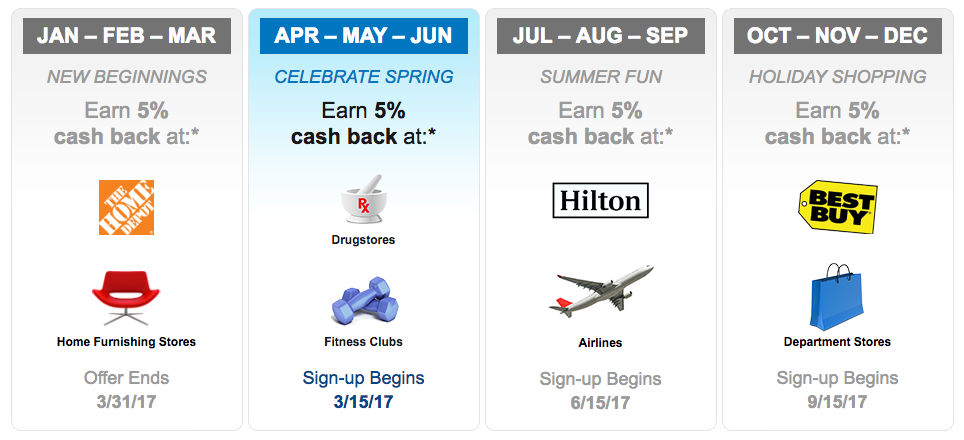

If you have a cash back credit card with 5% rotating categories, one of things you look forward to every three months is seeing what those sweet, sweet 5% cash back categories will be. Today, let’s take a look at the Citi Dividend Q4 2017 categories and where you’ll be earning the extra cashback.

Citi Dividend Q4 2017 categories

For the upcoming quarter, you’ll get 5% bonus Citi Dividend cashback at Best Buy and department stores. This is a pretty broad category, especially when it comes to department stores. For those of you keeping score at home, this is the same Q4 bonus categories as 2016–in fact, only ONE category changed from 2016 to 2017! You are now able to register for this quarter’s promotion.

As you can see, there is overlap with a Chase Freedom Q4 bonus category at department stores. If you have both cards, it could be a great way to maximize spending at those locations.

As a reminder, the Citi Dividend only lets you earn a MAXIMUM of $300 cashback per year, regardless if it’s regular spend or in the bonus Citi Dividend categories. Additionally, this card is no longer available to sign up for. For these reason, I would stay away from this card, as the Chase Freedom and Discover it allow you to earn unlimited cashback ($75 per quarter in bonus categories) all year long.

(SEE ALSO: Chase Freedom Q4 2017 Categories)

(SEE ALSO: Discover it Q4 2017 Categories)

With all that in mind, it’s good to know what the Citi Dividend Q4 2017 categories for increased cashback are, but all things considered, this card is a real dud when compared to other cash back cards, and should be relegated to the back of your sock drawer or whatever tool you use to organize your cards.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Recent Comments