Venmo is a peer to peer transfer system, owned by PayPal. They’ve recently begun offering the Venmo Card, which operates as a prepaid debit card, pulling from your Venmo balance to complete your transactions. It’s on the Mastercard network, so you can use it anywhere Mastercard is accepted as payment. A few months ago, I received an email from Venmo, detailing a $15 welcome offer on the card. I obiously opened one, so I could write up a Venmo card review for you.

(Plus, the extra $15 didn’t hurt!)

Here’s our review.

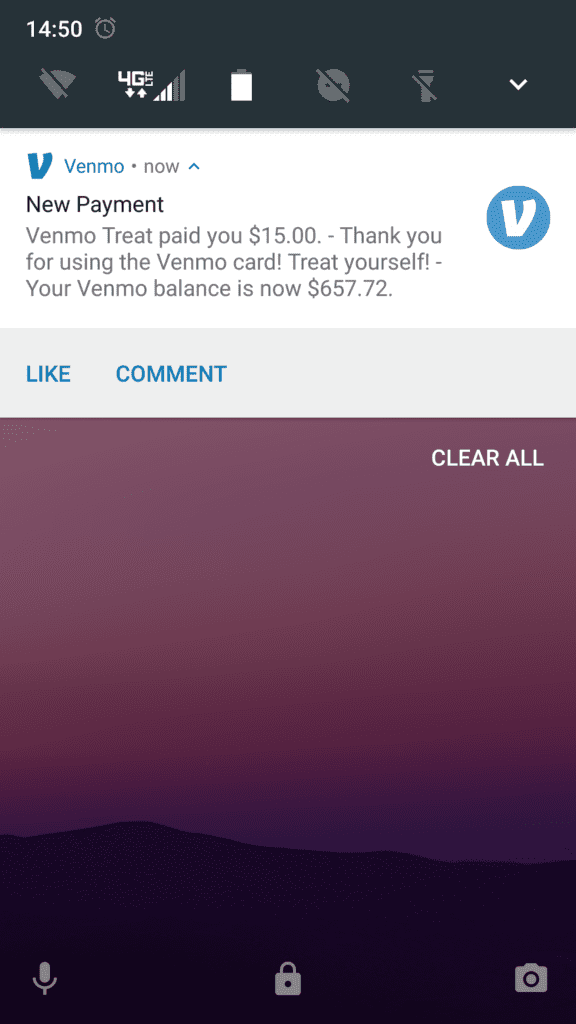

Venmo Card $15 Welcome Offer

The terms of the Venmo card welcome offer were really simple:

Apply for the card and make three eligible purchases with the Venmo card by 3/31/2019, and we’ll add $15 to your Venmo balance by 4/8/2019.

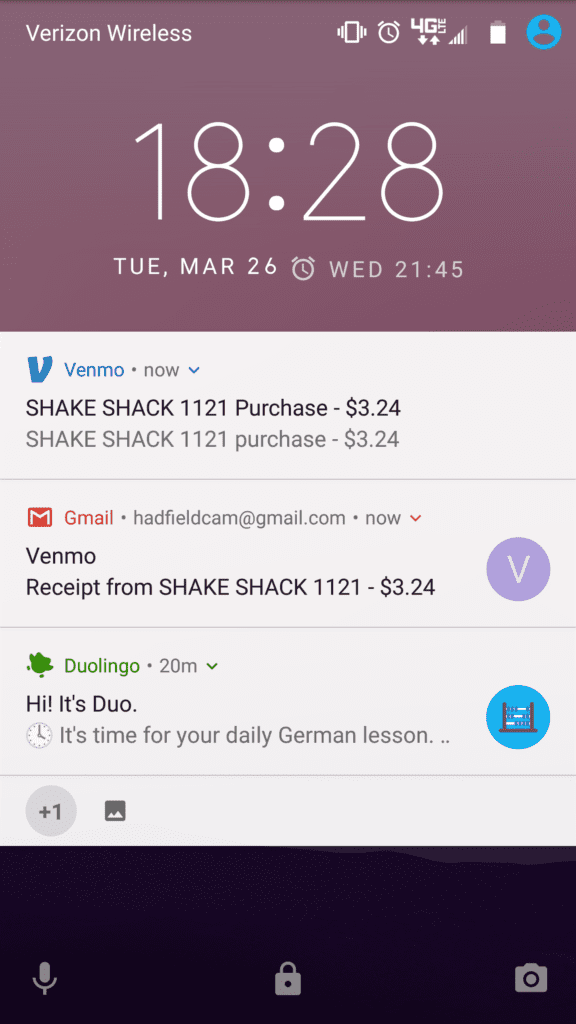

I used the Venmo card for exactly that: 3 purchases. I grabbed some coffee at a local cafe on the 25th of March, stopped by Shake Shack on the 26th, and then picked something up at the grocery store on the 31st at around 9PM. With that last purchase coming in right before the deadline, I did get a little nervous that the welcome offer wouldn’t come through. Luckily for me, Venmo transactions show up almost instantly in my experience, so I made it through!

Venmo credited the $15 welcome offer to my account on April first, at 3PM in the afternoon! I spent a total of $12.38 on the Venmo card to trigger a $15 credit, which gives me a rate of 121% cashback – if only there was a card that could do that on every purchase! (That bank would be out of business before it began…)

Venmo Card Review

The Venmo card is very easy to use. It’s essentially a prepaid Mastercard debit card that pulls from your Venmo balance. Just like a checking account/debit card combo, if you have money in your Venmo account, you’ll be able to swipe your Venmo card and pay for your purchase.

You can also opt into Venmo’s “Reloads” feature, which will automatically pull funds from your linked bank account if your Venmo balance isn’t enough to cover your purchase. Think of this like overdraft protection without all the fees. Reloads will pull funds in $10 increments to ensure you have enough. I didn’t opt into the Reload feature, and I always had enough money in my Venmo account to cover the purchase amount.

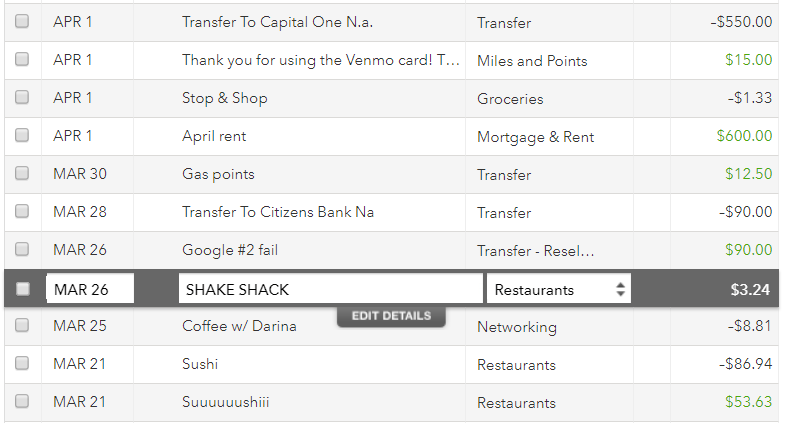

There’s one catch. If you use Mint, Personal Capital, or another expense tracking platform, it doesn’t always interface correctly. I happen to use Mint, and the software would sometimes post my Venmo card transactions as a credit, rather than a debit. Check it out here:

Weird huh? Mint knows I spent money on coffee and at Stop & Shop using my Venmo card, but it thinks Shake Shack paid me for my fries…

With no hard pull, no transaction requirements, and a super easy user interface, I think the Venmo card is worth picking up for a good welcome offer! It doesn’t offer tremendous value, but an extra 15 bucks never hurt anyone. I’ll likely close this one out at some point, as long as doing so doesn’t impact my Venmo account, which I use frequently.

Do you use the Venmo card? Have you seen a better offer out there?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I’ve had a Venmo account since 2019, today is 2021. I have not used the account in over a year. Today they promised me $15 just for clicking the link they sent. So I got $15 today for letting them know I’m still alive