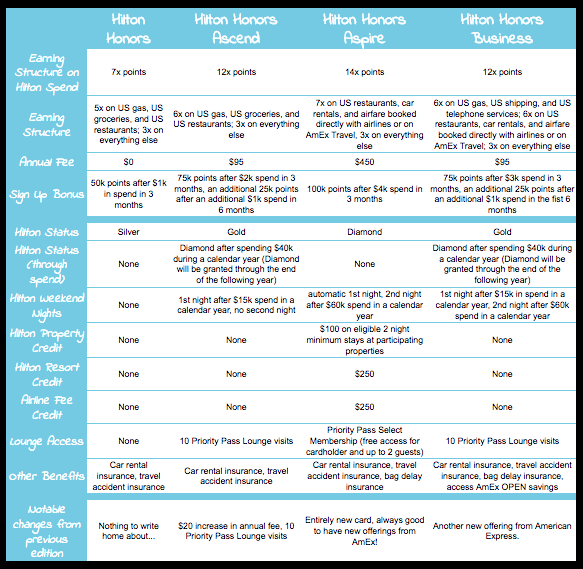

As expected, American Express officially launched their new Hilton cards this week. The new offerings include 4 options – 3 personal cards and a business offering. If you have one of the previous Hilton offerings from AmEx or Citi, you can expect a new card in the future.

Should you keep it? Let’s take a look…

A few things across the board: None of these new cards have foreign transaction fees. Although that’s an easy to find feature, its always nice not to worry about fees! Each card also comes with car rental insurance and travel accident insurance (another common benefit).

The Hilton Honors card remains largely unchanged from the previous American Express edition. If you found it useful before, you’ll be able to keep it in your wallet without another thought. For me, it doesn’t earn enough. When Hilton points are worth so little on their own, and the card doesn’t offer many other benefits, I’d be hard-pressed to keep this one in my wallet. There’s no harm in keeping your AmEx Hilton Honors card open, but I certainly won’t be going out of my way to apply for it right now. Maybe in the future, they’ll offer a more enticing sign-up bonus we can jump on.

The previous Surpass card is getting a facelift, and has been renamed the Hilton Honors Ascend. For all you Citi cardholders out there, the Ascend will also be replacing the former Citi Hilton Reserve. The card’s earning structure and sign up bonus are similar to the last edition, though higher bonuses have been seen in the past. Compared to the Surpass, you’ll pay $20 more for 10 entrances to Priority Pass lounges. Previously, the Surpass card waived the Priority Pass membership, but you’d still have to pay access fees each time you stopped by a lounge.

The Hilton Honors Aspire card will be stepping in as a new top-tier card. Previously, there wasn’t a premium-level card on offer. The Aspire will set you back $450 a year, but gives you some great benefits – $100 Hilton property credit at participating properties on all 2 night minimum stays booked through the Aspire package, 1 free weekend night automatically each year, a $250 airline credit, Hilton Diamond status, and full Priority Pass Select membership.

Another new option, the Hilton Honors Business card is similar to the Ascend, but offers bonus points on additional categories. Instead of 6x points on gas, groceries, and restaurants like the Ascend, you’ll earn 6x on gas, restaurants, shipping, car rentals, and airfare booked directly or through AmEx Travel. Other than the expanded bonus categories (note groceries are not included), and access to AmEx OPEN savings, this an identical card to the Ascend.

Who should get these cards?

My recommendation? If you really love Hilton properties, or have to book them for work, these might be a good option. I’ll echo Ian, and point out that if you’re a classic road-warrior and prefer Hiltons, the Gold or Diamond status on the Ascend/Business card and Aspire, respectively, become a nice perk. If you can book the hotels yourself and get reimbursed by your employer, even better. In that case, I’d absolutely recommend the Aspire. The credits will make up for the annual fee, and you’ll be earning 14x points on essentially someone else’s money. With all those extra points, be sure to book some stellar redemptions!

(SEE ALSO: The 5 best uses of Hilton points)

Hotel status really does make a difference if you’re at their properties every week, and the business traveller will definitely get some benefit out of Diamond status, if they don’t have quite enough stays to qualify organically.

A note of caution, however – you don’t need to rush to apply. With American Express’s once per lifetime rule, readers looking for a new hotel card might want to wait this one out a few months, and see what the issuer can do for us.

(If you don’t have one of these cards yet, feel free to pick one up over on our page!)

I currently hold the AmEx Surpass (now Ascend), and will at least hang onto it until my fee comes up, what’s your plan?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

From what I understood the 100 credit is not for regular two night or more stays regardless of the property, but only when you book through a special travel portal (which some are saying don’t have the most competitive rates at this time).

Looks like you’re right, thanks Mike! As always, some things are too good to be true. I’ve updated the post.

Still confused . . you write, “The Aspire will set you back $450 a year, but gives you some great benefits – $100 Hilton property credit at participating properties on all 2 night minimum stays booked through the Aspire package, 1 free weekend night automatically each year, a $250 airline credit, Hilton Diamond status, and full Priority Pass Select membership.”

HOWEVER, the above CHART reads:

“Hilton Resort Credit…….$200.”

Which is it?

Hi Jason! So there’s a few moving parts here: First, the $250 airline credit. That one is simple, same thing you find on the AMEx Platinum cards. Then, there’s a $250 “Hilton Resort” credit per cardmember year, a statement credit for charges at participating Hilton properties. Third, the $100 credit comes up when booking a 2 night minimum stay on an Aspire card package. You can see those here.

I’m one of those who think the Hilton program is just great as are their cards. I’ve had the Citi Hilton card since 2012 (sad to see it go), but will keep the AmEx version. Ironically, I have the AmEx Surpass card already (got it for a stellar sign up bonus last year.

Hilton points are super easy to earn and I personally get great value from them. I’ve stayed at some fantastic hotels throughout the world all for free.

The AmEx card I think is better than the Citi ones as they give 6 points per dollar for gas stations, restaurants, and supermarkets. That’s a great value. Twelve points per dollar for Hilton charges, on top of 10 points per dollar through the program. Add that to almost never ending bonus programs, and there’s a ton of points to be earned. I’m guaranteed to earn at least 22 points per dollar spent, and generally much more when factoring in the never ending bonus programs.

Back to the cards — looking for a bit of advice actually here. I won’t need two AmEx Hilton cards so I’m looking to perhaps convert one to a different AmEx product, perhaps a Delta card. I’ve got a high credit limit on both so don’t want to lose that as it helps the credit profile. Thoughts there?

Happy that you get so much value out of the Hilton program! If you ever need some help redeeming, check out Sharon’s post here.

As far as your question goes, I’d do two things. First, keep that Citi card, and then when they swap it to the Aspire, hit the $15k spend for the free night if you can. If you can earn all those free nights, that’s a great bonus! Doctor of Credit has some goo info on this comment and post.

Personally, I’d combine credit limits on the two “new” Hilton cards and cancel the additional card. Then, you can sign up for a new AmEx card and hit the bonus. Due to AmEx’s once/lifetime rule, I wouldn’t want to miss out on getting a sign-up bonus. If you move your CL over, you’ll still get the benefit of the lower utilization, but may be sacrificing some benefit on the average age of your accounts if you’ve had both AmEx cards open for a long time.