These offers are now expired – see this page for the current top credit card offers

New Hilton 75000 point credit card offer

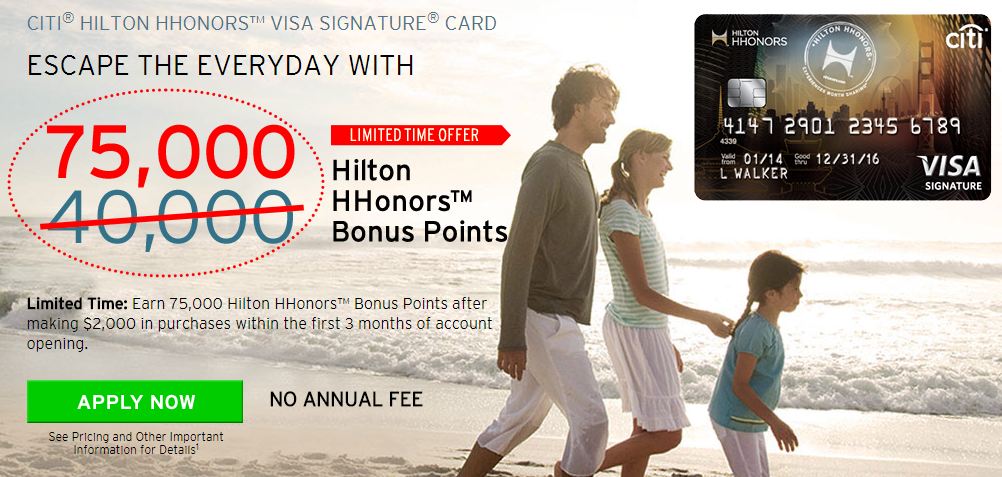

A few months ago, Citibank came out with a increased 75000 point offer for the Hilton HHonors card. My wife and I both signed up for one back then, but shortly afterwards it returned to its “normal” value of 40,000 points. Recenlty, Citibank just released a new offer for 75,000 Hilton points after spending $2000 on the card in the first 3 months of having the card. I realize this news broke last week but I was out on vacation so I wanted to make sure you were all aware of the Hilton 75000 point offer if you haven’t heard about it already.

In addition to the Hilton 75,000 points that you’ll get, you also will earn 6x points at Hilton hotels, 3x points at supermarkets, drugstores and gas stations, and 2x points anywhere else. 3x points sounds nice but Hilton points are not as valuable as other points, so this isn’t a card I’d put everyday spend on, though 75000 points is a lot and worth doing.

(SEE ALSO: Chase Ultimate Rewards: 5 reasons I think they’re the best miles out there)

The Citibank Hilton 75000 points offer does not come with an annual fee. If you’d like to apply for the Hilton HHonors 75000 points card, you can find a link on our top credit card offers page (If you apply and get the card by clicking through this link, I will receive a commission)

Hilton 75000 point offer also gives Hilton HHonors Silver status

This Hilton 75000 point offer will also give you Hilton HHonors Silver status, with a fast track to Gold status, if you stay at least 4 times within the first 90 days or spend $20,000 on the card each year.

Hilton Silver status is not that great, though Gold is pretty good (giving breakfast and lounge access, even in Europe), though I personally would not take advantage of this “fast track” offer. I have complimentary Hilton Gold status thanks to the American Express Surpass card (though that does come with an annual fee)

Citibank signup rules

If you’re active in the travel hacking world, you probably know that Citibank has recently changed the rules for credit card signups. This card is no different – from the fine print:

Hilton HHonors Bonus Points offer not available if you have had a Citi Hilton HHonors Visa Signature Card account that was opened or closed in the past 18 months.

Between my wife and I, we have a few of these cards, and since I signed up for the last Hilton 75000 offer a few months ago, we won’t be eligible for this offer, but maybe you are!

What to do if you just signed up for a lower bonus?

I have read reports that if you just signed up for a lesser offer recently, that you can call the number on the back of your card to request that they match you to the new Hilton 75000 point offer. I don’t have personal experience with Citibank matching offers, though I have with both Chase and American Express, and I certainly think that it would be worth a call.

You can view top hotel cards at this link (again, if you apply and get a card by clicking through this link, I will receive a commission)

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Does this mean 18 months from when you cancel the card or from when you first got it?

Either. So typically I wouldn’t close the card since it has no annual fee. That way it would be 18 months from when you opened it

Hi Dan — I’m very interested in applying for this, and definitely want you to get the credit! But when I followed the link you provided, the only Hilton card there said it was a 40K point bonus. Is there a different link?

The link is here, and I believe it’s correct. You’re probably looking at the Hilton AMEX which is still at 40K. You need to select “Show More” to see the 75,000 offer on the Citi Hilton card

Darn it. I just opened the AMEX one last week and received 50000 points. I would much rather have had this one for 75000.

Nothing says you can’t have both 🙂

but it’s the same card i opened so i wouldn’t be eligible for this offer right?

Have you had any issues simply getting cards with Citi in general? My wife and I both got denied on our last applications with them, citing too many recent accounts (3-4 in last six months, 10+ in last 24). I don’t really see a lot of other people report this, but they seem stricter than Chase (I guess until Chase tightened down even more in May). Amex seems to approve us for everything.

never mind i see what you are saying. It is a different card. Thanks!

“I don’t have personal experience with Citibank matching offers, though I have with both Chase and American Express, and I certainly think that it would be worth a call.”

I recently tried to get the 70,000-mile bonus on the Chase UA card, which was offering 50,000 when I signed up. I sent them a message via their web site, but was turned down 🙁 Maybe a phone call would be more effective? And if so, is there a particular number you’d call with an extra-bonus-miles request?