If you’re not already familiar with the company, Plastiq is a service that lets you pay bills by credit card where credit cards normally aren’t accepted. For this they charge you a small fee. Even including the rewards you earn, the fee often doesn’t make using the service worth it. In some cases, though, such as trying to meet a high minimum spend on a new credit card, it is a great option to have. I’ve used Plastiq on several occasions now.

[My experiences using Plastiq for “free” money paying my mortgage”]

The fees for using Plastiq are currently:

- Amex, Visa, MasterCard – 2.5%

- Debit – 1.0%

The fees have been pretty stable at 2.5% for credit cards. For a while the MasterCard fee was only 2.0%, and I took advantage of that to pay a bunch of bills with my Citi DoubleCash card at net zero cost.

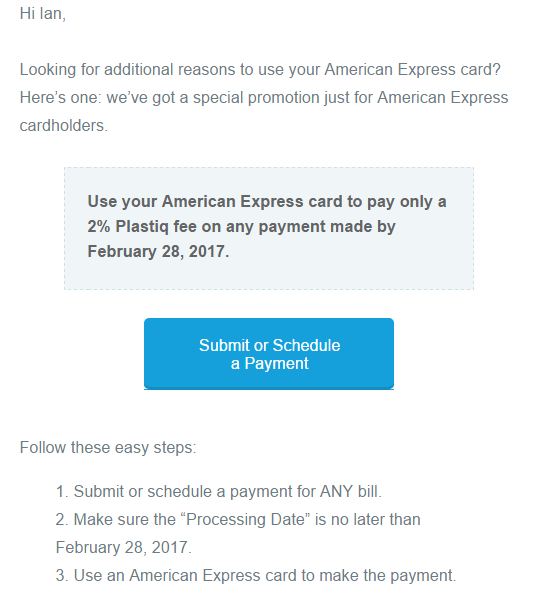

However, from now through February 28, 2017, the fee for paying by American Express card has been reduced to 2.0%. My wife and I each received an email describing the promotion. As long as you submit or schedule any payment to process on or before February 28, 2017 using an American Express card, the fee will be 2.0% instead of the normal 2.5%.

As it turns out, I just paid some large bills by Amex via Plastiq back in December 2016 to take advantage of the 2x small business promotion. I used my Starwood card, and paying 2.5% for 2x Starpoints is much better than paying 2.0% for 1x Starpoints, so I am glad I paid my bills then.

(PWaC: Personally, I use the AT&T Access More card to pay my mortgage on Plastiq as it gives 3x ThankYou points for online purchases)

(READ MORE: Yes, you CAN still get the AT&T Access More card)

If you use my referral link for Plastiq, you’ll earn $200 fee free dollars after your first purchase of $20 or more

Do you think you’ll use Plastiq over the next several weeks to take advantage of this promotion?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Does paying rent via Plastiq using AMEX business platinum counts towards minimum spending? $15K spend requirement is pretty high to get 100K points..

As far as I understand, it is a legitimate way to meet minimum spend requirements for Amex cards. I’ve not seen any data points counter this. I used a few $1,000 paid via Plastiq, actually, to help meet the minimum spend on my new Amex SPG Business card.

I’m using it to meet my spend on my new AMEX Surpass.

When you pay with Citi double cash @ 2% your net cost is not zero. You earn a 0.04% as Citi double cash will pay you 2% on the 2% fee that you paid to Plastiq. For example, you pay a $10000 bill using Plastiq; Platiq will charge you $200, so the charge on Citi double cash is $10200. You pay your Citi bill in time and you don’t owe any interest. Now Citi will give you $204 in cash back which is 2% on $10200.

True. And I did realize that. But I decided not to explain it in the post since earning 0.04% back is really inconsequential to me.

Hey, Ian –

Thanks for the intel. However, I used your link ($200 free fees) and have no indication from Plastiq confirming this sign-up bonus. Am I missing something? – MM

You should see it after your first payment of at least $20

I am using Plastiq to fulfill my SPG $5k minimum spend. I noticed that American Express seems to charge a $1 fee for each transaction I’m making with Plastiq. Has anyone else experienced this?

Are you sure it’s a completed charge? That sounds like the $1 hold that banks often put on a purchase until it reconciles

Maybe that’s it. It’s in the pending category. I’ve never seen that before. I guess we will have to wait and see. I hope you are right!