Last time we helped a reader get her family of 5 to Berlin, Germany. Today’s destination is a little closer (and more domestic) but still fun – Seattle!!

The question comes from reader Katie who asks:

Our family of 5 is planning a trip back “home” to Seattle this summer. We’re fine flying from CVG, DAY, Louisville (SDF I think) or even IND if that makes a big enough difference to equate for all the gas getting there. Tickets tend to cost about $500 a piece so it adds up way too fast!

Katie also mentions that they have a few points in a few different programs, but not enough in any one program to get a free ticket. She also suggests that they may be in the market for buying a home sometime in the not-too-distant future, so she and her husband want to avoid signing up for a lot of credit cards. That’s too bad because with a few successful credit card bonuses, she would clearly have enough for 5 tickets. On the other hand, she’s probably read our Beginner’s Guide, and especially the article about the importance of credit score, and she is wise in not wanting to get a bunch of credit cards with a potential home purchase  looming.

looming.

So if we’re only focusing on getting one or two cards, which one(s) should it be? My recommendation would be for Katie and her husband to both get the Chase Ink Plus.

The Chase Ink plus offers 50,000 Chase Ultimate Rewards points after spending $5,000 in the first 3 months of having the card. It is a business card, but we just talked about how you can still apply for a business card, even if you don’t have “a business”

Having your miles in a flexible “currency” like Ultimate Rewards gives you options, and options are good. Especially when you’re trying to get 5 tickets. Sometimes the availability isn’t there when you need that many tickets, so having a couple of different airline options is not only a luxury, it’s a necessity. By the time the two of them meet their signup bonuses, they’ll have (at least) 110,000 Chase points.

Ultimate Rewards transfer at a 1:1 ratio to United, Southwest and British Airways (as well as a few other airlines and hotel programs). Unfortunately, there are no direct flights from SEA to anywhere near Cincinnati (ORD / Chicago is the closest), and since British Airways has a distance-based award chart, this probably wouldn’t be a good redemption.

United is a possibility – roundtrip tickets on United cost 25,000 miles, so that would be enough for 4 tickets, and for the 5th ticket they could either pay for it or put some more spending on the card. The Ink card is actually a good one to put spending on, because it offers 5x points on several different categories, such as office supply stores, cellular phone, landline, internet, and cable TV services. The office supply stores is the best, because Staples (as well as other such stores) carries a lot of gift cards. So one thing I like to do is if I need to go to Lowe’s, I stop by Office Depot (next door), buy a $500 Home Improvement gift card (good at Lowe’s).

That purchase earns 2500 Ultimate Rewards points, and then I use that $500 gift card at Lowe’s. That’s opposed to just spending $500 at Lowe’s, which would only earn 500 points. You can also buy prepaid Visa cards there. Those have a fee and so they’re not “free” but might make sense. There was a deal a few weeks ago at OfficeMax as well as I wrote a bunch about this on how to meet spending totals.

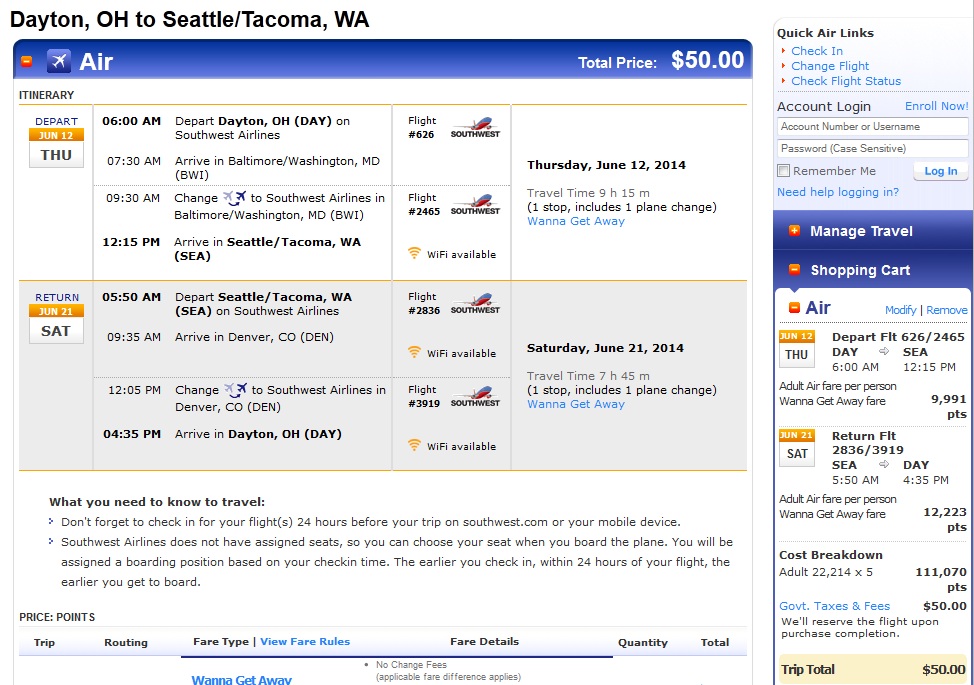

Southwest is also an option – unfortunately Delta has (so far) kept them out of CVG, but they do fly from DAY (as well as several other nearby airports). Southwest has a fixed point value tied to the actual dollar cost of the flight (which is devaluing later this year), but as it stands now, one option would be

It depends on the exact dates / flights you pick, but as it stands now, you can get 5 tickets from DAY-SEA for a mere 111,170 southwest points. One unfortunate side effect is that Southwest points transferred in from Chase do NOT count towards earning the Southwest Companion pass (where your companion flies free for nearly 2 years)

It depends on the exact dates / flights you pick, but as it stands now, you can get 5 tickets from DAY-SEA for a mere 111,170 southwest points. One unfortunate side effect is that Southwest points transferred in from Chase do NOT count towards earning the Southwest Companion pass (where your companion flies free for nearly 2 years)

Business Cards on Credit report

As I mentioned, the Chase Ink card is a business card. One other feature of business cards is that they don’t show up on your credit report (more info from Million Mile Secrets). Now, IANAMU (I am not a mortgage underwriter), and I wouldn’t advise you go going crazy, but this would be one data point why in this situation a business card would be better than a personal card.

Other Options

So there are a few other options. One would be that Citibank has offered their “Executive AAdvantage card”, which offers 100,000 miles after spending 10,000 miles in 3 months. Now, that is a pretty hefty spending requirement, and it also comes with a $450 annual fee (though you do get a $200 statement credit so it’s like a $250 annual fee).

Another option would be to have either Katie or her husband sign up for a 2nd card. If that’s the case, I would recommend the Chase Sapphire (signup bonus of 40,000 Ultimate Rewards points) , the Southwest card (50,000 Rapid Rewards points), or maybe the United Explorer card (30,000 United MileagePlus miles but if you have a Chase branch local you may still be able to get the 50,000 mile offer).

So now that we’ve gotten Katie to Seattle, where do you want to go??? Email me at dan@pointswithacrew.com or reach out on Share or

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

We flew our family of 4 to Seattle from Atlanta last Summer and we were able to get 3 tickets with the points from our Chase Sapphire card. Love using points!

I’d go with the Sapphire as well, as Business cards are tougher to get than the CSP. If you have childcare expenses, hitting $3000 minimum spend is unfortunately too easy. Unfortunately because, you know, child care is expensive and I wish it were harder for me to hit min. spends because I spent less.

Also, how legit, and I mean actually legit, is the whole don’t apply for cards within 2 years of a home loan? If I a manage my credit responsibly, and avoid hard pulls in the 3-6 months prior to apply for a home loan, and have a higher credit score, why would being a points and miles hound affect my ability to get a great rate on a loan?