When I was first starting out with signing up for credit cards, I stayed away from credit cards like the American Express Platinum or Citi Prestige – those that had huge non-waived annual fees in the $450 range. And while I still think that those kinds of cards might not be great for people starting out, they still can’t be worth it. Perks such as the Citi Prestige airline credit can make it worth it, especially if you generally take at least 2 or 3 airline flights a year (and pay cash). Personally I try to pay for most of my flights with airline miles, but when I do pay cash, having something like the Citi Prestige airline credit is a nice perk!

Doing the math on the Citi Prestige airline credit

The Citi Prestige airline credit is a benefit that gives $250 back on air travel each year. The reason it can make a lot of sense is that the Citi Prestige airfare credit works on the CALENDAR YEAR, so you are paying the $450 annual fee but getting a $250 annual Citi Prestige airline credit TWICE (at least in the first year)

There are other benefits of the Citi Prestige card as well (in addition to the signup bonus), though some of those are changing shortly

(SEE ALSO: Which is the worst Citi Prestige benefits devaluation?)

What counts for the Citi Prestige airfare credit

Unlike the American Express Platinum card airfare credit, which generally does not count for ticket purchases, the Citi Prestige airline credit WILL generally count ticket purchases. So you usually don’t have to go through the extra step of having to buy a gift card and then using that gift card to buy the tickets.

Also unlike the American Express Platinum card, you can use it on any airline and you don’t have to pick a specific airline

Screwing up the Citi Prestige airline credit

Seems pretty simple right? Just pay for $250 of airline tickets every calendar year. So how did I screw up my Citi Prestige airline credit?

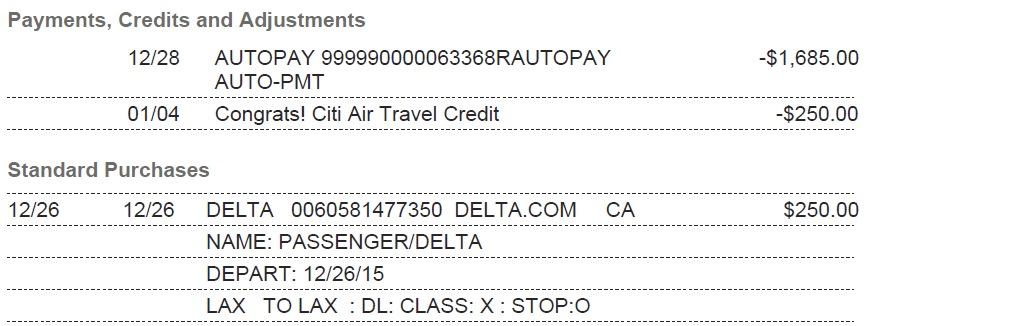

It turns out that the Citi Prestige airline credit is based on the date the STATEMENT closes, not the date of purchase. I only got the Citi Prestige card towards the end of 2015, and at the end of the year, I still hadn’t gotten around to using my Citi Prestige airfare credit, so I ended up just buying gift cards. Here is (part of) my statement from January 4, 2016

Unfortunately for me, even though I made that purchase in December 2015, it counts as my Citi Prestige airfare credit for 2016, which means that I missed out on my 2015 credit 🙁

You can view top travel rewards credit cards here. If you apply and get a card by clicking through this link, I will receive a commission

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Hey , Why are you using AutoPay, Have you not heard about Nationwide Buxx and Pay with Debit card over the phone?

1. Get Natiowide Buxx Card

2. Load online for $200 each week using your Citi Prestige, you get chaged with $200 + $2 , so you get 202 points per card. Max 5 Cards per household

3. When you have $800 balance, call the collect# on the back of your Citi Card and say Pay with Debit card and give your Nationwide Buxx# and pay $800 .

4. Repeat with the other 4 Buxx cards

If a prestige point is worth 1.7c, you are getting 4,000 points per month ($68) at a cost of $40 ($2x4x5). You are therefore making $28 a month and you have to make at least four separate calls to the bank. Seems like a lot of work for a tiny amount of money.

Actually this is a great supplementary MFG technique, I use the Citi AA Gold card for this, I make one or two calls per month and make 2-5 $800 debit card payments to any of my Citi Cards as needed.

What exactly does this mean? How are you making 2-5 $800 payments a month? That seems like a lot of spend

Your spend is loading the 5 Buxx Cards Online using your Citi Card. Making payments back on your Citi credit card using the same Buxx Cards is the unloading.

Each Buxx Cards allow max $800 debit card spend per month, hence in my example when you call Citi , you pay $2400 split using 3 Buxx cards (3*$800), I call them back a few days later and make another $1600 split using 2 Buxx cards.

In the end your cost was $40 you got 4040 points at the rate of 1 cpm. In a 52 week year that’s 52520 miles for $520

This use to be better when they had $500 loads for the same $2 fee but hey anything to get generate points/miles on the cheap.

Let me see if I understand this correctly . . . you charge $200 each week to your Citi Prestige card, so you can load $200 each week onto a Nationwide Buxx Card. Every four weeks, you pay for a collect call so you can use the $800 you put onto your Nationwide Buxx Card to pay off the $800 you owe on your Citi Prestige card . . . except that you do this on a total of FIVE Nationwide Buxx cards a month, so — in reality — you’re charging $4,000 to your Citi card and paying back $4,000, all at a cost of 1% ($40 total) . . . do I have it right so far?

a) I’m with Tom, in that it seems like a lot of work to make $28 — but if you go with the The Points Guy, Citi points are actually worth 1.6¢ each (not the 1.7¢ valuation that Tom used) — you’re making even less! You say you’re getting 202 points per transaction, four times a month on five cards. (202 x 4 x 5 = 4,040 points; 4040 x 1.6¢ = $64.64) So, you are REALLY only gaining $24.64 in value. How much is your time worth per hour?

b) Screw the number of points you’re getting with this little shuffle — and I will agree that getting 4,040 points/month is a nice number of points — what about the *real* purchases you make with the card? How much are you REALLY charging per month?!?!?!

I plan on dropping the card early next year. I got the $100 fee for global entry and $250 for one taxes on free trip, but just don’t have another trip next calendar year before having to pay $450. With the reduced perks I just cannot make that $450 work. I will wait out the waiting period and get it again in the future.

You could buy gift cards with your other $250 Citi Prestige airline credit

John, here’s my (different) take on the issue. (Not that you asked, but . . . ) I travel relatively frequently, but am by no means what I would describe as a “power flier.” I typically average about four business trips a year, along with maybe another four personal trips — all by air. Normally I fly Virgin America, and using my Virgin America credit card, I earn an extra 3 pts. per dollar on Virgin — over and above the 7.5 points per dollar I get with my Elevate Silver status for actually flying. The Points Guy (TPG) values VX points between 1.5-2.3¢ each, that’s an earn of 4.5-6.9¢ per point. But I occasionally fly another airline, and so — for me — it’s relatively easy to use my Citi Prestige card for those flights, earning not only the 1.6¢ per point, but also taking advantage of the $250 annual flight credit. In fact, although I only obtained the card earlier this year, I’ve already used it for 2016; I have no doubt I’ll use it again in 2017, prior to my card’s anniversary date — so I’ll gain $500 in credit the first year for the card’s $450 annual fee.

But more important, to me at least, is the “4th night free” hotel credit. Even though this benefit has changed, and now only credits an average of the four nights, I anticipate this, too, shall cover the cost of the card itself if I can utilize this benefit twice a year. (The loss of AA Admiral Club access and golf were irrelevant to me, as I don’t fly AA and don’t play golf.)

Well they quit selling the Nationwide Buxx card in Aug so moot point with that one.