3/29 – Reposting as the last day to buy Marriott points under the current offer is Sunday, March 30th

With over 8,000 Marriott properties worldwide, you’re likely to find one that fits your needs when planning your next vacation. And your next vacation might be closer than you think, now that Marriott is offering up to a 45% bonus on purchased points, through March 30th. This is a high bonus, close to the best bonus Marriott has ever offered. Let’s examine the math and see if this makes sense.

The Promotion

Below are details of the Marriott 45% bonus on buying points promotion:

- Transactions must be completed between 9:00 a.m. ET February 11, 2025, and 11:59 p.m. ET March 30, 2025, to be eligible for the bonus Points purchase offer with a minimum purchase of 2,000 Points.

Bonus percentage is determined by the amount of Points purchased. Buy 2,000 to 9,000 Points and get a 35% bonus. Buy 10,000 – 19,000 Points and get a 40% bonus. Buy 20,000 or more Points and get a 45% bonus. - The bonus Points earned with this promotion through the Buy Points or Gift Points pages are not included in the annual purchase limit of 100,000 Points.

- This offer is valid only for Points purchased through the promotion’s Buy Points and Gift Points pages.

- I may receive a commission if you purchase points through my link

Normally, Marriott points cost $12.50 to purchase 1,000 points (tax included), for a purchase price of 1.25 cent per point. That might seem cheap, but remember, Marriott points are only worth about 0.7 – 0.8 cents each, so at the normal rate, you’re paying a premium on the value. At the normal rate, it doesn’t make sense to buy Marriott Bonvoy points.

What about with the 45% bonus? This time the bonus is tiered –

- 35% bonus when you buy 2,000-9,000 points

- 40% bonus when you buy 10,000-19,000 points

- 45% bonus when you buy 20,000 + points

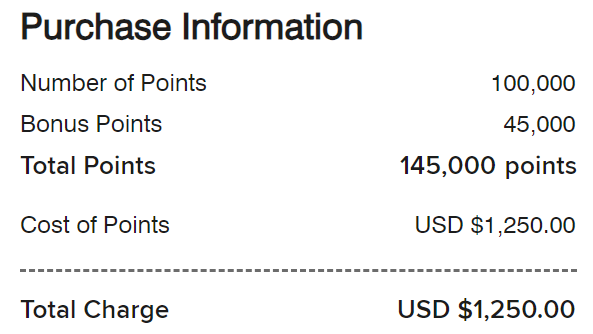

If you buy the full 100,000 points, it will cost you $1,250 for a total of 145,000 points, which brings the purchase price to 0.86 cents per point, which is closer to the normal redemption value, but still slightly higher.

While I’m generally against buying points speculatively, if you need some points for your next redemption, it could be worth topping up your account.

(SEE ALSO: When is buying miles worth it? Only in these 3 instances)

If you do that, I recommend buying enough points to get the full discount. You can find the link to this promotion here

Getting More Marriott Bonvoy Points

Generally if you’re looking to get a lot of points in a (relatively) short period of time, it’s better / cheaper to sign up for a new Marriott credit card, if you’re eligible. Here are a few of the current welcome offers on Marriott credit cards

- Marriott Bonvoy Business® American Express® Card – Earn 3 Free Night Awards after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points. Certain hotels have resort fees. Terms apply. $125 annual fee (see rates and fees). Read our full review here.

- Marriott Bonvoy Bevy® American Express® Card – Earn 155,000 Marriott Bonvoy bonus points after spending $5,000 in 6 months. $250 annual fee (see rates and fees)

- Marriott Bonvoy Brilliant® American Express® Card – Earn 185,000 Marriott Bonvoy bonus points after spending $6,000 in 6 months. $650 annual fee (see rates and fees)

- Marriott Bonvoy Bold® Credit Card – Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening. $0 annual fee. Read our full review here.

- Marriott Bonvoy Boundless® Credit Card – Earn 3 Free Nights (each night valued up to 50,000 points) after spending $3,000 on eligible purchases within 3 months of account opening. $95 annual fee. Read our full review here.

The Bottom Line

While I don’t generally recommend buying points speculatively, there’s no denying that it can make sense in certain situations. Sometimes it’s cheaper to even buy points and use them to book an award night rather than paying an elevated cash rate. And if you’re going to buy points, it makes sense to buy them when they are running a bonus.

Will you buy Marriott points with a 45% bonus? Or will you wait for a better offer to come back?

Note: the affiliate links in this post support the blog and our bloggers. If you do use one of our links, thank you!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.