A few months ago I got the Chase Fairmont card when I found out that Chase had pulled the public application links (SEE: Jumping on the Chase Fairmont Visa before it’s gone!). A couple of other links were still active, so I was able to still get approved.

Besides the free 2 nights from the sign up bonus and the other certificates from Fairmont which allowed us to have a wonderful vacation in Banff (SEE: How We Stayed at the Fairmont Banff Springs for 3 Nights for $99.18), I was hoping that obtaining the Fairmont card would be a back door to a Chase Freedom Unlimited. Neither my wife nor I have this card, and we cannot get it due to the Chase 5/24 rule.

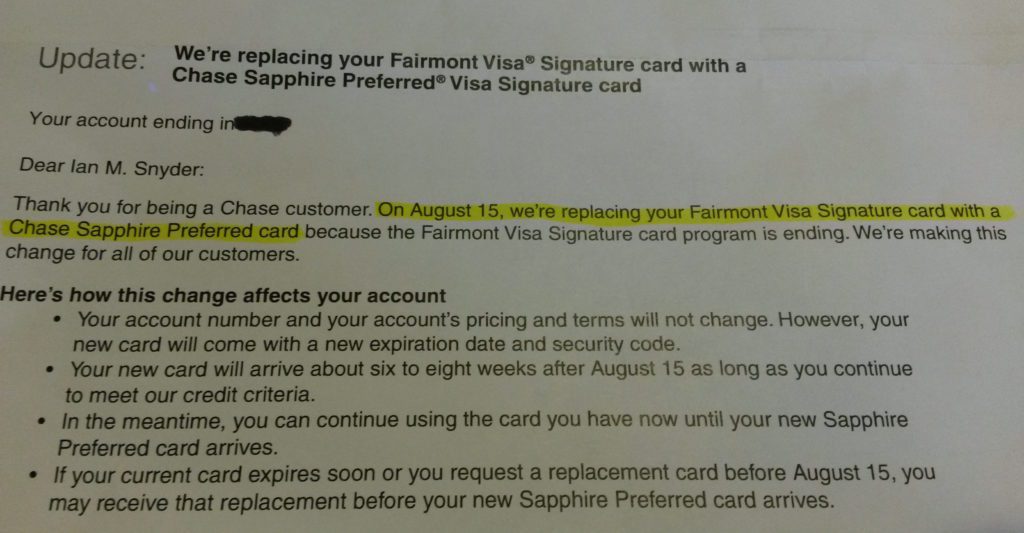

Fairmont card being product changed

Today I received a letter from Chase spelling out the future of the Fairmont card. As of August 15, my Fairmont card will be converted to a Chase Sapphire Preferred card! While this isn’t exactly what I wanted, I’m sure I’ll be able to product change the CSP into a Chase Freedom Unlimited. So I’m still quite happy.

If for some reason I cannot product change my new CSP right away, I’ll simply have my wife change hers to a Freedom Unlimited. Easy peasy.

Details on the account change

The letter from Chase explained the changes that will happen come August 15. Specifically:

- Account pricing will not change (simple, because the Fairmont annual fee is the same as the CSP)

- Fairmont points will accrue like normal on statements closing up until August 15, 2017

- On August 15, unredeemed points will be transferred to the new Sapphire Preferred account (assuming at a 1:1 ratio to Ultimate Rewards)

- The complimentary night will still be offered if you spend $12,000 on the Fairmont card before August 14. The certificate will be good for one year from issue.

- If you don’t have 12 months to earn the complimentary night, Chase will issue it if you hit $6,000 in spend before August 14. This is a one time courtesy. It will be deposited within 6-8 weeks, but only good through February 28, 2018.

The last point is interesting. I should fall into that category since I won’t have a full 12 months to earn the annual free night. Since I already spent over $3,000 for the initial card sign up bonus, I only need to spend another $3,000 to get a free night at a Fairmont. I even have a room upgrade certificate still. This might come in handy for a trip to San Francisco!

It’s also nice that Chase is transferring the points to Ultimate Rewards rather than simply cashing them out at $0.01 per point or something like that.

What about you: do you have the Fairmont card and are you excited that it’s being changed to a Chase Sapphire Preferred?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The question is if Fairmont will have a card with another Bank soon. That would be be nice…. Accor does not have a card in USA….

@ Ian — I find the terms about not having a full 12 months to earn a free night odd. Unless your anniversary date falls on exactly August 14, you don’t have a full year to earn a free night. By my reading, if your anniversary date is August 5, for example, you could earn one free night by spending $12,000 from August 6, 2016 – August 5, 2017, and then earn another free night by spending $6,000 from August 6, 2017 – August 14, 2017. Do you agree?

I can see that reading, and you could certainly argue that with Chase, but that is not how I read it. I think it means that if you anniversary falls between now and August, you need to earn the free night per the normal 12 month terms. Otherwise, you have access to the $6,000 option.

However, if my interpretation applies, and I was in the position of my anniversary falling between now and August, I would *absolutely* be asking Chase to waive the annual fee, as I wouldn’t be getting the benefit of the card in the future, and the CSP normally has the first year’s fee waived.

I must be one of the few who will miss this card. We have had 2 amazing trips to Hawaii with the free nights and buy 2 get the 3rd nights free certificates. I’m hoping Fairmont will continue their loyalty program with another bank. There is no place as gorgeous and perfect for a large family than the Kea Lani in Wailea!

What would happen if you complete the $6000 in spending by August 15, but your annual fee is charged around Sept 1 and cancel the card to avoid the fee, will the free night still be credited to my account?

My understanding is that, yes, it should be credited. You could also wait most of the 30 day window after the fee hits, call to cancel, and have it refunded.

What to do if I do not want the conversion to the CSP, but still want to spend the $3000 to receive the bonus night ?

I’m not sure you can avoid the conversion to the CSP. I’d call Chase and ask if there are any other options. I wouldn’t risk canceling, though, since it may affect your ability to receive the night.

I’ve likewise spent enough to get the night. But after the CSP conversion, I’m planning on converting it (or my wife’s CSP) to a Freedom Unlimited.