When American Airlines and US Airways merged a few years back, people were unsure whether American Airlines would continue US’s partnership with Barclaycard, or consolidate their credit cards with Citi. American initially decided to retain their partnership with Citi, and asked Barclaycard to stop issuing new credit cards under the American/US name. Barclaycard was allowed to retain existing US Airways card holders, as well as convert them to a new product line: the AAdvantage Aviator, with four different “flavors” available.

Then, last July, American announced they had negotiated new contracts with both Barclaycard and Citi, allowing both of them to continue issuing American Airlines credit cards. Citi would continue to offer the AAdvanatge Gold, Platinum, Platinum Business, and Executive cards online and in Admiral’s Clubs, while Barclaycard would offer it’s range of four Aviator cards in airports and on flights. Not a bad arrangement, and consumers would still be eligible to get cards from both companies.

Well, as it turns out, as of earlier this week, you are able to apply for one of the Barclaycard cards online, something we originally didn’t think would be possible!

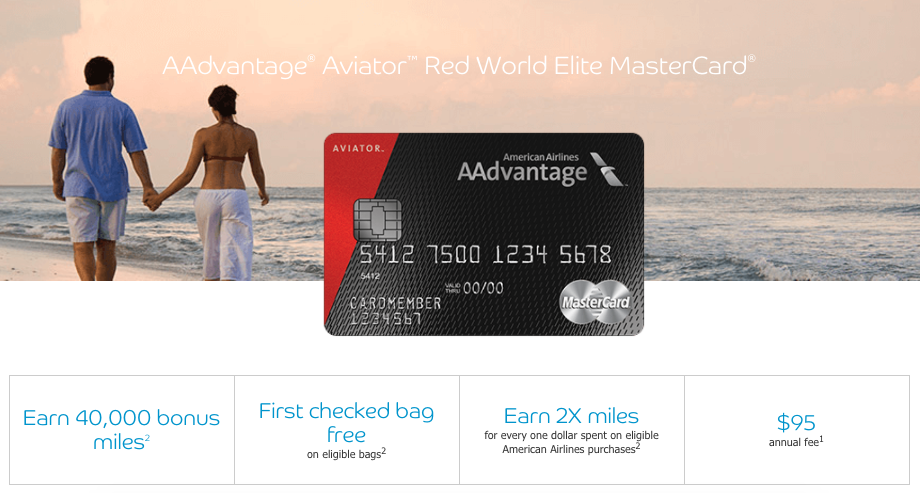

With the Barclaycard AAdvantage Aviator Red World Elite MasterCard (phew, say that five times fast!), you’ll earn 40,000 American Airlines miles after your first purchase and payment of $95 annual fee. That’s right, no huge minimum spend here, just buy a pack of gum, pay the annual fee, and BOOM–40,000 miles.

In addition, you’ll earn 2 miles per dollar on American Airlines purchases, a free checked bag, Group 1 boarding, and a 10% point redemption on award bookings, just to name a few benefits.

This offer is a great way to boost your American Airlines miles balance, especially if you couple it with the recently discovered Citi Platinum link without the 24 month language. If you decide to go that route, with $3,096 in credit card spending, you could end up with 90,000 American Airlines miles, which is good for eight to 13 one way domestic redemptions in economy. That’s a lot of flights! Or, you could splurge and get a one way first class ticket to South America or Europe.

(READ MORE: Citi AA Platinum 50K Offer [possibly WITHOUT the 24 Month Language])

Even if you don’t apply for the Citi card, this one sign-up bonus will still get you the following economy redemptions: three to five one way domestic flights; a roundtrip flight to the Caribbean or Mexico, or a oneway flight to Japan or China. Not terrible for $96!

Where would you go with 40,000 American Airlines miles? Let us know below!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

How easy is it to get multiple cards? As an existing cardholder, and extra 40k would be great, but not if Barclay’s won’t approve the card.

Not very unfortunately. I am also an existing card holder (RIP US Dividend Miles), so I’d need to cancel, wait about a month, and then reapply. Barclaycard can be very stingy.

I have an open US Dividend Miles card (2013) that converted and just applied for this new card offer yesterday and was approved! I have two now.

Good datapoint. Barclays gave me hell opening a 2nd card (JetBlue) so I’m gonna have to pass now I think.

I had the blue version of this card for years it was a converted us airways card a few years back. I got approved last week for the red version but it wasn’t instant approval and took 2 days. Not sure why…

Comment

I’ve been hearing tales that AA premium seat award availability has become “hot garbage”, as the kids say…has this been your or others’ experience? I have a decent AA balance, but wondering if it’s worth adding additional AA miles.

I also have heard tales of that, to the effect that someone referred to the recent Citi 50K link as “50,000 more AAdvantage miles I won’t be able to use” ™

MileSAAver has definitely become a joke in many cases. Good luck finding a domestic route where you could actually travel for 25k RT. You may need flexibility to stay three weeks (as long as they’re a totally different three weeks from when you actually wanted to go). 😉

I guess at the very least, they can be used for off-peak economy flights to the Caribbean/S America

But what if it were a buxom young blonde asking? Gotcha!