Recently, we were informed that Chase is exploring the possibility of limiting Ultimate Rewards transfers between accounts (SEE: Could this one change make the Chase Freedom Unlimited useless?). We had one reader comment that they didn’t know you could combine points, or how this worked. So…I figured we could provide a quick guide on how combine Chase points from multiple accounts.

Criteria for being able to combine Chase points from multiple accounts

To combine Chase points from multiple accounts, you must either:

- Be the primary cardholder on both accounts

- Be a members of the same household

- Be transferring points to an account belonging to an owner of the company, if it is a business card

If Chase believes you are making fraudulent transfers, their terms state that they may suspend earning/redemption of points and/or close your account if you are engaging in fraudulent activity.

The primary reason people move points from one Chase account to another is to take advantage of the higher redemption value offered.

Quick guide on how to combine Chase points from multiple accounts

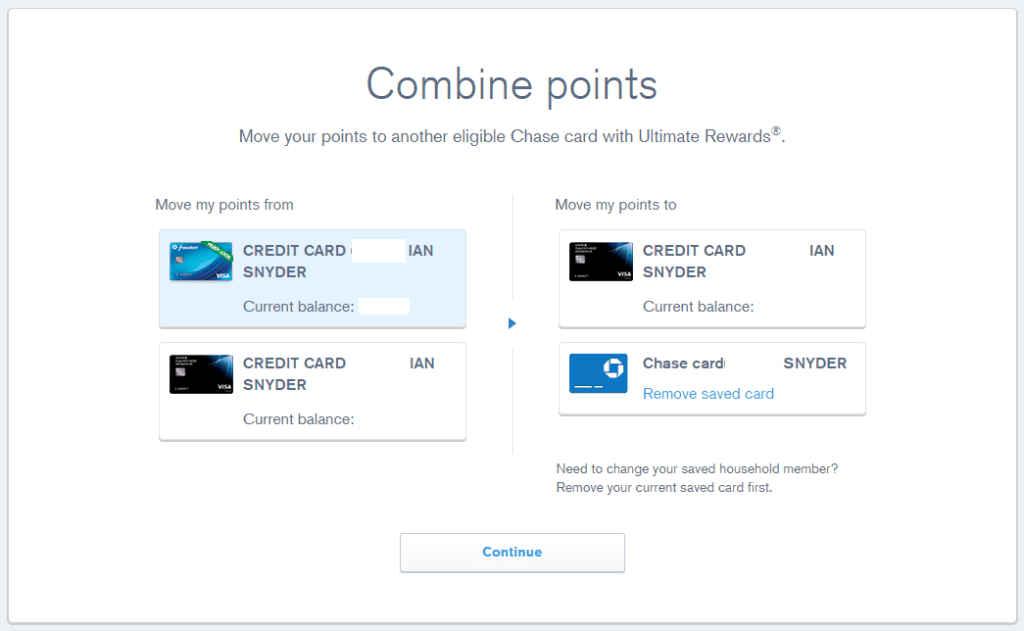

Assuming you’ve already set up online access for your Ultimate Rewards-earning credit cards, combining points from multiple accounts is pretty straightforward. It’s easiest if you’re the primary cardholder on both cards. To start, log in to ultimaterewards.com and find the link that says “Combine Points”.

Your own linked accounts should show up automatically. Simply select the account from which and account to which you like to transfer points.

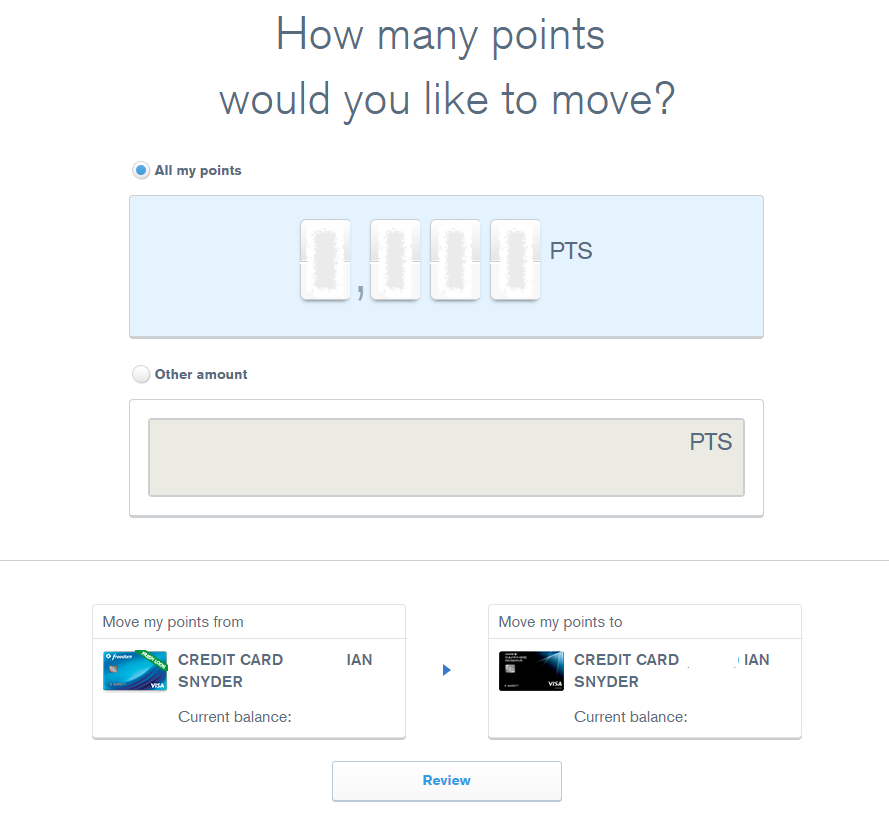

In this case I’m looking to move the balance of points from my Freedom card to my Sapphire Reserve card. It’s not much, but it is the remainder of what I earned at 5x for the first quarter of 2018. Once selected, you be asked to confirm how many points to move. I always go with all of them since I don’t see the point of keeping points in my Freedom account.

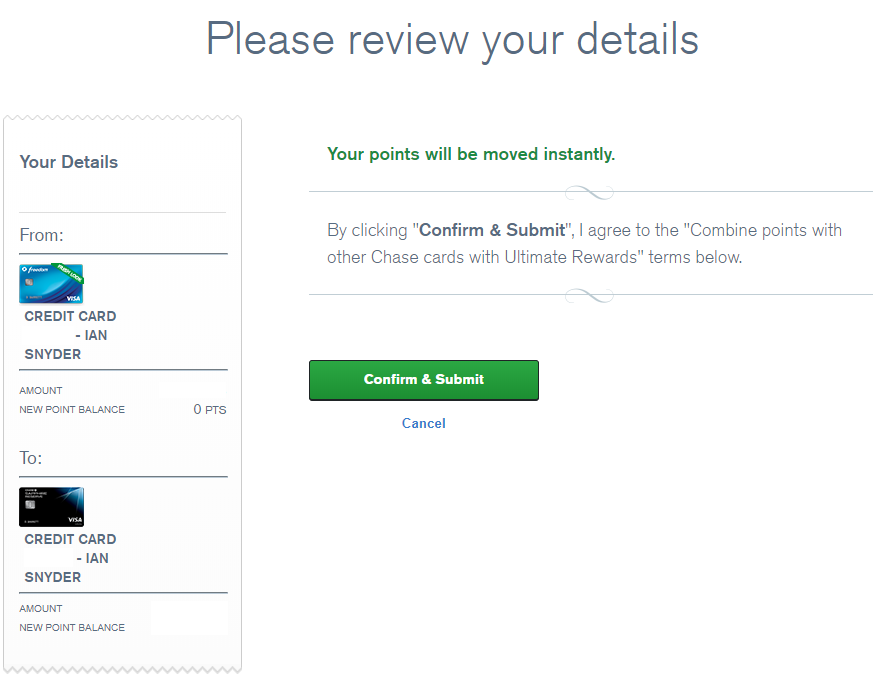

Finally, you’ll be prompted with a final screen confirming the details of the transfer. Am I sure I want to do this? Yes. Totally sure.

How to transfer Ultimate Rewards to another person’s account

While transferring Ultimate Rewards points between your own accounts is pretty cut and dry, make sure you understand the rules for transferring points to someone else. Remember: you must both reside in the same household if transferring to another person’s personal card.

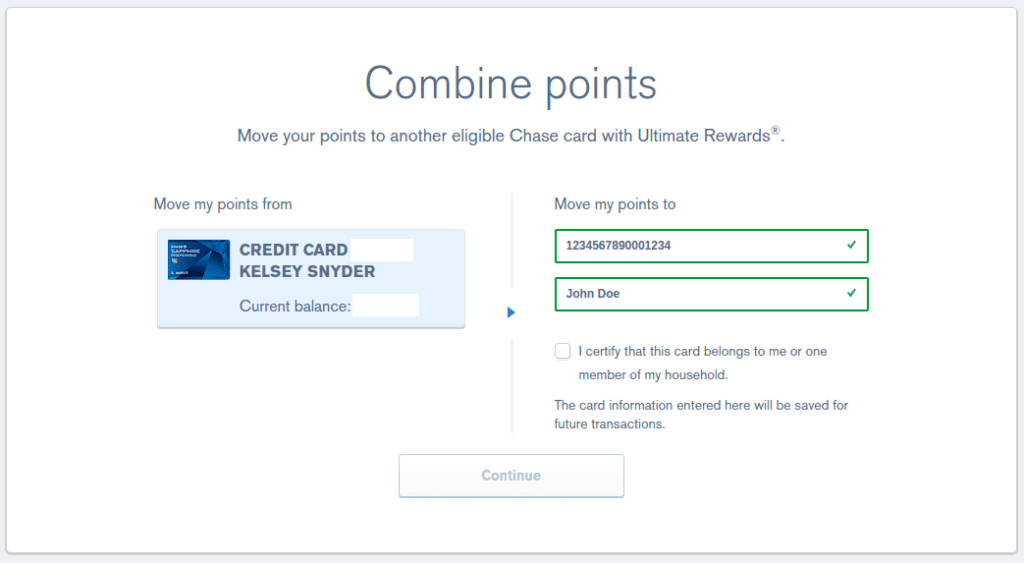

To transfer Chase points to another person’s account, you start out the same way by clicking on “Combine Points”. If it is the first time you are making a transfer to someone in your household, you’ll need to have their card information ready. The first step is entering this.

You’ll have to certify that this person is indeed a member of your household. After that, it basically works the same as the other transfer.

When should you move your points?

Because I see little value in letting my Ultimate Rewards points sit in any account other than that of my Chase Sapphire Reserve card, I move all points monthly from my Freedom card and my wife’s Freedom Unlimited card. You don’t necessarily need to do this, but combining Chase points from multiple accounts is quick and painless.

At minimum you should move your points when you are looking to cancel a card. Don’t throw away your points by closing a Chase card you no longer need before you move them to another account you are keeping! Another primary reason for transferring is to take advantage of the ability to transfer to travel partners since no-fee cards do not allow this. It converts your UR from essentially cash back to truly flexible points.

Finally, combining Chase points from multiple accounts to my most valuable card lets me maximize their value through the travel portal. If I move points from my Freedom account to my Chase Sapphire Preferred card, I’ll be able to get a greater value out of them when booking through the Chase Travel Portal (1.25 cents each versus 1.0 cents each). If you have the Chase Sapphire Reserve, you’ve all of a sudden made your points 50% more valuable by moving them to that account, as they are worth 1.5 cents each!

Conclusion

While I doubt Chase will roll out any major changes without allowing for a window during which people can still combine Chase points from multiple accounts, proactively moving your points to your most valuable account doesn’t hurt. However, I wouldn’t speculatively transfer your points to any travel partners!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Thank you for this post, I have a couple of business cards that I would like to close. I have a bunch of points hanging there with them and am wondering how I move the points to my non business cards? I went thru your instructions, my non business cards are not available to move my business card point balance. Thank you

How do you combine your points between business and personal cards when you have one login for personal and one for business?

You can call Chase and ask them to combine your personal and business accounts to the same page. Essentially they move your personal accounts to your business login so that when you sign on your business account, you’ll see your personal accounts as well.

Thanks!

Do not wait for the last minute to transfer to another household member’s account, as you may get a message stating there is an unexplained error. I called a CSR rep to look into this problem, and she double-checked that I qualified yet she still could not transfer some of my UR points to my husband’s account. It’s been three days and I’m still waiting for Chase to contact me with a resolution to this problem.

Thanks for this simple explanation. It was much easier than I expected to combine UR points.