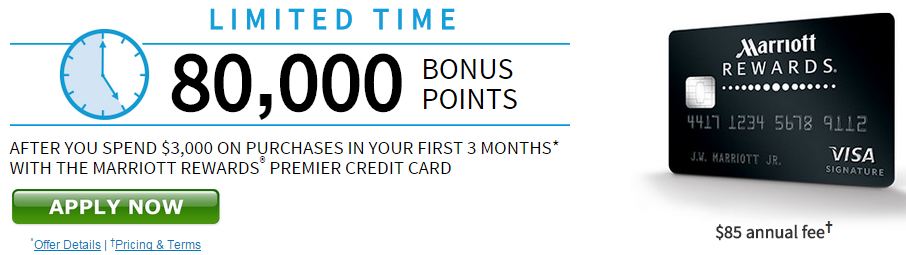

Last week, I wrote that the offer for the Marriott credit card that gave 80,000 points was expiring.

(SEE ALSO: An 80,000 point offer, but I’m not sure I care)

There were definitely some reasons you might consider the 80,000 point offer, but the past offers that have been up to 70,000 have also been attractive, given that the annual fee was waived the first year and your free night certificate was for up to a Category 5 hotel (instead of only a Category 4).

80,000 point offer still around

(UPDATE: This offer is expired – you can see other offers for this card on our top credit card offers page)

According to Flyertalk, the 80,000 point offer is STILL around

I find it amusing that they have the EXACT same graphic, except minus the “Bonus expires August 31, 2015” part!!! 😀

Be careful where you get the card from

Remember, according to the current rules and best practices of credit card signups, you can only get a bonus on a Chase card if you haven’t received the bonus in the past 24 months. So make sure that you’re signing up for the bonus that interests you. The current top “affiliate” offer that I’ve seen combines the worst of both worlds, with only 50,000 bonus points, and the free night certificate only on your anniversary (not right away)

Other Marriott credit card offers

The Flyertalk thread on the subject is pretty comprehensive – the wiki lists the following offers for Marriott cards (none of these pay me or anyone else a commission as far as I know)

- Marriott business card – 70K bonus points after spending $3000 in 3 months. Annual fee of $99, waived the first year. Category 1-5 free night certificate on your anniversary. (Note that the Flyertalk thread links to an 80K business offer but the link went to the 70K offer)

- The other links do not appear to be currently valid

- As I mentioned, the top “affiliate” offer is 50,000 bonus points, and the free night certificate only on your anniversary (not right away)

As always, my recommendations for credit cards is to start slow, and only do what you’re comfortable with. For the Marriott cards, I’d recommend waiting for this current 50,000 offer to go back up to 70,000 points.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I already have the card. Is there any way to ‘re-apply’ to take advantage of the offer?

Depends when you got it. If you got it recently, you might try asking Chase to match the bonus. If you’ve had it awhile, then your only option to get the bonus would be to cancel the card and wait 24 months.

I thought the 24 months was from your last sign-up bonus and not from the date you cancelled the card. I just pulled this from Chase: “This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.”

Can I apply for the business card if I have the personal card and get the bonus? Would I get the bonus of I applied for the business card?

Yes – those are 2 different cards so you should be fine there.