random blog posts

I saw a segment of you on one of the morning talk shows. I couldn’t remember your website until I came across it today.

I’d really like to sign up for one card to try out this “points” thing. I’m not really sure what I’ll use them for, but feel I could be building points for something. Eventually, my husband and I would like to use them for flying in the United States. Chase Saphire looked like it could be good. We are planning on renting a car for about 3 months.

What credit card would you recommend for building points, but not sure about the spending of them?

Just signed on to your blog. My husband and I are active, traveling seniors. We each accumulate miles on a American Airline Visa credit card and now each have over 100,000 miles. I”ve considered signing up for additional cards, but in order to get those bonus signup miles, I have to spend $2-3,000 in the first 3 months. Do I just start using the new card exclusively, reach the $3,000, get the bonus miles and sign to another card? How do I combine these earned miles from several different cards?

Holly – it’s up to you what you feel comfortable doing. If you do end up signing up for a new credit card, I earn a commission if you apply through my links – https://www.pointswithacrew.com/go/cc/travel and I appreciate it. As for combining miles, generally speaking, you can’t combine miles from different programs, though some bank points (Chase / American Express / Citi) do transfer to some airline or hotel programs.