First for a bit of background – Chase 5/24 is the colloquial term for a recent rule that Chase has introduced where people who have applied for more than 5 cards in the past 24 months (from ANY bank) are unlikely to get approved for (most) new Chase credit cards. Both my wife and I are well over 5/24, so we have essentially both given up on getting most of the new Chase credit cards. It’s the reason that I was not able to fill out a Chase Sapphire Reserve application, and I also can not apply for the new Chase Ink Preferred card. While there were various ways of getting around Chase 5/24, most if not all of those have been closed down.

Getting a (targeted?) email from Chase

The other day though, I received an email from Chase, specifically inviting me to apply for the Chase Ink Cash card, which is a card I don’t have.

The Ink Cash card isn’t a premium card (so I wouldn’t be able to transfer URs to transfer partners (without having another premium card like the Ink Plus). It does do the 5x at office supply stores (similar to the Ink Plus but unlike the Ink Preferred). It has a limit of $25,000 at office supply stores (as compared to the $50,000 limit for the Ink Plus) and doesn’t have an annual fee

Giving it a try

Last week, when I was in the middle of trying to get a 2nd lifetime bonus on an Amex card, I figured I’d go ahead and try to apply for the Chase Ink card with the link in my targeted email. I’m not a big worrier about hard pulls, as I’ve been doing this for several years and my credit score hasn’t really been impacted.

The results!

So when I applied online, I got the dreaded “Pending” notice. I have learned (especially with Chase) to not bother calling reconsideration, so I just waited.

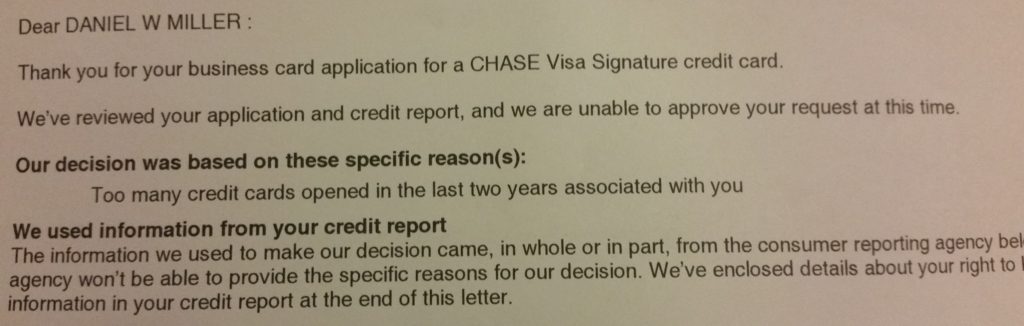

Then yesterday, I got a letter in the mail

dun Dun DUN!

Probably not surprising but I thought it was worth a shot. The 25,000 Ultimate Rewards as well as another outlet for 5x spending would have been nice….

Anyone else have experience being over 5/24 and trying to apply for a Chase card with a targeted mailer?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan…I wrote this blog 2 weeks ago. We were not getting any Chase pre approvals in the summer through early Fall: Here are the highlights.

– My wife and I are way over 5/24 (probably 14/24 – me, and 11/24 or 12/24 -wife)

– last Chase cards we got approved for was end of April 2016 (IHG and Hyatt)

– l applied for Chase Ink in September – got declined

– She applied for a CSR end of Sept – got declined even after a Chase Prvt Client banker/friend followed-up on her behalf

– I lowered my credit card limits on the cards I’m not using (by $30K-$40K) – mid Oct.

– In early Nov, I started getting a pre approval for Slate and Freedom Unlimited (I didn’t apply for them though)

– End of November, we decided to clean our Auth User statuses. We were about 5 AUs on each other’s accounts.

– Early December, my wife dropped down to 7/24….got a CSR pre approval – Applied…GOT IT!!!

– I still don’t have a CSP under my own name, but I kept my AU status on my wife’s CSP

– Today, I removed myself as AU on her CSP. Also, talked to Credit Bureau to have it removed from my credit report – will reflect in 3-5 business days

Is it obvious that I want this darn CSP, or CSR, or Ink? 🙂

https://daddytravels.wordpress.com/2016/12/11/the-hamilton-tickets-of-credit-cards/

Heh. I want a CSR or another Ink too but I think it will be easier to just wait for one of my kids to turn 18 😀

I’ve become a familiar face at my local Chase branch. They are also not sure how exactly the 5/24 worked. They learn from bloggers as well. So I think I’ve done everything I could for me to increase my chances in getting a CSR or CSR. Oh I forgot to mention, last night, I sat down with a banker and had him update my Chase Profile with my income info….hoping that triggers something….not that I’m thinking about this at all or anything!!!!

Hi Jason, could you tell me how to remove AU by talking to credit bureau? I think my wife and I both have many AU on the profile. Thanks for your attention. I am located in southern Cal.

Ozzie…I’ve had to do that with Chase. I removed myself and my wife as AUs on each other’s accounts (Chase IHG, Sapphire Preferred, Freedom, Hyatt, Marriott, Slate). So I called the # on the back of my Chase credit card, the rep removed me as an AU….but as an extra step, I had to ask to be transferred to their Credit Bureau specialist. That’s the person or group that will actually reflect your removal from your credit report. They’ll ask basic questions, and then let you know that the removal will take effect in 3-5 business days. Easy. I had to call Amex, Citi, US Bank too and remove ourselves as AUs….they don’t seem to have the same Credit Bureau process like Chase. Any other q’s let me know.

Thanks so much for the great info. I would make the call ASAP. Hope we all get the new CSR cards next early of year. Happy Holidays!!

Ozzie, I called my banker today by phone, and no, I’m not a Chase Private Client, I just built relationships with the bankers hahaaha…..I’m now preapproved the CSR!!!! All the hardwork….I’ll blog about this soon.

Same here Dan, with me being just over the Chase limit and proud carrier of the Sapphire and Freedom cards with never a problem associated with them. I applied for the Reserve card through the local Chase bank, as recommended, to no avail. They offered me Reserve membership minus the bonuses which came with the new card, the very reason I was applying! I declined their kind offer.

Roger, I was given a similar offer (Slate to CSP – I have no CSP). My only gain there was getting an Ultimate Rewards account, but not the 50K sign-up bonus points, so I also declined. I’ll wait 🙂

I’m right at 5/24. I thought I would give it a shot as I wanted to get in on some of the gift card deals at office stores during the holiday season. I thought maybe I’d still be able to open the business card since majority of the cards I’ve opened lately were personal.

I did not receive a targeted offer through my CSR/CSP, so I applied directly on the site. After applying online, I received a similar “application pending” message, and thought I was just locked out due to 5/24. Surprisingly though, a week later I got an email saying I was approved for the Ink Cash and my card was in the mail!

I guess the pending applications can go either way afterall.

That has happened to me too where I don’t call and it just shows up in the mail. Congrats!

Dan,

Thanks for sharing your approach and unfortunate result for what appears to have been a targeted offer. I believe that 5/24 account openings per the respective reporting agency pulled at the time of the Chase application review is the trigger rather than the number of applications over the 24 month period. As a DP, did you apply using SSN or EIN (not that this matters with 5/24 being the apparent driver)

I applied with an EIN but also had to put my SSN in as the “user”

Dan, when I applied for the Ink 3 months ago, I was clearly 14/24. With all the changes I mentioned above, I’m probably at 7/24 now. Should I pull the trigger? Maybe I will “after” I see development with getting a CSR or CSP offer

I would not expect to be approved for an Ink at 7/24

Hi, What is your opinion about getting a UA business card while holding an Ink Bold? I would be using my SSN again to apply. Is it very tough to get more than 1 Chase business card nowadays? Thanks.

It’s tough but not impossible from what I’ve heard. IMO the downside to trying is small

I decided to upgrade my CSP to CSR just for the ongoing benefits. I’m due to be under 5/24 by September. Is it worth trying to downgrade CSR to CSP and then applying for the CSR (while not applying for anymore cards)? Also does my upgrading to CSR count against 5/24?

I did with a targeted 100k mailer offer, got the same letter as you