I am not a huge fan of buying points and miles, especially speculatively. But in certain situations, especially where you are buying these points for a specific purpose, I think buying points can be a great idea. I wrote before about how buying points saved me 70% on a hotel stay, and it happened again with even bigger savings. So I thought I’d share a bit about what happened as a reminder and PSA to check for buying points opportunities.

A 4 Night Stay in San Antonio

Funnily enough, just like last time, this is for a 4 night stay for a conference. Last time it was in New Orleans – this time it’s in San Antonio. The conference is at the San Antonio Marriott Rivercenter, and the conference has a group rate for $259 / night. With taxes and fees, a 4 night stay at the conference hotel was right at $1,274.

While I do think that staying at the conference hotel is often a good idea, and if the price was close, I would also consider staying at the conference hotel as a way to support the conference, I thought I might be able to save a chunk of money by buying points.

Using IHG Points Instead

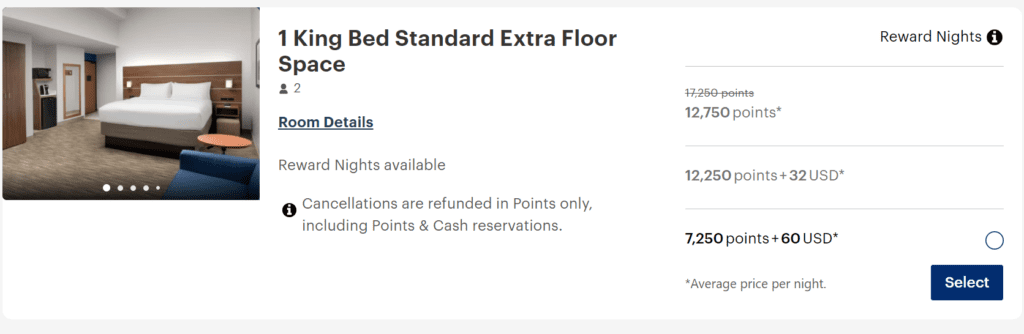

So I looked around and saw that I could book 4 nights at the Holiday Inn Express San Antonio N-Riverwalk for only 52,000 IHG points.

Let’s set aside the ridiculousness of IHG offering a stay for 12,750 points OR 12,250 points and $32! That’s like buying IHG points for 6.4 cents per point, about 10 times what they are actually worth.

But since I have the IHG One Rewards Premier Credit Card, I get the 4th night free on all rewards points stays and since I needed a 4 night stay, this worked out fantastically.

(SEE ALSO: Which IHG credit card is the best?)

Buying Points

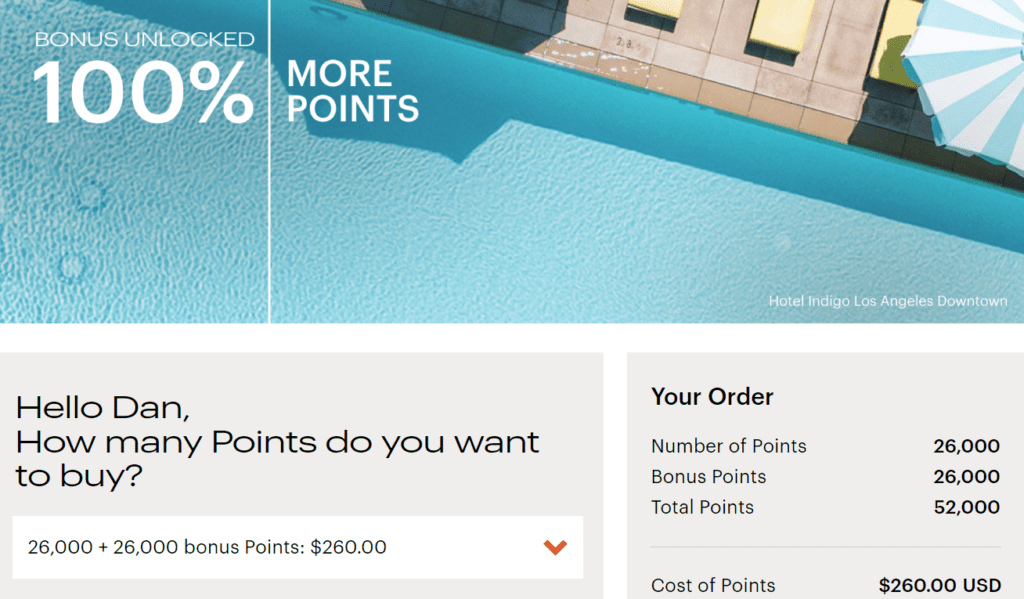

IHG regularly offers sales on buying points, and recently they offered a 100% bonus on buying points. So 52,000 points only cost $260 to buy.

Compare that to the $1,274 that I would have had to shell out to stay at the Marriott , and you can see that doing it this way saved over 80% of the cost. Yes, there are a few downsides to staying at a separate hotel, but I’m on record as not liking staying in “fancy” hotels anyways.

(SEE ALSO: When is buying airline miles worth it? In ONLY these 3 instances)

The Bottom Line

While buying points is not something that I would typically recommend, there definitely are times when it can make a lot of sense. On a recent stay in San Antonio, I saved over 80% by strategically buying points instead of paying cash to stay at the hotel where the conference was. Now this isn’t a true apples to apples comparison, but I think it does illustrate the point that it can make sense to check for buying points as a way to save money, especially on a 4 night stay if you have an IHG credit card that gives you the 4th night free on award stays.

Do you ever think buying points can make sense? Leave your thoughts in the comments below.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan,

On occassion you might find a sweet spot in purchasing points. Ironically I found this to be true with IHG and Wyndham. Depends on the hotel, the time of year, the rate and the value of points. Two examples:

IHG in NYC during the winter where rates are low for using points.

Wyndham properties charging 15,000 points per night and a rate in excess of $250 per night.

Yeah – I think those are great examples. I had good luck with Choice points in Scandinavia back in the day as well. I think buying IHG points on 4 night stays is probably the ultimate sweet spot for this type of strategy

It’s a looooong walk from New Orleans to the Conference Center in San Antonio.

LOL

LOL – I hate when I do that :-). Post updated / corrected