I wrote a few months ago about an offer that Bank of America was offering, that gave 25,000 bonus Alaska miles for opening up a new checking account. Since I already have (several!) Alaska Airlines cards, this seemed like a good fit. Even though I don’t live near an airport served by Alaska, Alaska Airlines has some great partners, and I’m definitely heavily considering using my Alaska miles to fuel my next (first!) round the world trip

I wrote a few months ago about an offer that Bank of America was offering, that gave 25,000 bonus Alaska miles for opening up a new checking account. Since I already have (several!) Alaska Airlines cards, this seemed like a good fit. Even though I don’t live near an airport served by Alaska, Alaska Airlines has some great partners, and I’m definitely heavily considering using my Alaska miles to fuel my next (first!) round the world trip

Opening the Bank of America checking account

Both my wife and I opened up our Bank of America checking accounts, and all went well. We made our qualifying direct deposits, and a short time after, the 25,000 bonus miles were credited to each of our Alaska Airlines mileage account.

But then… the problems began!

How my new Bank of America checkout totally screwed me over!

My system for keeping track of my spending and bonus offers is that every week or two, on Saturdays, I log on to each of my accounts, make sure I have accounted for the spending, and make sure there aren’t any charges I don’t expect. Another important part of my system is that every time I sign up for a new credit card, one of the first things that I do is set up an automatic payment to pay off the statement balance in full each month. This has been working very well for me, including with my existing Bank of America Alaska cards

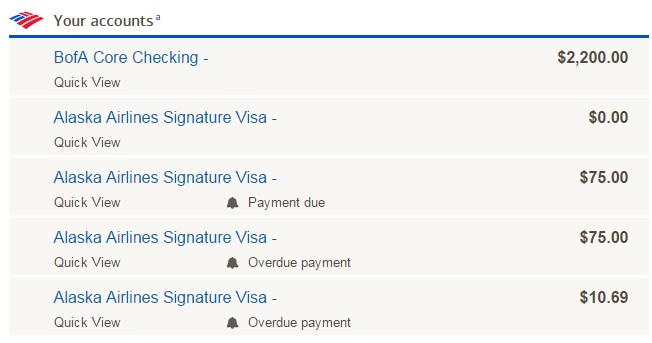

So I was surprised when I logged in to my Bank of America account to find several overdue payments as well as a $1.50 interest payment!

Wait… what?!?! It would not have been the first time that I had signed up for a credit card and then forgotten to set up the automatic payment, but some of these accounts were NOT old accounts! They had been on auto pay for several months!!

I used the online chat system to try and figure out what was going on. The chat agent was able to waive one of the 2 interest fees, but said for the other one, I’d have to call the online banking department.

(SEE ALSO: Bank of America reconsideration phone number and website)

So I called them up and got passed around to 3 different people, before eventually getting to someone who explained what was going on. She said that when I opened a Bank of America checking account, it changed my online profile to a “full” profile (because I guess before I was not a “full” customer, only having credit cards with them).

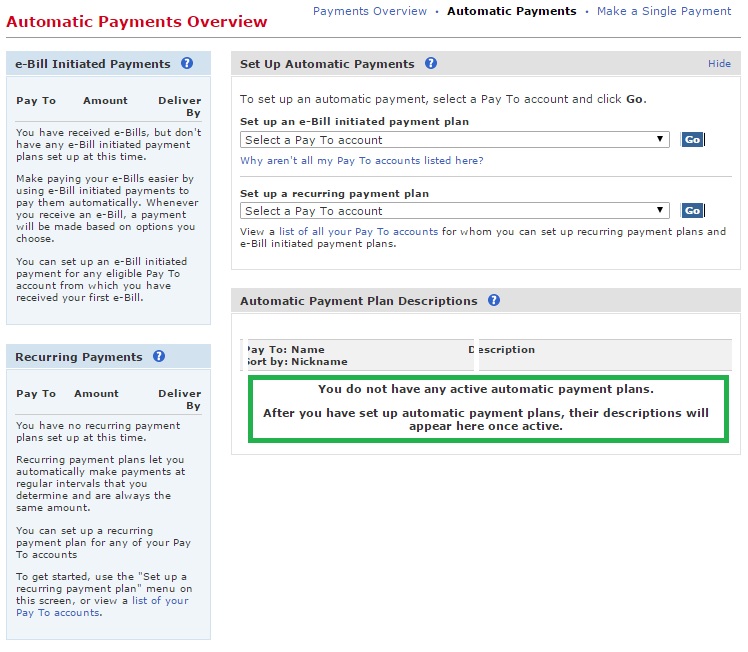

She said that when that happened, my previous online bill pay profile was deleted. Sure enough, when I go into my Automatic Payments section, there’s nothing there

(!)

They were able to waive all the interest charges, and I was able to get all my accounts paid up and set up again, but talk about super shady! I am guessing that if (WHEN!) I close my Bank of America checking account, it may mess up my bill pay profile again, so I’ll make sure to double check when that happens.

Has this ever happened to you? If not, you’ll need to be careful to check

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Have a Citi Gold account attached to an IRA with a balance large enough to have the Gold Account $30 monthly fee waived. Every year the attachment is broken by the bank at least 1-2 times and the $30 fees start rolling in. Nothing was changed on my side with the accounts. Every time it happens my call to the bank gets the fees waived. Nobody at the bank can tell me why this keeps happening. I used to believe in the tooth fairy, the honesty of the Clintons and the integrity of the banking system, but now I have my doubts.

Yeah. The one good thing is that I’ve found if you call, you can pretty much get every fee waived. It is frustrating to have to keep calling in about it though….

BOA’s automatic payments always suck…

Agreed, BofA online payment is difficult to work with. How can I set up a recurring payment for the full statement balance of a credit card? It only seems to accept entering a dollar amount

@Gerd You need to PM BOA and they will send you a link to pay your balance in full. They don’t make it easy, that’s for sure.

Appreciate the head’s up but I thought, based on the inflammatory title, that your opening the checking acct must have brought eyes on the acct in a way that they closed CCs and/or clawed back points! Since it was indeed made right, you did come out whole, if inconvenienced.

I hate B of A’s tech and dealing with their website. I swore once that I’d never get another CC with them for that reason. But I relented and now I just assume that if I do anything with B of A, I may be in for inconvenience along with the promo or bonus miles.

The title worked and got me to click, but it does seem, after reading, a bit over the top.

Maybe… but I think that getting interest charges and overdue payments is a bit more than an inconvenience, right? I mean yes, I did get it all righted in the end, but only because I’m hyper-aware of my accounts.

That just reeks of terrible programming on BofA’s end. Apparently no one ever thought through in testing – well what if someone who was a credit card customer then opens a checking account? I’m sure that is something they want!

I know – it seems pretty ludicrous!

The only late payment check on my credit report is from BofA from something similar years ago. They gave back the late fees and interest but the late payment stuck (over 30 days). Always made me more careful with them!

I would try to get that off your report! I had something similar. I went on the reporting agency’s website and disputed it. It was gone in a month.

I agree with ES above…..you weren’t “TOTALLY screwed!” but rather were “TEMPORARILY inconvenienced until you made a phone call!”. Nice clickbait, though.

Were you targeted for BofA Core Checking & 25K Alaska miles? How long did it take for the miles to post after meeting requirements?

Yes – I believe anyone that has an Alaska card was eligible. The miles posted pretty quickly

I had a minor payment overdue plus a small penalty because I thought the card ( Alaska ) was set up for auto pay from BOA checking . I had to get on the phone when I noticed ‘overdue’ . Did not get waived but learned a lesson . When due time is getting close I usually just pay early now .

Doesn’t seem to have effected my credit score though .

Not as horrible as that but heads up if you have a Chase personal card and add a business card and want to keep one login you’ll lose your existing personal login and profiles and have to create a new business login ID and go through much of the initial setup process like a new card customer since you are now a different customer type.

It’s more work but I check my accounts way more than every two weeks. Plus I do not trust ANY company/bank/etc to do anything for me automatically. If I can’t keep track of it, I don’t do it.

Not that your system is wrong, just that I don’t trust these companies to be on my side because really, they are not.

Yeah – you’re right. I try to check every week on Saturdays, but sometimes the rest of my life gets in the way… :-/

Why do you keep on saying “BOA”? Your account name clearly says BofA, bee of ‘ay.

I’m just abbreviating I guess? Is BOA something else?

BOA is definitely the Korean K-pop singer. Or Bôa, the British band.

Confused on how that “screwed you? Everything was resolved satisfactorily. Click bait?

Have trouble with several banks double paying balances if I pay from an acct. other than my autopay account. AMEX, Chase, & Citi check balance due on the due date and only pay what’s left. Every other bank I have is apt to double pay if I don’t call and tell them not to. Even then I have to triple check that they haven’t canceled my autopay. I’ve brought this to their attn. MANY times over the years, ‘ts in their best ‘interest’ not to listen. Sorry ’bout the rant, do other people have this problem??