I signed up for a US Bank FlexPerks card back in 2014 (during their Winter Olympics promotion)

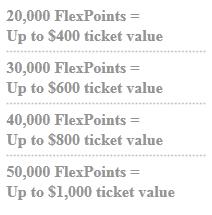

It’s not a card that I use a ton (though I know there are others that love MSing on this card), so after meeting the minimum spenidng, I have a little over 30,000 FlexPerks travel rewards points. This is good for a ticket of up to $600 – here’s the system for redeeming FlexPerks travel rewards

As you can see though, you have to redeem a minimum of a $400 ticket (20,000 FlexPerks), and it really pays to get a ticket that is right up against the limit. For example, a $600 ticket costs 30,000 FlexPerks travel rewards, but a $401 ticket ALSO costs 30,000 FlexPoints.

But… is there a better way to redeem FlexPerks travel rewards?

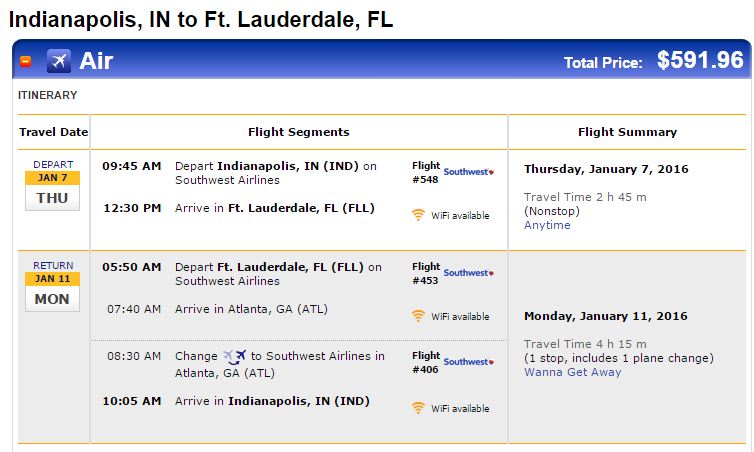

I was looking at whether it was possible to redeem US Bank Flexperks Travel Rewards on Southwest flights, and I started thinking about how awesome Southwest’s cancellation policy is. What if… I bought a $600 ticket on Southwest and paid for it with my US Bank FlexPerks points? Then, after 24 hours was up, you just cancel the flight (no cancellation fee on Southwest!) and that travel amount is just returned to your Southwest account for future use on ANY Southwest flight

The flight you pick doesn’t really matter at all – and it just depends on how much time you want to take searching to see how close you can get to $600 (or whatever limit you have with your Flex Perks, depending on how many you have). Turns out I was not the first person to think of this – see also this Million Mile Secrets post from last year.

You do have to CALL in to FlexPerks to book a Southwest ticket 888-229-8864. You will want to find a flight where there aren’t any Wanna Get Away fares available so that the FlexPerks agent won’t “accidentally” book you a cheaper flight (oh! the horror!). There is a $25 phone fee but typically they will waive that fee as Southwest tickets are not bookable on the website.

Another note to keep in mind with your Southwest travel voucher funds – they expire one year from the date of issue, and if you use the travel vouchers on a flight, and then cancel THAT flight, the voucher still has the expiration date of the original flight. And of course, this assumes that you are okay converting your FlexPerks to Southwest Rapid Rewards points (and not for any other airline). Still, I think this is a pretty good way to redeem FlexPerks travel rewards, or at least to be aware of!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Please retract this post if you want this trick to live.

I get the concept, but this has already been posted on MILLION MILE SECRETS!, a blog with approximately 10x my readership. I actually don’t think it’s really much of a “trick” or “loophole”

I agree that this isn’t a trick. This is just how Southwest works, and there’s no way for US Bank to know about what I do with my Southwest flight after I’ve booked it with them. Why would it go away?

thx, good to know. million miles surely had a good write up about it

Have you actually tested this strategy? I had the same idea a few months back and decided to call and ask what would happen if I had to change my plans (i.e. would my points be returned or would I get a credit with Southwest). I can’t remember exactly what the response was, but I know that it sounded like a dead-end to me.

I have not actually tested it, but the comments in the MMS post seemed to indicate that there were people that it was working for them.

Posted about this awhile ago and it works. Flex perks doesn’t have access to the cheap wanna getaway fares so look for the anytime fare.

Although flex perks states you must make any changes/cancelations with them directly, you can go straight to southwest and bypass flex perks.

Also note that if you have the southwest companion pass you can add them on as well to get another free flying passenger out of your points!

Here’s more info in addition to the info above: http://dealswelike.boardingarea.com/2015/05/14/maximizing-us-banks-flexperks-program-with-southwest/

Thanks Jen! Glad to see confirmation that it does really work

To re-emphasize – this works if and only if you cancel on the Southwest web site (specifying that you want to retain the funds for future use).

One “gotcha”: When you combine unused ticket-less travel funds with new money in a reservation, all funds inherit the “oldest” expiration date. For example:

-Suppose you buy a $397 ticket through Flexperks on January 5, 2016.

-Then you cancel, and use most of the funds to purchase a new $350 ticket that you really want to fly on January 10. So far, so good. You still have $47 in unused ticket-less travel funds.

-But then, if you buy another $550 ticket on December 15, 2016, using the $47 in credits plus $503 in new money, the ENTIRE $550 EXPIRES ON JANUARY 5, 2017 (one year from date of original $397 ticket issue).

-Bottom line – unless you are absolutely sure your travel plans won’t change, it might be better to forfeit the $47 and buy the $550 ticket entirely with new money. The funds would then be good until December 2017.

One other “gotcha”: The funds can only be used by the original traveler – not for a companion or friend.

Right – I did mention them expiring on the oldest expiration date (I remembered your comment on the cancellation policy post!) :-). Thanks for the reminder about the fact that they have to be used by the original traveler. You COULD however add a companion using the Companion pass (if you have one) to double your points

So the point of this is that you want to get a dozen or so $49 (or whatever) cheap Southwest tickets for one 30,000 point Flex Perks redemption? Quite a deal.

can i transfer us bank flex perk points to my wife flex perk account if so what is the limit of points i can transfer from my acct to her per year

Okay, so I just did this. I don’t know why I didn’t think of this before…I did a one way ticket that was around $340 (lost $60) but figured out I could get two roundtrip tickets out of this. How long do you wait before rescheduling your trip? Did your reservation come up on Southwest or did you have to call Southwest and change it? Sorry for all the questions!

You can cancel Southwest reservations with no problems – see How to cancel a Southwest flight – 1 easy step!

If the Flexperks booking agent put your Rapid Rewards number in the reservation, it should come right up on WN’s Web site. If not, you’ll need to call Southwest to have your Rapid Rewards number added.

When you cancel the reservation, if you are given a choice between “refund” and “hold for future use”, select “hold for future use”. (If you get a refund, the money goes back to the Flexperks booking agent, and you lose it.)