I got an email yesterday about a new credit card offer for the Hyatt Credit card. It appears that this new Hyatt credit card offer is targeted, but I know I was not the only one who got one. The new Hyatt credit card offer is as follows

As I said, it appears that this offer is targeted, and I haven’t been able to find a public landing page. Still, since I know I’m not the only one who got this offer, I thought I’d look at the 2 different card offers and compare them.

First, some more details on the new Hyatt credit card offer. You get 40,000 points after meeting the spending bonus of $2000 in the first 3 months. You can also get 5000 points for adding an authorized user. Notably you do NOT get a $50 statement credit. You do also get a Category 1-4 bonus night on your anniversary (so not the first year)

Comparing the 2 Hyatt credit card offers

The main offer for the Chase Hyatt credit card is 2 free nights plus a $50 statement credit. You can apply for this from our top credit card offers page. Setting aside the $50 statement credit for now, what’s better – 40,000 points or 2 free nights?

Both offers give 5000 points for adding an authorized user, charge a $75 annual fee (not waived, and also have less exciting things in common like no foreign transaction fees, chip card, etc.

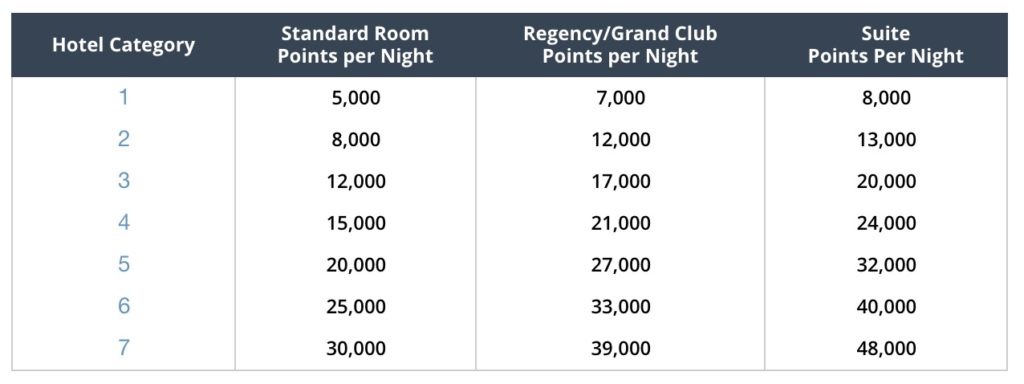

Obviously it depends on where you want to use the points. If you’re going for aspirational properties, the 2 free nights can be a better deal. Here’s the Hyatt award chart

From there, a Category 5 is the breakeven point between the 2 cards. Carolyn signed up for the card and we used one of our free nights on the Category 6 Hyatt Regency in Nice, though sometimes I wonder why people think free hotel nights are a good idea… 40,000 points would be enough for 8 nights at a Category 1 (like my first 5-star hotel stay ever)

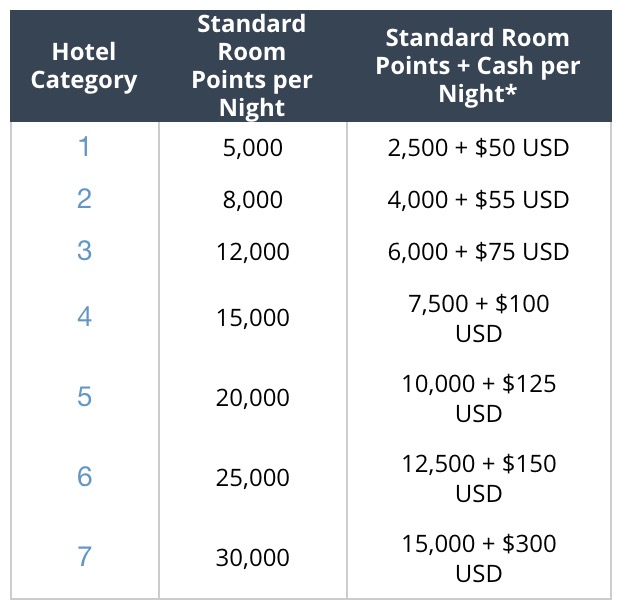

Points are also more flexible of course, and let you also use your points on Cash + Points offers as well as Club Upgrades (3000 points / night) and Suite Upgrades (6000 points / night)

The targeted 40,000 point offer expires November 6th. It’s not subject to the Chase 5/24 rule, but you have to not have received any bonus on the Chase Hyatt card (even the 2 free night offer) within the past 24 months.

I think I’d lean towards the 40,000 Hyatt point offer – what about you?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I do not know why the know-it-alls at Chase keep messing up with the Hyatt Visa card. Most of us don’t think 2 nights is that great, and Chase tries to make up for the weak offer by marketing the pants off this card.

Sure, there are some people who sign up for the card, sign up their spouse, and then fly to Paris on their honeymoon and stay 4 nights at the Paris Hyatt Vendome for free. Good for them.

However, that isn’t most of us. I think this is a bunch of bull. I am a Hyatt Diamond and I do not have the Hyatt Visa card because of the terrible sign up bonus.

Last year Chase test marketed a 50,000 point sign up offer and I thought I’d finally sign up, but I wasn’t targeted.

A couple of years ago, 40000 points would’ve gotten me, but because of all the devaluations in the Hyatt award chart, this offer is now pretty weak. I haven’t been targeted, but I doubt I’d sign up. If Chase doesn’t want me, ok, I have a pile of better cards in my wallet.

I think I am on the Chase do not offer this guy anything list. I have great credit and have been getting the chase cards for years. I have no idea where I stand on the 5/24 rule. Does it count against you when you apply and get declined of too many cards opened in 24 month period? When I mean count against you. Does your 24 month period start over?

With points and cash can you also use points for suite nights?

I believe so but I’m not 100% sure