You’ve undoubtedly heard of the data breach that Equifax had back in 2017, where data from approximately 147 million Americans was exposed. Later on Equifax agreed to a $475 million settlement for people who were affected.

How to process an Equifax data breach claim for money

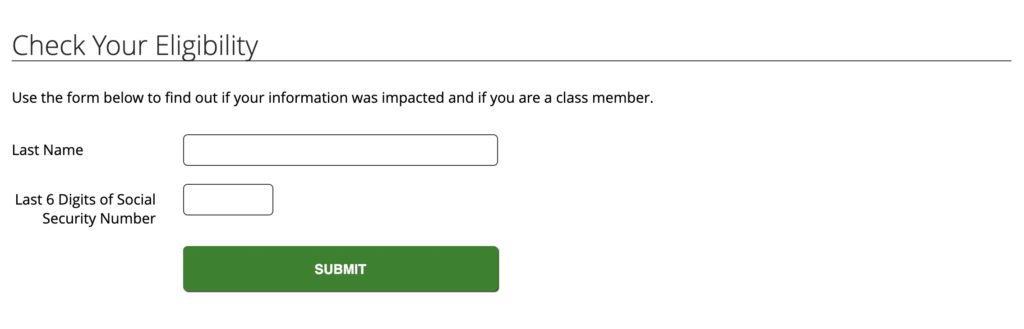

It’s actually quite easy – first go to the Equifax settlement eligibility site.

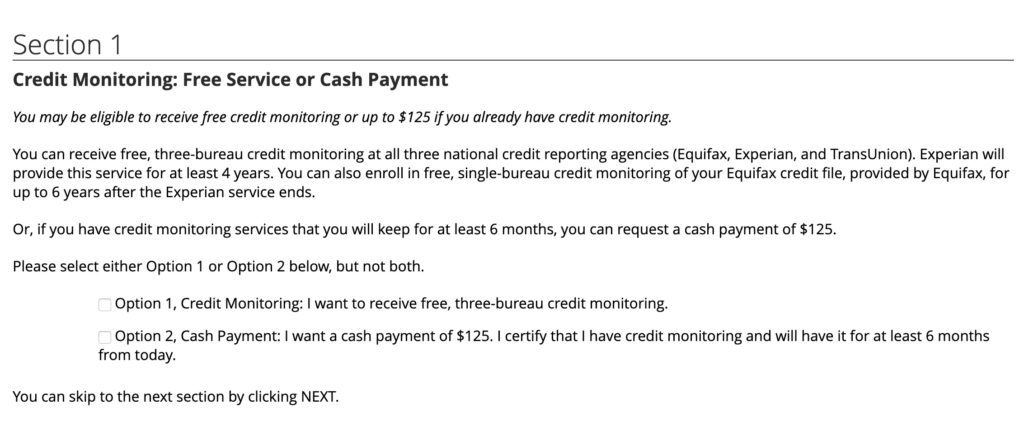

Then enter in your last name and the last 6 digits of your social security number. You’ll be told either you were affected or not. If it says you weren’t affected, you can try and manually submit that you should be part of the claim. If it says you were affected, you can file a claim online, and then enter in your contact information. Then you will be taken to a screen where you can choose either $125 or free credit monitoring service

I highly recommend choosing the $125. Most of us already have credit monitoring through CreditKarma or various credit cards, myself included, so I personally found no need to sign up for additional credit monitoring. You do not need to provide any documentation for this section. Sections 2 and 3 involve filing claims for time or money spent combatting the data breach. In these cases you should be prepared to submit documentation. I skipped these sections.

How much money will I get from the Equifax data breach settlement

Astute observers may notice that $475 million divided by 147 million affected members is…. not $125. Surely not every one of the 147 million affected users will file a claim, but I’m not holding my breath for a meaningful amount. Still, I’d say it’s worth doing for you and any family members whose credit you help to manage. In a few years, you may randomly get a check for a few bucks 🙂

The last day to file a claim is January 22, 2020

Good luck!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Thanks for this info! Do you have a list of which credit cards offer credit monitoring? I’m not sure if I have one that does. Thanks!

I’d just sign up for Credit Karma