UPDATE: One or more of the offers in this post have expired – check out top hotel credit card offers here.

My wife signed up for the Best Western credit card last year when it was offering 64,000 points as a signup bonus (usually the bonus is just 16,000 points). The Best Western credit card was issued by Barlcays Bank, and I’ve been getting letters and emails letting me know that it is transitioning to being issued by First BankCard, a division of First National Bank of Omaha.

I just got an email letting me know that as part of the transition, Bank of Omaha is now offering a 70,000 Best Western point credit card

But is it REALLY 70,000 points?

But is it REALLY 70,000 points?

Well, you CAN earn 70,000 points, it’s not quite that cut and dry. The actual details are as follows

- 25,000 BONUS POINTS after you spend $2,500 in first 3 billing cycles

- Another 25,000 BONUS POINTS after you spend total of $5,000 in the first 6 billing cycles

- Earn 20,000 BONUS POINTS when you spend at least $10,000 during each 12 billing cycle period

So it’s at least 25,000 points (for $2500 in spend), and another 25,000 points for spending another $2500, and then you have to spend an ADDITIONAL $5,000 to get the final 20,000 points. Whether that’s worth it to you or not depends on how much you value Best Western points. Personally, I’m finding it hard to find good usages for my Best Western points (we have about 57,000 points left).

We did use points for one night at a Best Western, and also got a 2nd room using a Best Rate Guarantee. Of course, it took me 5 times to finally get that BRG approved, but I eventually got it!

Other Best Western credit card benefits

There are some other benefits included with the card

- You do get Platinum Elite status

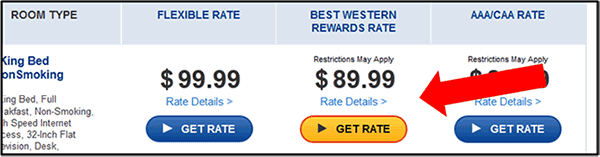

- For paid stays, you get a 10% discount on the best available Best Western flexible rate

- There is a $59 annual fee, which is waived for the first year.

All in all, this 70,000 point offer is intriguing but not super amazing. One nice thing is that it is issued by a “smaller” bank (Bank of Omaha), so it won’t count as a card that you’ve got with one of the larger banks.

Here is the link for the 70,000 point Best Western credit card. This is not an affiliate link and should be publicly available.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

There is no publicly available award chart to be found for Best Western hotels. So, allow me to save you lots of time you could spend figuring out if this card makes sense — the Best Western credit card is a waste.

Out of the five Best Western hotels in a particular region in Europe, all of which are available for a cash stay, only one is available for an award stay. And it must be a good one too, since it will set you back 36,000 points per night. That was for the months of September, October and November.

3. Overall not a good card in my opinion.

Would be interested to know more about how many points it takes for an OK room.

I use AwardMapper to find hotels. The one we stayed at in Indianapolis was nice, it was a category 2 and cost 12,000 points. I will agree with Nuinu that sometimes it’s tricky to find good availability. When we went out to Yellowstone and Mt. Rushmore, we couldn’t find a BW that was the best choice even once out of 8 nights.

Do not waste your time applying for this card if you have had any recent applications for other credit cards. They are extremely tough for approvals and the reconsideration line is just as mean. (plus an extra hard pull). I have never been rejected for any card since I was 21 years old (61 now), high 700’s/low 800’s credit score-pay my bill in full monthly. When I called they weren’t interested in any of it. They also do the La Quinta card so know the bank which is issuing the card before you apply.

Bill – that’s good to know! Thanks for the data points.