Last summer, I used my miles to fly my parents (in business class) to Scotland and Ireland. They spent about 10 days, mostly in Scotland, and had overall a great time.

(SEE ALSO: 9 traditional Scottish foods to try (besides haggis))

(SEE ALSO: See Scotland’s amazing Falkirk Wheel)

The DREADED stickshift!

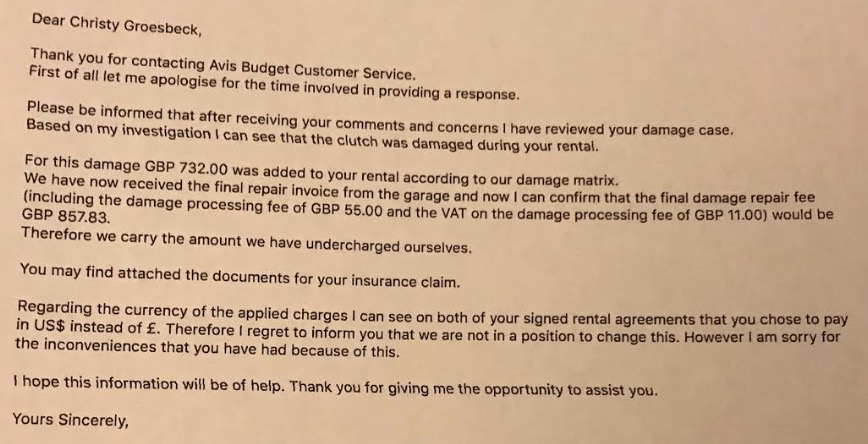

Unfortunately the first day of the trip ended up being what my mom described as “the worst day of her life“. They had rented a car with manual transmission and something with the factor of it being a 6 speed stickshift where it was harder to find 1st gear, driving on a different side of the road and/or narrow roads ended up causing them to burn out the clutch on their rental car!

They were (eventually) able to get a new car and continue on their journey, but at the end of their trip Budget saddled them with a car rental bill of nearly 900 GBP! (about USD$1350)

Thankfully they had paid with their Chase Sapphire Reserve card, which is one of the best cards for car rentals, since it serves as primary rental insurance (SEE ALSO: 17 rewards credit cards that offer primary rental car insurance).

I thought it might be instructive / interesting to walk through the process

Making a Chase Sapphire Reserve insurance claim

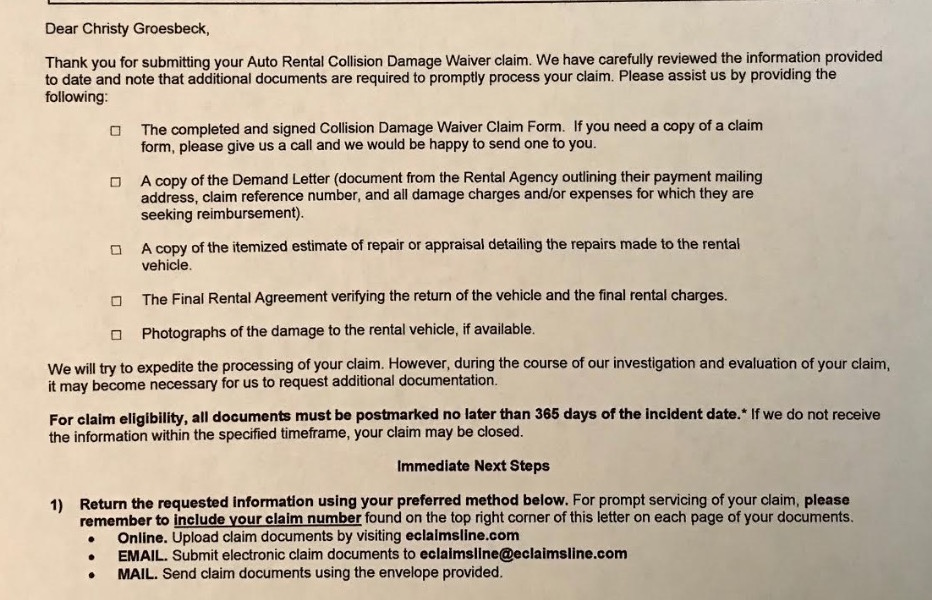

My parents’ trip was in August 2017, and so when they returned back to the United States, my mom reached out to Chase and started the Chase Sapphire Reserve insurance claim process. As you might imagine, Chase does not handle the Chase Sapphire Reserve car insurance claim process directly but instead contracts to a 3rd party (I believe it’s Allianz but I’m not 100% sure – the website is eclaimsline.com)

This company requested details about the incident (included an itemized bill, incident report, etc) but for some reason the information my mom was sending to them for their Chase Sapphire Reserve car insurance claim was not getting processed correctly. When I was up visiting my parents, my mom showed me their Chase Sapphire Reserve insurance claim folder which had no joke 4 or 5 exact copies of the below email

Finally my parents emailed the information AND sent it via registered mail and that managed to do the trick

(Not their actual car 😀 )

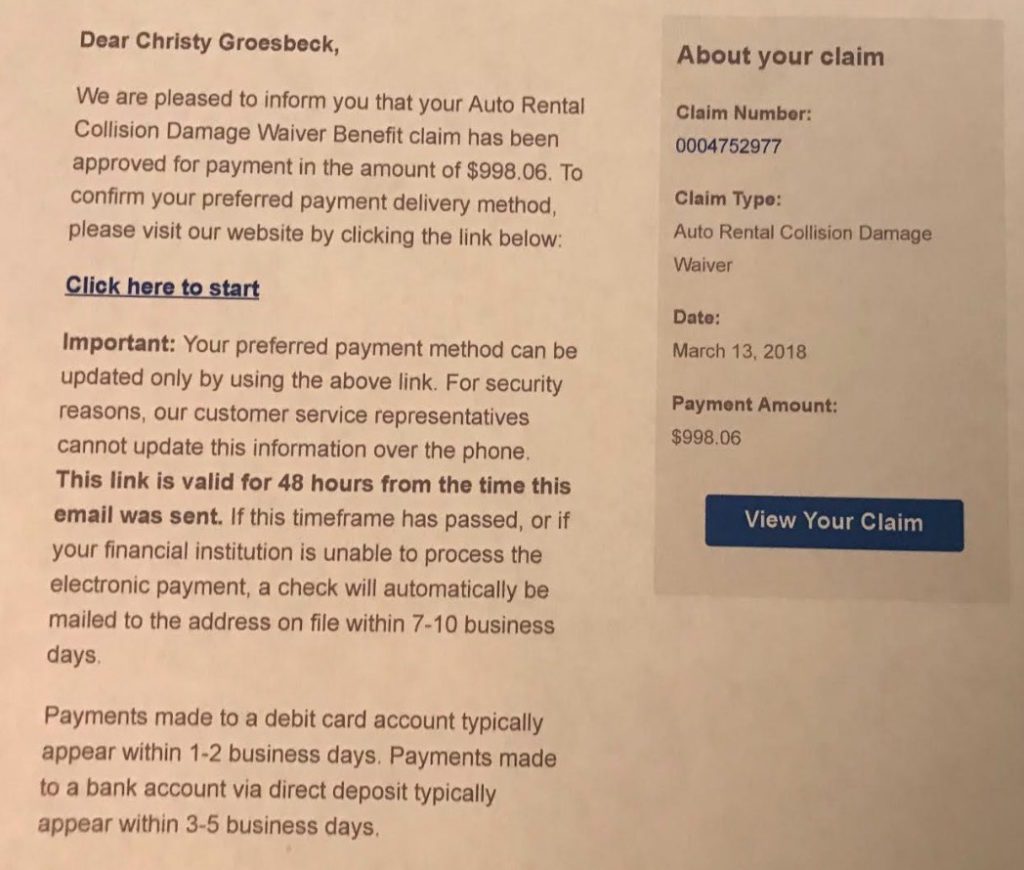

Success! A Chase Sapphire Reserve car insurance claim saved us $900

Once the information was sent to the company, the Chase Sapphire Reserve insurance claim process worked flawlessly. Within a few weeks, they (finally) received an email that a credit in the amount of $998.06 was added to their Chase account

One downside of the process was that they had to float that money for nearly 9 months. As you can see, the original claim was from August 2017 and their claim was not approved until March 13, 2018(!) I don’t know if this is typical for the Sapphire Reserve car insurance process, but that was a bit frustrating.

What’s your experience been with the Chase Sapphire Reserve car insurance claim process? Leave it in the comments

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Had the same experience with Avis / Budget in Edinburgh. They would not send the damage matrix that the Chase Sapphire Reserve was requesting. After multiple conference calls and 9 months, they finally processed the claim using the information that was available.

Sounds like that is typical experience.

I caused nearly $4k of damage to a car I had rented domestically. The Chase insurance covered it in full. What was even better was that the car rental company registers as “travel” on my CC (obviously), so I received 12k in points for the damage claim, and I was reimbursed by check.

It does not normally take 9 months. In my case, it was more because of Sixt taking forever to respond to my dispute, and then me in turn making Sixt wait 3 months to get their money back. The process with eclaimsline was painless and took less than 3 weeks after I had all the docs submitted.

So did they save $900 or $998.06? And what was out of pocket then?

I’m surprised that Chase covered this. My understanding was that they only cover damage as a result of a collision. Since there was no collision in this case, I’m not sure why Chase would have covered it.

But if the damage was ~ $1350 and Chase paid back $998, what was the extra $352? Some part of the claim was disallowed?