As I’ve mentioned several times before on this blog, one of the best ways to get miles and points is through bonus offers from signing up for new credit cards. I maintain a list of what I consider to be the best travel credit cards and signup bonuses

And of course, as I’ve mentioned, probably just as often, PLEASE DON’T SIGN UP FOR A CREDIT CARD JUST BECAUSE SOME GUY ON THE INTERNET SAYS THAT YOU SHOULD

Applying for the Citi Hilton HHonors card

Citibank recently changed the rules back in August so that typically you can only get the signup bonus if you have not opened or closed any account in that family of cards (so for a Hilton card, opening or closing ANY Hilton card would count)

(SEE ALSO: The current credit card signup rules and best practices for each bank)

A few weeks ago, news broke that there was a specific link for the Hilton HHonors card offering 75,000 points if you signed up and spent $2000 on the card in the first 3 months. The big news was that it did NOT contain the language preventing past account holders from getting the card.

So, Carolyn and I both applied for the card, and were both approved. We both did have to call in and move credit around. In my case, I closed one of my old Hilton cards and product changed it to an AT&T Access More card (READ: You CAN still get an AT&T Access More card)

Getting the “wrong” card

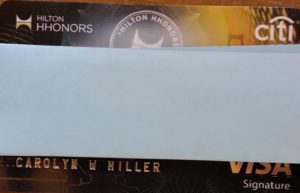

So when Carolyn’s card came in the mail, it showed up with the incorrect middle initial on her card

I blame Chrome auto-filling out the application and sticking in my middle initial somehow in the application. I’m actually kind of surprised that the application went through with the incorrect information

Getting it fixed

To get it fixed, I sent Citibank a secure message (as Carolyn), alerting them of the mistake and asking for them to update their records and send me a replacement card.

Hopefully that should be pretty straightforward with no real lasting consequences

Has this ever happened to you? Have you ever opened up a credit card account with incorrect information?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Middle initial and or name is rarely identifying information (it’s rarely required on airline tickets) for credit card / bureau purposes. That’s probably why it went through.

Is there stil a 75K link for that card somewhere?

Just recently applied for Alaska cards for me, my wife and our business. Accidentally put my social insurance number from Canada on my wife’s card. They called her (she hates dealing with any phone call from the card companies) to straighten it out. I was with her to coach her and still managed to make exactly the same mistake. Luckily, they gave her a second chance and she ignored me and gave them the right number!

Heh – sounds like my wife too 😛