KEY LINK: Chase United℠ Explorer Card – Earn 80,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $95.

I’ve often said that one of the best ways to get lots of miles and points is through applying for new credit cards. It’s just too hard to get any appreciable amount of miles by just your regular everyday spending (unless you are spending a LOT). So for most people, regularly applying for new credit cards every couple of months is the best way to get enough miles and points to go somewhere fun. Of course, that also goes right into the other thing that I regularly say, and that is to not apply for a credit card just because some guy on the Internet said that you should.

Chase United℠ Explorer Card

The Chase United Explorer Card is the mid-tier co-branded credit card from Chase and United. It currently has a bonus where you can earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

While United MileagePlus miles don’t get you quite as far as they used to, there are still certainly some decent deals around. I used United miles to fly my daughter and I on EVA Air to Taiwan and Beijing a couple of years ago (though we missed the Hello Kitty plane because I’m stupid)

United Explorer card benefits

In addition to the welcome bonus miles, the Chase United Explorer card has the following benefits

- 1st bag checked for free when you use your card to purchase your ticket (note that this benefit is slightly worse than some of the other airline co-branded cards; both American and Delta don’t require you to pay for your ticket with the card to get the free bag)

- $120 Global Entry or TSA Pre credit

- Priority boarding on United flights, including the ability to take a full-size carryon on a Basic Economy ticket.

- 2 one-time United Club passes each year for your anniversary (SEE ALSO: United Club Boston Logan review)

- Earn 2 miles per $1 spent at dining, including eligible delivery services

- Earn 2 miles per $1 spent on hotel accommodations when purchased directly with the hotel

- Earn 2 miles per $1 spent on purchases from United, and 1 mile per $1 spent on all other purchases

- 25% back on United inflight purchases

There is a $0 introductory annual fee for the first year, then $95.

The Real Benefit of the Chase United Explorer card – better award availability

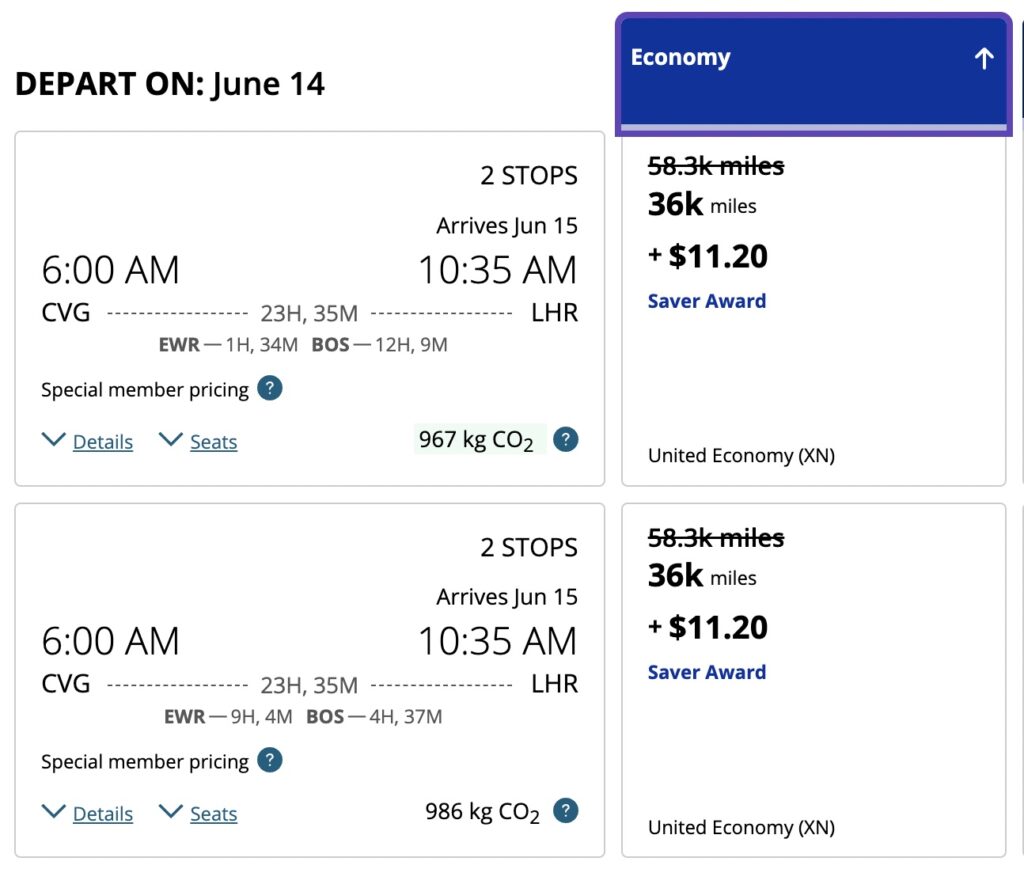

I signed up for this card awhile ago and I have been enjoying one particular perk – the increased award availability. United gives better award availability to elite members and people who hold one of their cobranded credit cards, like the United Explorer card. It’s not uncommon to see things like this when searching for award availability on United.

The crossed out price is the “regular” price while the lower price is only shown to elite members and people who have a United credit card. Just make sure that you’re logged into your MileagePlus account when searching. This has already saved me a few times. I got the card initially because of the waived annual fee the first year, and I’m considering keeping it when the annual fee is charged on my anniversary.

(SEE ALSO: 13 cards I’ll consider paying the annual fee on)

Other Ways To Get United MileagePlus Miles

Keep in mind that Chase Ultimate Rewards points transfer 1:1 to United MileagePlus miles, as long as you have a premium Chase card. So if you’re trying to get United miles, here are a few other cards you can get that will help:

- Chase United℠ Business Card – Earn 125,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $99. Read our full review here

- Chase Sapphire Preferred® Card– Earn 100,000 bonus points after $5,000 in purchases in your first 3 months from account opening. $95 annual fee. Read our full review here

- Ink Business Preferred® Credit Card: Earn 90,000 bonus points after you spend $8,000 in your first 3 months. $95 annual fee. Read our full review here.

The Bottom Line

KEY LINK: Chase United℠ Explorer Card – Earn 80,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. Plus, $0 introductory annual fee for the first year, then $95.

As always, DO NOT APPLY FOR A CREDIT CARD JUST BECAUSE SOME GUY ON THE INTERNET SAYS YOU SHOULD. But if you do plan on applying, we appreciate it if you support the site by applying through our links. Yes, United has definitely devalued their miles, but there is still some value here. The increased award availability can make a big difference, especially if you’re trying to get multiple tickets or travel to a popular destination.

Good luck and happy traveling

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The problem is that the United frequent flyer program has become nearly as bad as Delta’s. They doubled the mileage requirements for awards to Europe. One way economy is 75,000; Business 150,000.