I am not generally a fan of speculatively buying points. Even when points go on sale, they are often still sold at a cost which is high above their actual worth. And since miles and points are generally a deflationary currency (meaning that their value will only go down), it doesn’t make sense to buy them in a lot of cases. Still, there are a few times when buying points can make sense, ESPECIALLY (and only?) when you have a specific use for those points. So I want to share a recent real-world experience I had where buying points saved me around 70% compared to the alternative when booking a hotel

A 4 night stay in New Orleans

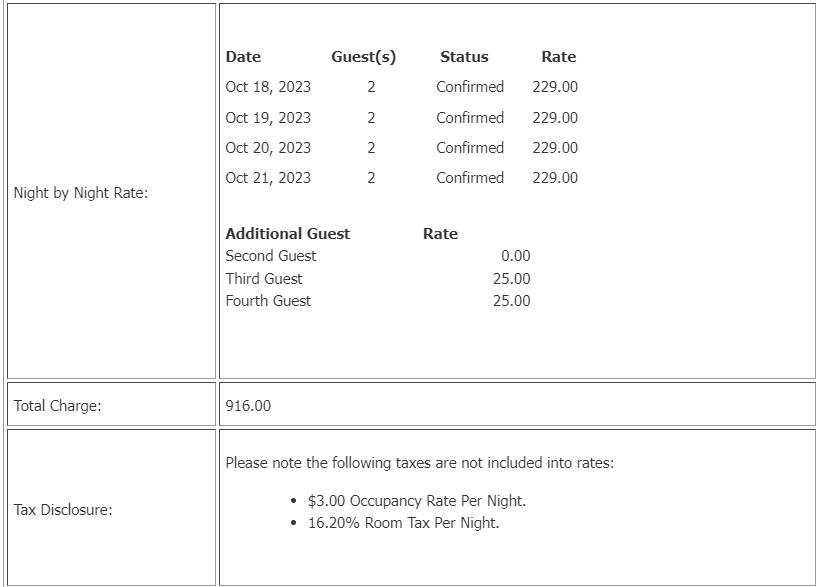

I recently returned from the FinCon conference in New Orleans, where I was staying for 4 nights. The conference itself was hosted at the Sheraton New Orleans. I booked originally via the conference room rate of $229

With $3 occupancy rate charge and 16.20% room tax, my total for 4 nights came to $1,076.39. I do think there’s a lot of value for staying at the hotel where the conference is located, but that was a lot of money

Using IHG Points Instead

So I looked around and saw that I could book 4 nights at the Holiday Inn Express New Orleans Downtown – French Quarter for only 61,000 IHG points. Since I have the IHG One Rewards Premier Credit Card, I get the 4th night free on all rewards points stays.

(SEE ALSO: Which IHG credit card is the best?)

Buying Points

IHG regularly offers sales on buying points, and recently they offered a 100% bonus on buying points. So 61,000 points only cost $305 to buy. Compare that to the $1,076.39 that I would have had to shell out to stay at the Sheraton, and you can see that doing it this way saved over 70% of the cost. Yes, there were a few downsides to staying at a separate hotel, but I’m on record as not liking staying in “fancy” hotels anyways.

(SEE ALSO: When is buying airline miles worth it? In ONLY these 3 instances)

The Bottom Line

While buying points is not something that I would typically recommend, there definitely are times when it can make a lot of sense. On a recent stay in New Orleans, I saved over 70% by strategically buying points instead of paying cash to stay at the hotel where the conference was.

Do you ever think buying points can make sense? Leave your thoughts in the comments below.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

In 2023 I traveled to Europe three times and stayed 61 nights using IHG points I purchased at $5.00 per 1,000 points and Choice Privileges points purchased at $5.20 per 1,000 points. Redeeming about 600,000 points for free nights reduced my hotel room rates by about 50% overall for around $3,000 in savings.

I’m sure you made a good decision….but isn’t the point how much you saved over the cash price of the IHG hotel by biting the points?

Did I miss something? You didn’t mention how much the cash price for the Holiday Inn Express you stayed in. That would be an apple to apple comparison. You compared a Sheraton price to a Holiday Inn Express price via points purchase, how is that an equal comparison? I am glad you saved money but as you alluded to Sheraton being a fancier hotel I don’t see how 70% savings is true.

Buying IHG points is a great deal and saves significantly on hotel rates in my travels. I was inaccurate and imprecise in my comment above.

I spent 502,000 IHG points and one free Chase Visa reward night for 26 hotel nights in 2023. I stayed at several fine hotels including InterContinental Berlin, Kimpton DeWitt Amsterdam, Hotel Indigo Milan.

I can be precise with room rates and reward rates for 16 IHG nights from

a recently completed trip across Germany with 16 IHG hotel nights through 4 separate 4-night reward stays using Chase 4th night free rate.

275,000 IHG points = $1375 purchased for 16 reward nights at IHG hotels in Germany:

$2,556 Best Flexible Rate (BFR) for these 16 nights.

Buying 275,000 IHG points for $1,375 saved $1,181 on our 16 nights with IHG in Germany. A 46% discount on best flexible room rates.

InterContinental Berlin 103K = $515, $128.75 room night.

BFR IC Berlin = $239 x 4 = $956. Saved $441.

HI Nuremberg City Centre 51K = $255, 4 nights, $63.75 room night.

BFR HI Nuremberg City Centre = $129 x 4 = $516. Saved $261.

HIX Regensburg 56K = $280, 4 nights, $70.00 room night.

BFR HIX Regensburg = $103 x 4 = $412. Saved $132.

Holiday Inn Munich City Centre 65K = $325,

4 nights, $81.25 room night.

BFR Munich City Centre = $168 x 4 = $672. Saved $347.

As an InterContinental Ambassador ($200 fee) and IHG Diamond member for 2023 with a Milestone Award for lounge access after 40 nights in 2022, we also had 4 days at the InterContinental Berlin lounge and complimentary breakfast for two for 7 of 8 mornings at Holiday Inn.

IHG offered great deals in 2023.

Don’t forget you receive a 10% point rebate with the credit card and pay no sales or room tax which is a significant savings.