Barclays recently released refreshed the Hawaiian Airlines World Elite Mastercard. It has been among the more forgotten of the co-branded credit cards offered by U.S. airlines, but the refreshed product has me giving it a second look. I think Barclays has done pretty well with the revamped product.

Increased sign-up bonus

When I got the Hawaiian Airlines card a couple years ago, it came with a 35,000-mile sign-up bonus. This was exactly enough for a round-trip between the U.S. and Hawaii at the lowest saver rate available. The lowest saver rate for awards between the mainland and Hawaii start at 20,000 miles; however, Hawaiian Airlines credit cardmembers could get a further discount of 2,500 miles each way, bringing the price to 17,500 miles one-way. I’m not sure if this is still a perk of the card.

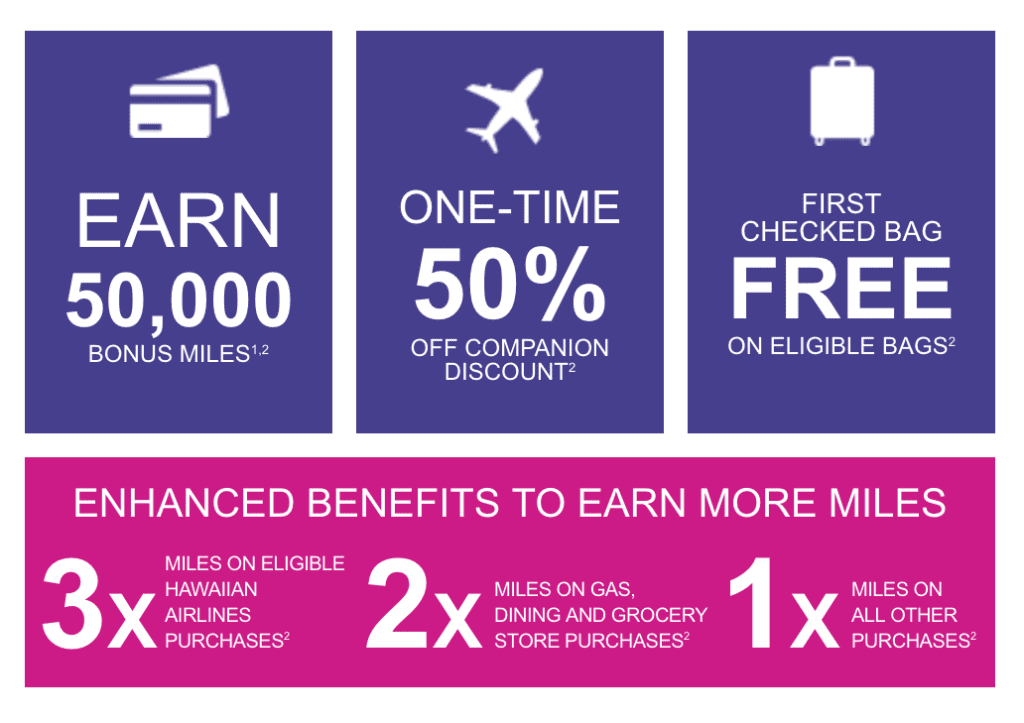

The new card is currently offering a sign up bonus of 50,000 miles after $3,000 in spending within the first 90 days, which is certainly enough for a round-trip coach ticket between the mainland and Hawaii. However, the annual fee is higher at $99 (not waived).

Now, we did see this bonus now and then with the old card, but it was fairly rare. What I’m left wondering now is whether 50,000 miles will be the standard bonus, or if this will be reduced to 35,000 miles once again (more likely 40,000 miles, if they no longer offer the promotional pricing and want to keep the “free round-trip” lingo). As for right now, it may be worth considering at 50,000 miles. I’d peg this current bonus value at ~$600 in value.

Note: I recently read that Hawaiian Airlines is offering an inflight credit card offer with a 60,000-milte sign up bonus. If you have plans to fly them soon, I’d suggest waiting to apply in case you can snag this excellent offer.

Increased points earning

The previous iteration of the card didn’t offer much in terms of points earning. It was a fairly standard airline card, earning 2x miles on Hawaiian Airlines purchases and 1x miles on everything else.

The new version of the card offers 3x miles on Hawaiian Airlines purchases, 2x points on gas, dining, and grocery purchases, and 1 on everything else. This is marked increase, although there are still better options out there for gas and grocery, and the American Express Premier Rewards Gold card will get you 3x on airfare, which can then be transferred to Hawaiian Air miles.

Other benefits

Other benefits

The other benefits of the card haven’t changed. Here are the other perks the Hawaiian Airlines Mastercard gets you:

- Free checked bag on Hawaiian Airlines flights when you use the card to buy your airfare.

- One-time 50% companion discount coupon for a round-trip coach flight between the continental U.S. and Hawaii.

- A $100 companion discount voucher for coach travel each account anniversary

While not groundbreaking, the card offers a few perks that will save you some money when flying Hawaiian Airlines.

Transferring to Hilton points

I picked the Hawaiian Airlines Mastercard up a while ago, intending to use the miles toward a trip to Hawaii, but that never materialized. I ended up converting the miles to Hilton points, which had been my backup plan from the beginning. This is a nice back door option if you aren’t sure you are actually going to use the miles.

Hawaiian Airlines miles convert to Hilton Honors points at a 1:1.5 ratio, in batches of 10,000. Therefore, you get 15,000 Hilton points for every 10,000 Hawaiian Air miles.

I’d accumulated 38,000 Hawaiian Air miles, so I transferred 2,000 Membership Rewards points into Hawaiian Air miles to top off to 40,000. Then I called into Hawaiian Airlines to convert these to 60,000 Hilton Honors points. It wasn’t ideal, but getting 60,000 Hilton points for $89 after the bonus and some spending really wasn’t too bad.

Conclusion

While definitely not a powerhouse product, the improved Hawaiian Airlines Mastercard is at least worth a bit more of a look than previously. Given all the restrictions with other banks, you may want to give it some consideration. But make sure the product works for you. Don’t just sign up for a credit card because some guy on the internet said to. 😉

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.