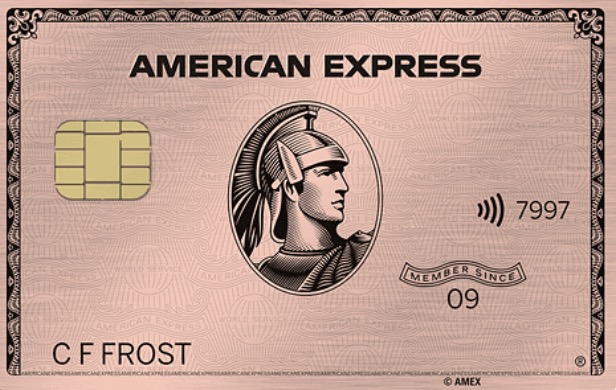

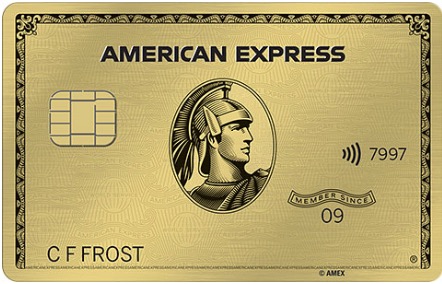

A few months ago, American Express revamped their American Express Gold card benefits. As part of the re-launch of the American Express Gold Card, they offered new cardholders the option to get their card in a new “rose gold” color

But the option to get the rose gold card goes away January 9th (Wednesday). Now personally I’m not sure I’d get super excited about the color of my credit card, but if you’re wanting to get the rose gold option, you’ll want to snag it in the next couple of days.

The highest public sign-up bonus is 25,000 American Express Membership Rewards points after spending $2,000 in 3 months (find that offer here). However, you can also get a refer-a-friend offer for 50,000 points with the same spending requirement!

Perks of the American Express Gold Card

Here are a few of the benefits of the American Express Gold Card

- 20% statement credit for US Restaurants in first 3 months, up to $100.

- $120 dining credit ($10 per month) at the following retailers: GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, and participating Shake Shack locations (SEE ALSO: This is how you screw up your $120 American Express credit (don’t be like me)

- $100 Airline Fee Credit

- Hotel Collection Perks – 2x points per dollar and $75 credit towards dining, spa, and resort activities. However, you must stay 2 or more nights consecutively.

- Baggage Insurance

- 4 points per dollar on US Restaurants

- 4 points per dollar on US Grocery Stores

- 3 points per dollar on Flights booked directly or through AmexTravel.com (Keep in mind, the Amex Platinum is 5x points per dollar.)

- 1 point per dollar on everything else

- No foreign transaction fees

While all of these perks are awesome, there is a $250 annual fee, and it is not waived the first year. However, if you maximize the dining credits, airline fee credit, and statement credit, you will end up ahead! And then the value of the Amex points are just the icing on the cake!

The American Express Gold Card is absolutely worth it!

With the great value of American Express Membership Rewards and how you are able to transfer to so many different partners, your mouth can now drive your travel costs down! And you can look stylish while doing it with a choice of either gold or rose gold.

Where to get the American Express Gold Card

The highest public sign-up bonus is 25,000 American Express Membership Rewards points after spending $2,000 in 3 months (find that offer here). However, you can also get a refer-a-friend offer for 50,000 points with the same spending requirement!

Are you getting this card? If so, why? Where do you love to eat the most? Let’s hear it in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Do you have any idea how long the 50k offer is good for?

Also how long do you have to space out American Express offers? I just got a Hilton card, so I don’t know when I can jump on this.

I haven’t been given any guidance from any of my partners (and my crystal ball is broke 😀 )