This may be an obvious question (and answer!) to most of you, but it’s something that has bitten me once, and almost bit me a second time! As part of a recent credit card churn, “my wife” signed up for the Club Carlson Visa card. Air quotes around “my wife” since she doesn’t ACTUALLY sign up for anything but she loves getting on the phone and talking to credit card companies (not!)

This may be an obvious question (and answer!) to most of you, but it’s something that has bitten me once, and almost bit me a second time! As part of a recent credit card churn, “my wife” signed up for the Club Carlson Visa card. Air quotes around “my wife” since she doesn’t ACTUALLY sign up for anything but she loves getting on the phone and talking to credit card companies (not!)

(SEE ALSO: Barclay reconsideration phone number and website)

Keeping track of meeting minimum spend

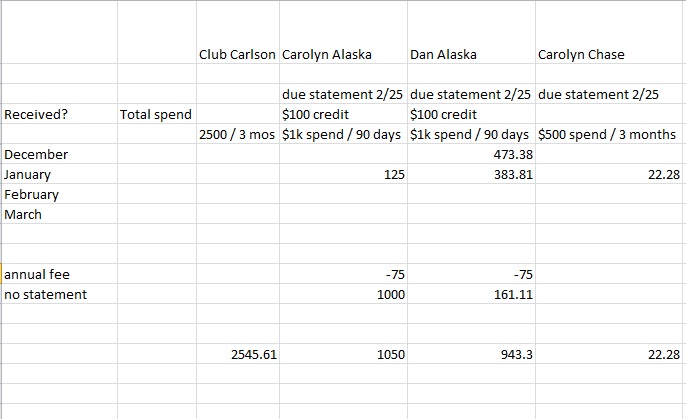

Anyway, I have a spreadsheet where I keep track of the spending I do on each of our credit cards. Each month, when we get a credit card statement, I mark it down. It looks a little something like this.

You can see the row for the annual fee. That was a recent addition, brought about the tragic events recapped in this post…

For the Club Carlson card, you can see that I had to spend $2500 in the first 3 months, and I have spent a total of $2,545.61. I should be golden, right? But the 35,000 bonus points never came (if you’ll remember, you get 50,000 points after the first spend and another 35,000 points after meeting the minimum spend requirements.

The time period had passed, and we waited, and waited, and waited. I know that sometimes the points take awhile to post, but eventually I sent an email to US Bank, asking why the points had not posted

US Bank responds about my minimum spend requirements

I got an email back

We understand, Carolyn, you are inquiring about the enrollment promotion and we are certainly able to review this matter. To receive an additional 35,000 bonus points you were required to spend $2,500 in the first ninety days of the account opening. Our records indicate you have a total spend of $2,470.62 and fees of $75.00. Please be advised fees are not included in the total spend. For this reason, you did not qualify for the promotion. We apologize for any inconvenience or confusion this matter may have caused you. If there are any further questions or concerns you may reply back to this email or contact our twenty-four-hour Cardmember Service Department at the telephone number found on the back of your credit card. A representative will be happy to assist you.

Uh oh.

I have learned never to take the FIRST no, so I replied again, asking if there was anything that could be done

We understand that you are concerned about not receiving the additional bonus points for applying for this account, Carolyn. As previously advised, to earn the additional 35,000 bonus points, you were required to make net purchases of $2,500.00 within ninety days of the account being opened. Fees assessed to your account are not net purchases.

Our records indicate that on the 9/17/2014 statement, you had purchases of $39.99. The 10/20/2014 statement had purchases of $2,430.63. No additional purchases were made to your account, so the amount of purchases made within ninety days of the account being opened was $2,470.62. Due to the spending requirement was not met, your account is not eligible for the 35,000 bonus points.

Although we sincerely regret your dissatisfaction, we are obligated to apply our policies in a consistent manner to all cardmembers. As such, we are unable to provide exceptions to offers in which the spending requirement was not met.

Okay – one last try. I asked if there were any other retention offers that my account was eligible for, which got me my 3rd and final email

Our records indicate that during the first ninety days of the account being opened, you spent $2,470.62 in net purchases, Carolyn. The Annual Fee amount is not a purchase, so it can not be included in the spending request. Therefore, we are unable to honor your request to award your account with the 35,000 bonus points.

While we understand that this in no way makes up for the inconvenience or confusion that this matter may have created, we have credited your account with 7,500 points. You will see these bonus rewards reflected on your statement within two billing periods.

Ah well, this was definitely my fault so I let the minimum spend matter drop at this point. One thing I did was made sure to add an “annual fee” row to make sure to account for that. As you can see above, this nearly bit me a 2nd time on my Alaska Airlines card. I had “spent” $1,018.30 on the card (you get a $100 statement credit after spending $1,000 on the card), but that included a $75 annual fee that wouldn’t have counted. So I made sure to keep that card around and spend a few more bucks on it

Do annual fees count towards meeting minimum spend?

NO! NO THEY DO NOT! BE CAREFUL OUT THERE!!! 😀

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.