I have a lot of Chase cards. I’d imagine I am not alone in this – after all, Chase Ultimate Rewards is one of the best mileage “curencies” out there – with tons of transfer partners and lots of good ways to earn them, one can never have too many (can they?)

I have a lot of Chase cards. I’d imagine I am not alone in this – after all, Chase Ultimate Rewards is one of the best mileage “curencies” out there – with tons of transfer partners and lots of good ways to earn them, one can never have too many (can they?)

Yesterday I learned a trick on how to manage my Chase account online and I thought that I would pass it on!

When I log on to my Chase account online at chase.com, I am greeted first by an Account Summary breaking down my statements into groups based on whether they are personal cards or business cards (and I actually have several different businesses, so they’re grouped even further). To me, these summaries are not particularly useful and just clutter up the page.

Then, it lists my accounts. Here’s what I have:

- Chase Ink business card (closed)

- Southwest Business card (how I got my Southwest Companion Pass!)

- Chase Sapphire Preferred (closed – though thankfully I remembered to transfer my Ultimate Rewards out first!!)

- Southwest Airlines Personal card

- Chase Freedom card

- IHG Rewards card

- United Explorer card (there are reports of a possibly targeted 50,000 mile bonus out there)

Why do closed cards show up there?

Why do closed cards show up there?

I guess I can see why Chase would keep closed (zero balance) cards for a little bit, to let you see your final statements and/or make a final payment, etc.

It just feels like I closed these cards quite a bit of time ago, so I’m not sure how long Chase will keep them in my account summary.

How to hide your Chase account online

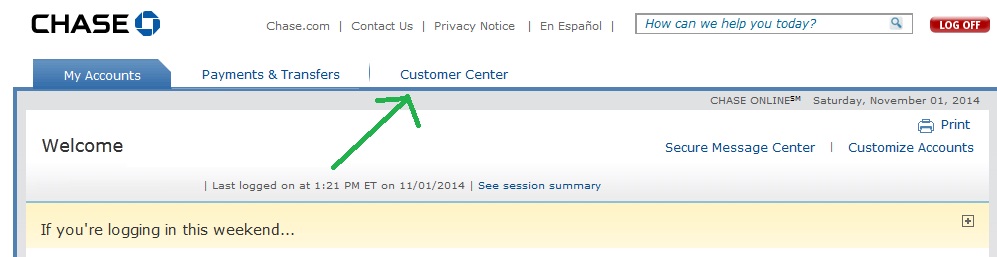

Thankfully, there is an easy way to hide accounts that you don’t want to see. First, on your main “My Account” page, go to the Customer Center

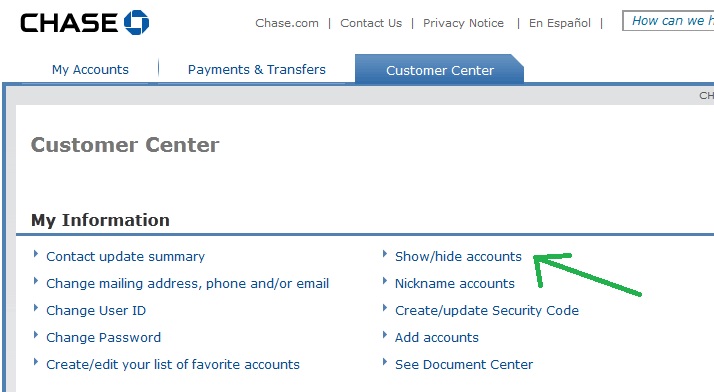

Then, choose “Show / Hide accounts”

Once you’re there, it will ask you from which login you want to show / hide accounts. In my case, I have myself and 2 business accounts (I have them linked together, but I’ve never quite understood how Chase has them linked on their back end – they all show up for me in one online login).

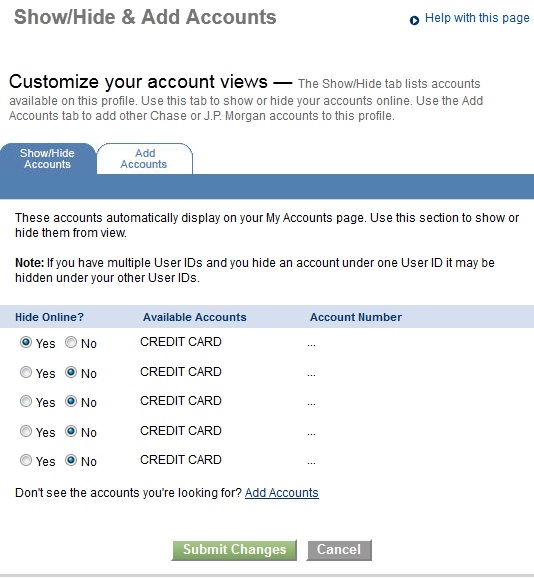

Pick one of them (you’ll need to repeat the process for each login), and you’ll see the following screen:

Choose which cards you want to display and ta da! You’re done!

Choose which cards you want to display and ta da! You’re done!

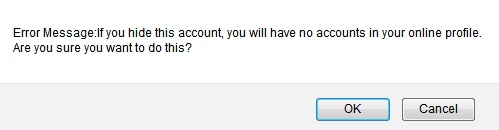

One thing to note is that in my case, my business only had my Ink card, which I was hiding. When I chose to hide that card, I got the following error message

Not a big deal – I just hit OK and that account did not show up any more. You still can go back in and unhide these accounts later if you want. Hopefully this helps you keep your life simple and uncluttered!

(HT: Travel With Grant)

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

if you had a account does is still show up on the chase mobile app

you can hide in the app using the same steps.