There’s a new Chase Sapphire Preferred 50000 point offer available. To get the signup bonus, you’ll need to spend $4000 in the first 3 months of opening the account. The typical bonus for the Chase Sapphire Preferred card is 40,000 points, so an extra 10,000 Ultimate Rewards is always welcome!

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

You’ll also get 5,000 Ultimate Rewards when you add an authorized user and that user makes a purchase in the first 3 months.

Chase Sapphire Preferred 50000 point offer benefits

The Chase Sapphire Preferred is one of the best cards out there, especially for people that aren’t super interested in signing up for lots of cards. Personally, I try to always be meeting minimum spend on a credit card, and cycling through spending on different cards. But for those people who just want to get ONE card, it’s hard to argue with the Chase Sapphire Preferred.

The main benefit I see of this Chase Sapphire Preferred 50000 point offer is being able to transfer your Chase Ultimate Rewards to transfer partners such as British Airways, Hyatt, United, Amtrak and more.

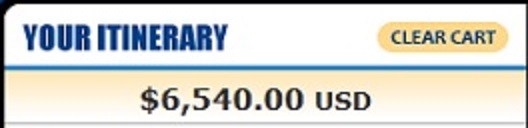

I used 100,000 Chase Ultimate Rewards to transfer to Amtrak to get a $6540 trip for free!

Here are the details on the Chase Sapphire Preferred 50000 point offer

- 50,000 bonus points when you spend $4000 in the first 3 months

- 5000 bonus points for adding an authorized user and having him/her make a purchase in the first 3 months

- $95 annual fee (waived the first year)

Some of the other benefits of the Chase Sapphire Preferred 50000 point offer that range from marginally useful to very useful are:

- No Foreign Transaction fees (this is important, but many cards now offer this)

- It’s chip enabled (SEE ALSO: US Chip and PIN cards – what they are and why you’re seeing them)

- You get 2x points on travel

Who should not take advantage of the Chase Sapphire Preferred 50000 point offer

While I do find myself often recommending the Chase Sapphire Preferred card, especially now that the signup bonus is 50000 points, people who frequently sign up for credit cards should probably not bother applying.

According to the current credit card rules and best practices, Chase is denying applications for the Chase Freedom and Chase Sapphire card to anyone who has more than 5 new accounts open in the past 24 hours (from any bank). So I know that I won’t be eligible for instance, but that’s okay. I’ve earned a “few” more than 50,000 points from credit card signups over the past few years… 🙂

Lastly, it’s important to know that you have different options if you want to apply for the Chase Sapphire Preferred 50000 point offer. Nearly all of the blogs that are talking about this increased offer also make money if you apply for the Chase Sapphire Preferred 50000 point offer through links on their website. I don’t think there’s anything wrong with that, but I do feel that it is important as a consumer to know if the person recommending the card also makes money from you if you act on it!

There are also Chase Sapphire refer a friend offers active, so if you have a friend with a Chase Sapphire card, you can ask them (and they will get 5000 Ultimate Rewards for referring you)

There is also a public link for the Chase Sapphire Preferred 50000 point offer on Chase’s website, if you want to support nobody (I guess that supports Chase? :-D)

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Ugh, I literally just got my Chase Sapphire card yesterday with the 40k point offer. Do you think they will bump me up to 50k if I ask nicely? 🙂

Yes – usually they will. Send them a secure message and they will usually match.

“more than 5 new accounts open in the past 24 hours (from any bank).”

Well, that doesn’t seem so bad. I’ll just wait another day!

If only. That would make for some Happy Holidays though.

🙂 24 months, obviously 🙂

If I already have 3 chase credit cards will this limit or deny my application for the sapphire ?

From what I’ve seen – if you have fewer than 5 open accounts from any bank in the past 24

hoursEDIT: months, you should be okay (depending on the rest of your application details)Does a business card count as part of the 5 even though it isn’t usually part of one’s credit report?

In the past year I have opened exactly 5 credit cards including a Business Ink a year ago. Some reports indicate it’s 5 in last 24mos as a max and others indicate more than 5….

If I apply for Sapphire as my 6th card in 24months am I likely to be approved?

If business cards aren’t counted as part of the 5 card “limit” then shouldn’t I get another Ink for my other business first then get the sapphire?

If I can only get one more chase UR card given the 5 card limit isn’t the Ink the better card to get since it offers 60k bonus? I already have citi premier with better spend category bonuses.

It depends on what credit report Chase looks at, and you’re right, oftentimes a business card will not be listed on that.

Generally speaking yes, I’d prefer the Ink over the Sapphire if I had to choose 1. In addition to the higher signup bonus, it has better bonus categories (5x office supply stores for one)

I do have an affiliate link for the Chase Ink card as well if you’re looking to support PWaC, and if you do, I appreciate it!

Here’s my shameless plug:

https://applynow.chase.com/FlexAppWeb/renderApp.do?PID=CFFD2&SPID=FGKQ&CELL=6RLH&MSC=1494976382