The Southwest Airlines Companion Pass is one of the best deals in travel hacking. If you earn 110,000 Southwest Rapid Rewards points in one calendar year, then for the rest of that year, as well as all of the year after, on every flight you fly, a selected companion can fly for free.

The easy way (credit cards)

The easy way has been to get 50,000 points from signing up for the Southwest personal credit card, and another 50,000 from signing up for the Southwest Business credit card, then get the other 10,000 through spending on the card or other sundry ways.

The 50,000 point links come and go. I know of one link to the 50,000 mile offer for the personal card that I saw on an in-flight brochure

Looking at my go-to source, Frequent Miler’s list of the best credit card offers, there appear to be links for both the personal and business cards. But what do you do if for whatever reason you can’t get one or both of those cards (I was originally rejected for the business card last October due to too many business cards from Chase)? Or if you want / need to apply for the cards when they only offer the 25,000 mile bonus?

Reselling / Manufactured Spending

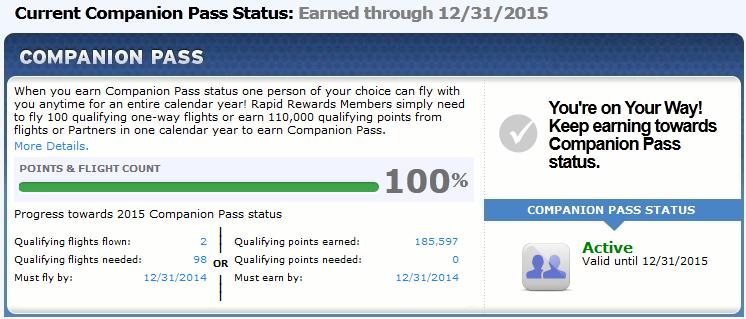

Reselling or doing Manufactured Spending is one way to get the extra points you need if you can’t get all your points from the credit card signups. I did a little bit of both on my account this year – you can see from the Companion Pass status page.

You can see I went a little above and beyond the 110,000 point mark – I probably could have planned that a little better… I just couldn’t help it when I saw that I was able to rack up over 22,000 miles via reselling through the Southwest shopping portal

You can see I went a little above and beyond the 110,000 point mark – I probably could have planned that a little better… I just couldn’t help it when I saw that I was able to rack up over 22,000 miles via reselling through the Southwest shopping portal

READ: My experience with 19x points through shopping portals at Sears.

Transferring points from other programs

Another option is transferring points from other programs into Southwest. Unfortunately, the most popular transfer (1:1 from Chase Ultimate Rewards) does NOT count towards the 110,000 miles you need for the Companion Pass.

But transfers from most other airline and hotel programs DO count towards the Companion Pass. I had been meaning to write this post for awhile, but I was spurred into action by a recent series of posts from Travel with Grant, where he talked about his adventures transferring Hyatt Points to Southwest Rapid Rewards points – Part 1 and Part 2.

Playing around with the Mileage Converter from WebFlyer, here are a few options that will get you 50,000 Southwest Rapid Rewards points

- 208,333 Best Western Rewards points

- 416,667 Hilton HHonors points

- 105,000 Hyatt Gold Passport points

- 170,000 Choice Priviliges points

Needless to say, for the most part, these transfers represent a HUGE devaluation, and not one I’d do under most (any?) circumstances

The best transfer option

So, inspired by a post from Travel is Free about Amtrak Guest Rewards, here’s an option to get 45,000 Southwest Rapid Rewards points

- You start with 50,000 Chase Ultimate Rewards points. Normally the best way to transfer to Southwest would be to just transfer 1:1 right from Chase, but those transfers do NOT count towards the Companion Pass.

- These transfer 1:1 to Amtrak points, so you still have 50,000 Amtrak points

- Amtrak transfers 1:3 to Choice Hotels, which gives you 150,000 Choice Privileges points

- Choice transfers 6,000:1,800 to Southwest Rapid Rewards. 150,000 Choice points yields 45,000 Southwest Rapid Rewards points.

Not bad, huh? You only lose 5,000 points in the transfer – not too bad at all considering the devaluations we saw in the last section, and definitely worth it to get the lucrative Companion Pass.

So what’s the catch?

What’s the catch, you say? A deal like this is too good to be true and must come with a catch? Well, yeah, actually there IS one small catch. Here’s the fine print for Amtrak transferring to Choice.

Only Members with Amtrak Guest Rewards Select, Select Plus or Select Executive tier and Members that are active cardholders of the Amtrak Guest Rewards® MasterCard® issued by Chase Bank with an Amtrak travel spend on the card of over $200 per calendar year may redeem for hotel points and Audience Rewards points.

- Members that are active cardholders of the Amtrak Guest Rewards® MasterCard® issued by Chase Bank with an Amtrak travel spend on the card of over $200 per calendar year may redeem up to 25,000 Amtrak Guest Rewards points per calendar year for hotel points and Audience Rewards.

- Current Amtrak Guest Rewards Select or Select Plus Members (including those who are active cardholders of the Amtrak Guest Rewards® MasterCard® issued by Chase Bank with an Amtrak travel spend on the card of over $200 per calendar year) may redeem up to 50,000 Amtrak Guest Rewards points per calendar year for hotel points and Audience Rewards.

- Current Amtrak Guest Rewards Select Executive Members (including those who are active cardholders of the Amtrak Guest Rewards® MasterCard® issued by Chase Bank with an Amtrak travel spend on the card of over $200 per calendar year) are not subject to point limits when redeeming for hotel points and Audience Rewards.

So in order to transfer at all, you have to have the Amtrak Guest Rewards credit card, and to get 50,000 points you have to spend at least $200 on Amtrak travel. If I’m reading the Amtrak Guest Rewards terms correctly, to get the unlimited transfers, you need to spend $10,000 on Amtrak travel (to become a Select Executive Member) – i.e. not gonna happen. I’d love to be proven wrong about that.

One possible option might be to qualify to do your 50,000 points at the end of December and then again at the beginning of January, which might let you transfer 100,000 points to Choice, netting you 90,000 Southwest points.

Still, if you’re a bit short on Southwest points towards your Companion Pass – this is probably the best transfer option out there! What do you think? Have you or will you take advantage of the Chase -> Amtrak -> Choice -> Southwest point transfer “train” (pun totally intended!) Let me know in the comments!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Good stuff! The credit card requirement does suck, but I love how you out it together!

I think that HAVING the credit card isn’t too onerous (especially if they can get a decent signup) but spending enough to get the top tier in Amtrak and waive all transfer restrictions is crazy.

Thank you for posting this great alternative for those of us unable to get approved for a business southwest card!

I do have a question: does the Amtrak credit card sign up bonus count toward the Select, or Select Plus status?

I am not sure but I don’t think so

My mind is a little blown right now. I have to spend $200 on the Amtrak card to transfer to Choice? I had actually planned on getting that card soon, but was not aware I needed to spend $200 on Amtrak first. Am I reading that right?

Yes I THINK that is how it works. That’s how I read it anyways. Kind of a bummer

I’m not exactly sure what counts as Amtrak, does buying a $200 Amtrak gift card count? Depending on where you live, you might be able to take Amtrak somewhere.

I took advantage of the 45K transfer to SW in early 2014 (Amtrak->Choice->SW) to get the CP.

Also, 100,000 Hyatt points to SW transfer will give you 60,000 SW points. You get an extra 6,000 point bonus for a 50,000 point transfer.

Great post!

Did you also have to spend $200 first to transfer any points out?

Yes, I had to spend $200 first on tickets in 2013 and then again in 2014. I bought the tickets but did not ride on the train. So, basically a $400 donation to Amtrak in order to get 45,000 points to count toward the Companion Pass. It was worth it to me.

Thanks! 🙂

For anyone that needs the Southwest Personal Plus card with the 50K sign up bonus to get your Companion pass or just wants the Plus card. I have some 50K referrals that expire 9/30/2015 if interested.

It is a $69 annual fee

Spend $2000 in 3 months

3000 anniversary bonus

Please email if you want the offer

dbandersen2@yahoo.com

Thanks and have a great day

Thanks for the tips! I take Amtrak to work and didn’t realize I could use my points this way. The only other thing to keep in mind is the time lag if you’re trying to get this in by year-end (as I am). Transferring points from Amtrak to Choice Hotels can take 6-8 weeks (thankfully it only took 2 for me). Now I’m being told that the transfer from Choice Hotels to Southwest will take another 6 weeks…so I’m hoping that is shorter, too, otherwise I’ll be ending the year about 10,000 points short of the Companion Pass 🙂