I first read on Mommy Points details of a new offer that Hyatt is offering, where holders of the Chase Hyatt card will (for a limited time only) will get 20% off all redemptions.

Chase Hyatt card promotion details

According to the official promotion page, the way it works is:

STEP 1: Register for this promotion by entering your information to the right before March 31, 2015.

STEP 2: Book a stay with points and complete your stay before July 31, 2015. Keep in mind, free nights start with just 5,000 points at any Category 1 property.2

STEP 3: Get 20% of your points back. Your points will be deposited directly into your Hyatt Gold Passport account 4-6 weeks after your completed stay.

Hotel chains have been known to be testing different loyalty offers (in user surveys), to see what kind of benefits really engage user behavior. I wonder if this promotion is something along those line since the removal of the Hyatt Diamond Challenge. Certainly other airlines and hotel chains have similar rebate offers – holders of the Citi AAdvantage card get a 10% rebate on American Airlines redemptions, and IHG bookings get a 10% rebate if you have the IHG card as well.

How to be eligible if you don’t have the Chase Hyatt card

You do have to have the Chase Hyatt card to be eligible for this offer. Wait, didn’t I just say that you DIDN’T have to have the Chase Hyatt card to take part in this promotion??!?! 🙂

Well you do, but if you don’t have the card, you can sign up for the Chase Hyatt card now (soon) and sign up for the promotion once you’re approved. FrequentMiler confirmed with Hyatt on Twitter that that would work. Note that the official terms and conditions say that you have to be a card holder by 1/31, so it may be something you might have to fight for potentially, though the following official tweet should give you some ammunition if it comes to that

@FrequentMiler It is valid for new Hyatt Credit Card members as well. ^MB

— Hyatt Concierge (@HyattConcierge) February 18, 2015

Getting the best Chase Hyatt card offer

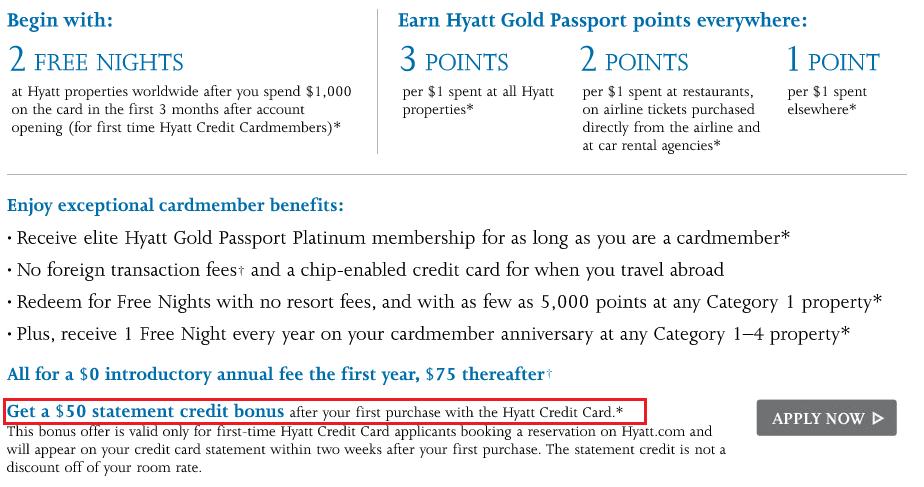

There is a public link for the Chase Hyatt card where you get 2 free nights at any Hyatt that is Category 1-4 after spending $1,000 in the first 3 months. There is a $75 annual fee, but it’s waived the first year. There is a way that you can get the same offer but ALSO get a $50 statement credit after your first purchase.

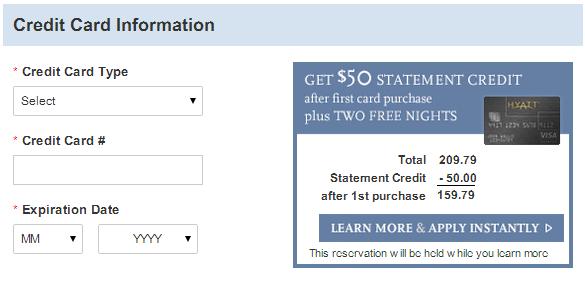

Go out to Hyatt.com and make a booking. When you get to the screen where you put in your booking information, right near the part where you are putting in your credit card information, you should see the following ad

Clicking on that page takes you to the following page, where you can see the bonus details for the card

Clicking on that page takes you to the following page, where you can see the bonus details for the card  (emphasis mine)

(emphasis mine)

Miles to Memories has more information on getting that Chase Hyatt card offer along with his review of the Chase Hyatt card.

Initially, there were some reports that this Chase Hyatt card promotion may be a targeted offer, but we have now learned that it is open to all cardholders that register by 3/31.

Do you have the Chase Hyatt card? How many points do you think you’ll get back in rebates?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.