Putting my surprise trip into motion

Recently I got back from a trip where the destination was hidden from my wife until she got her boarding pass in the airport. It took a lot of work to keep things a surprise – initially she did not even know that we were going anywhere, but eventually I did let her know that we were going “somewhere warm” but still not the actual destination.

While she wondered where we might be doing (even doing a video with some guesses!), I put the plans in for a trip to Puerto Rico.

- [VIDEO] Preparing for a surprise trip

- Keeping the secret in a secret trip - planning the trip

- Hotel Review: Fairfield Inn Dayton North

- Using Barclay Arrival miles on small transactions under $25

- #SouthwestHeart Scavenger Hunt January 2015

- Why it pays to check the Chase Ultimate Rewards mall before transferring points

- Hotel Review: Hyatt House San Juan

- Touring the Condado region of San Juan, Puerto Rico

- Old San Juan: a UNESCO World Heritage Site

- Navigating the Old San Juan Trolley

- Update on Southwest TV on Android devices

- Updating my travel maps

- The ledger: Total trip cost breakdown

Getting the flights for my surprise trip

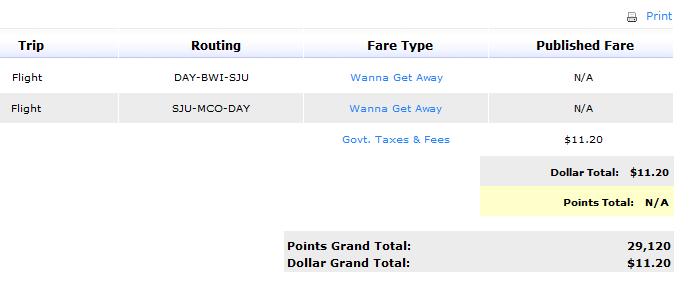

Whenever you’re planning a trip, the first thing to do is get your flights in order. One reason to pick Puerto Rico was the fact that it scores super low on the list of Caribbean locations with cheap airport taxes and fees. Another is that Puerto Rico is on Southwest Airlines’s list of international destinations (well…. “kind of” international 😀 ). Because I have the Southwest Companion Pass, Carolyn flies free, which means that we only need half the miles we might otherwise need.

Compare that to one of the “big 3” airlines (United, American, Delta), where tickets would cost 17,500 miles one-way from the US to the Caribbean per person, or 70,000 miles total for a roundtrip for the 2 of us.

Hotels for my surprise trip

Once the dates were set for the flights, it was time to turn my sights to booking the hotels. I quickly zeroed in on the Hyatt House San Juan, using my Chase Ultimate Rewards points.

The Hyatt House San Juan is a Category 2 Hyatt, which means that a night costs 8,000 points. Also, I noticed when booking that (almost) ALL of the rooms were 8,000 points, including a one-bedroom kitchen suite. Compare the 8000 points to the average daily rate for the room we got at $275 / night, you’ll find that is a redemption of about 3.4 cents per point.

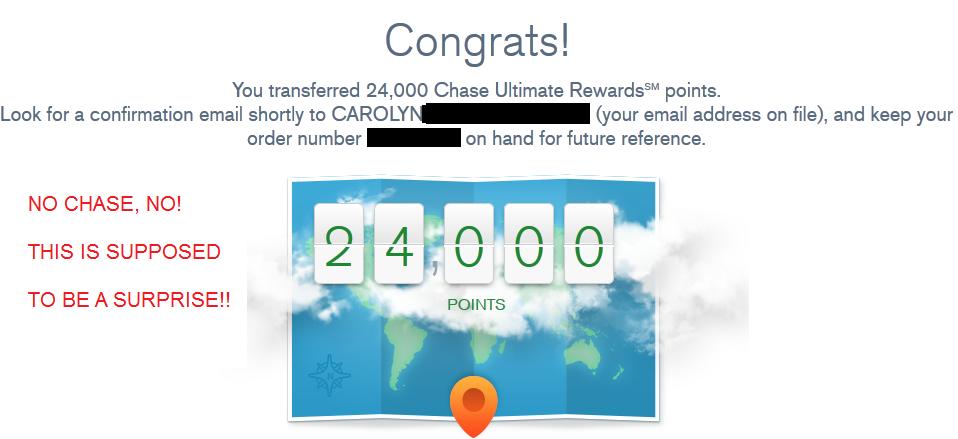

Because I no longer have a premium Chase card, I had to transfer from my wife’s Ultimate Rewards account. Luckily you are able to transfer Chase points to the Hyatt (or other partner) account of a spouse or domestic partner, so I logged on to her account, and transferred 24,000 Ultimate Rewards points to my Hyatt account.

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

Chase apparently didn’t get the memo on the fact that it was supposed to be a SURPRISE!, so I had to monitor her email and delete it when it came in :-). Luckily she gets so much bank and credit card email that she generally just ignores it all 😀

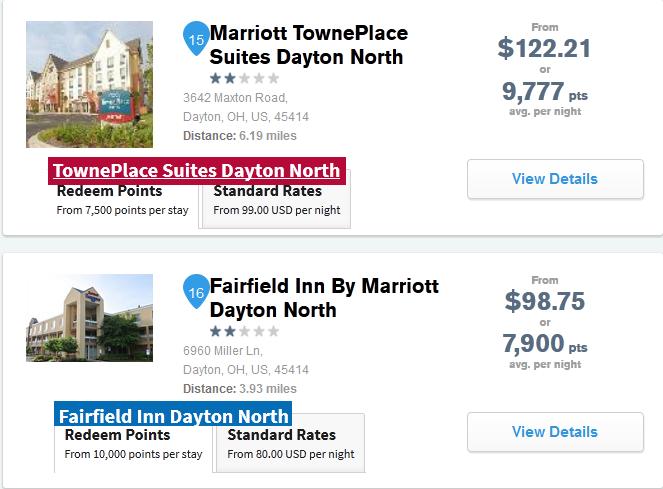

Next I decided that since we were leaving early out of Dayton (an hour away), it would be best to find a hotel near the airport

As I mentioned in my post talking about why you should check the Chase Ultimate Rewards mall before transferring points, you can see that it actually is cheaper (7,900 points) to book the Fairfield Inn through the Chase Ultimate Rewards mall than it would be (10,000) to transfer the points to Marriott and book it as an award stay.

(SEE ALSO: Hotel Review: Fairfield Inn Dayton North)

You may point out that I could have used 7,500 points to stay at the TownePlace Suites, to which I will say…. thanks for reading, my astute viewer!!! 😛

And there you have it! Another successful trip in the books! Have you ever booked a surprise trip for someone? What’s your favorite part of the booking process?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Awesome I hope you had awesome time. This is a cool idea, I have been thinking for sometime to actually book one for my mum 🙂

Sounds like a fun trip. I hope your wife loved it. Did you opt to use 7,900 Chase points instead of just paying the $98 per night? Is that in line with your valuation of Chase points? I’m always curious to hear what others think they’re worth, since it varies so much.

I did use the 7900 Chase Ultimate Rewards points instead of paying the $95. This is probably worth a whole blog topic in and of itself – I know the conventional wisdom is that Chase UR points are “worth” 1.7-2 cents / point and in that case I made a “bad” redemption. Same thing happened when I paid UR miles instead of paying cash for my rental car.

The way I see it is that I have more miles and points than a) cash and b) realistic real life time to use all of them. So in that case I’d rather use more miles and save my cash.

Another way to look at it is what is the cost of generating another 8000 Ultimate Rewards miles? Using the simplest manner of MS possible, I could buy 8 $200 Visa gift cards at Staples with a Chase Ink card to get 8278 Ultimate Rewards miles, at a cost of 8 * $6.95 = $55.60. Add in a bit of cost to liquidate the gift cards possibly (depending on your options), and you’re still well below the $98 you would have paid for your hotel.

So if I DID run out of Chase miles, I’d rather do something like that than spend money instead of points. YMMV