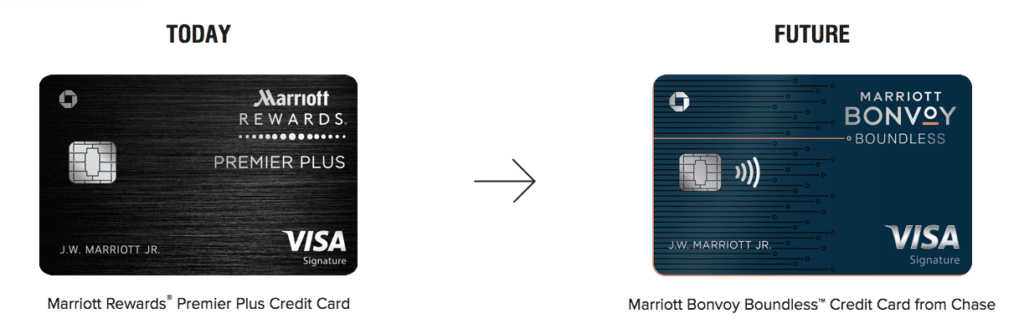

This one’s a doozy. Chase and Marriott are virtually eliminating their Marriott family of cards (though existing cardholders will be grandfathered). The only card available for new applications after February 23rd will be the Marriott Bonvoy Boundless Credit Card from Chase (currently the Marriott Rewards Premier Plus Credit Card). Yes, you heard that right – Chase is cutting their current portfolio of Marriott and Ritz-Carlton cards down to ONLY ONE card for the near future. We’ll have to wait until this summer to get access to a new Marriott personal card with no annual fee.

Changes to the Marriott Premier Plus Credit Card

Existing benefits:

- $95 annual fee

- 6x Marriott Rewards on Marriott and SPG stays, 2x everything else

- Free in-room internet

- 15 Elite night credit annually as long as you hold the card (does not stack with other SPG/Marriott card elite credits)

- Silver Elite status

- Earn Gold Elite status with $30,000 or more in purchases in a calendar year

- Free hotel night each year after renewal, up to 35,000 points

The updated versions of this card will be called the Marriott Bonvoy Boundless Credit Card from Chase. Quite the mouthful. This card is almost identical to the new Marriott Bonvoy American Express card being released. Both have a $95 annual fee, the same earning structure, and the same status benefits.

If you’re looking to apply for the existing Marriott Premier Plus Credit Card before it goes away, you can do so here (I may receive a commission)

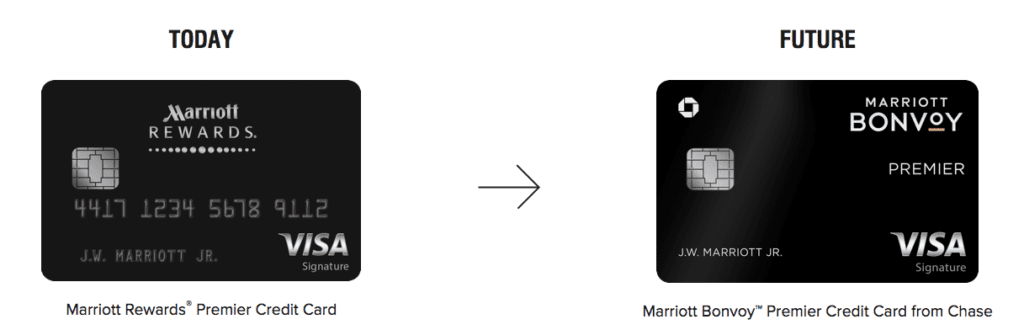

Changes to the Marriott Premier Rewards Credit Card

Existing benefits (reminder, this card is no longer available for new applicants):

- $85 annual fee

- 5x Marriott Rewards on Marriott and SPG stays, 2x on car rentals/restaurants/air travel from airlines, 1x everything else

- 15 Elite night credit annually as long as you hold the card (does not stack with other SPG/Marriott card elite credits)

- Free hotel night each year after renewal, up to 25,000 points

- 1 additional Elite night credit after each $3,000 in spend

This card pales in comparison to the Bonvoy Boundless. With half the benefits and a terrible earning structure, you can tell that Marriott/Chase is pushing you away from the card. The observant reader will also note the change in annual night rules. Not a typo, they’re reducing the availability from a 35,000 night to a 25,000 night.

In my opinion, there’s no reason at all to keep this card.

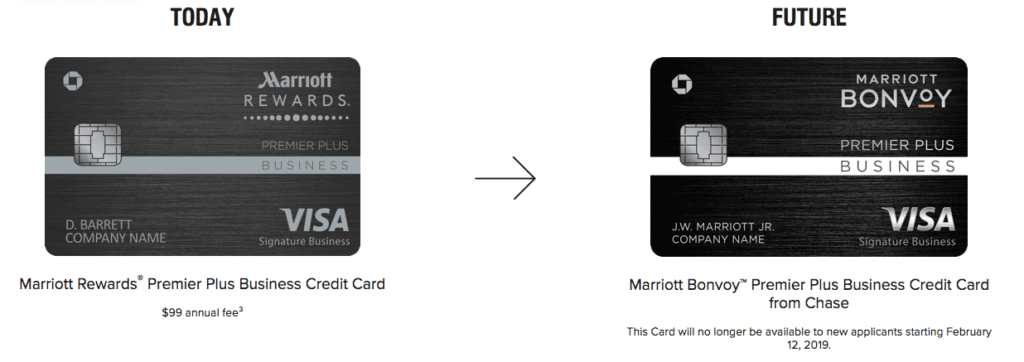

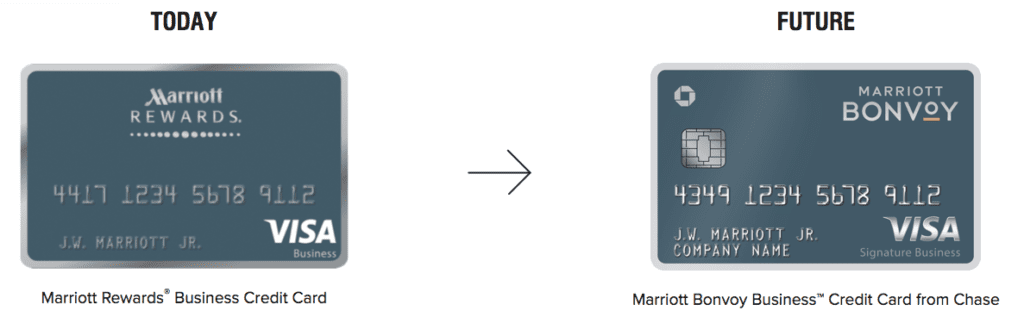

Changes to the Marriott Rewards Premier Plus Business Credit Card

Existing benefits (reminder, this card will no longer be available for new applicants after February 12th, 2019 ):

- $99 annual fee

- 6x Marriott Rewards on Marriott and SPG stays, 4x on gas/restaurants/shipping/cable/phones/internet, 1x everything else

- 15 Elite night credit annually as long as you hold the card (does not stack with other SPG/Marriott card elite credits)

- Free hotel night each year after renewal, up to 35,000 points

- Free in room internet

Chase has added one new feature to this card – the ability to earn an additional free night (up to 35,000 points). You’ll have to spend $60,000 within a calendar year, putting it on par with AmEx’s Hilton offerings.

Interestingly, you’ll still be able to apply for the business card until February 12th, after which it will no longer be available. If you want a business card to earn Marriott Rewards, ahem, I mean Bonvoy points, you’ll need the Bonvoy Business from American Express.

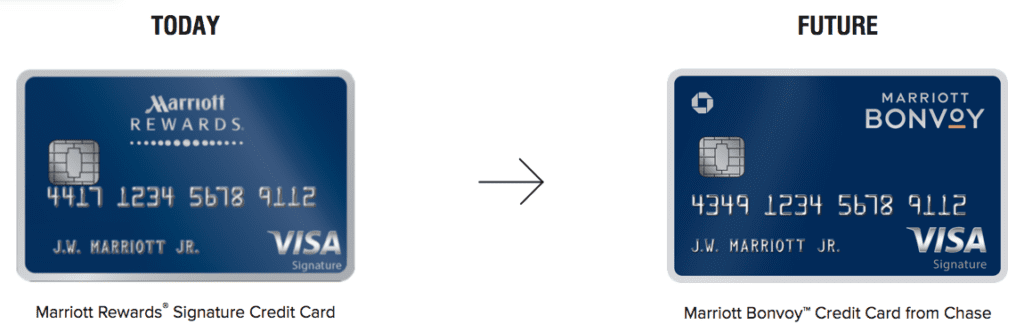

Changes to the Marriott Rewards Signature Credit Card

Existing benefits (reminder, this card is no longer available for new applicants):

- $45 annual fee

- 3x Marriott Rewards on Marriott and SPG stays, 1x everything else

- 15 Elite night credit annually as long as you hold the card (does not stack with other SPG/Marriott card elite credits)

- Free hotel night after $25,000 in purchases, up to 20,000 points

- 1 additional Elite night credit after each $3,000 in spend

This will be a TERRIBLE card. Please, please cancel. Virtually no benefits, an awful earning structure, AND it has an annual fee. The audacity…

Changes to the Marriott Rewards Business Credit Card

Existing benefits (reminder, this card is no longer available for new applicants):

- $45 annual fee

- 3x Marriott Rewards on Marriott and SPG stays, 1x everything else

- 15 Elite night credit annually as long as you hold the card (does not stack with other SPG/Marriott card elite credits)

- 1 additional Elite night credit after each $3,000 in spend

Just when I thought it couldn’t get any worse…the Marriott Bonvoy Business deserves no consideration. Chase is clearly trying to get rid of these cards.

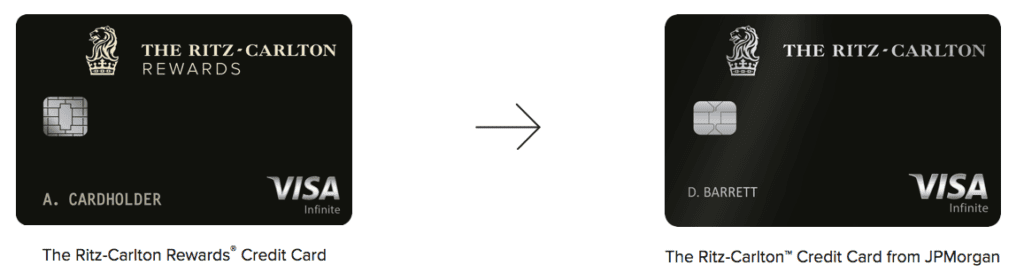

Changes to The Ritz-Carlton Rewards Credit Card

Existing benefits (reminder, this card is no longer available for new applicants):

- $450 annual fee

- 6x Marriott Rewards on Marriott and SPG stays, 3x on airlines/car rentals/restaurants, 2x everything else

- Free in-room internet

- 3 club upgrades annually

- Gold Elite status

- Earn Platinum Elite status with $75,000 or more in purchases in a calendar year

- Free hotel night each year after renewal, up to 50,000 points

- $300 travel credit

- $100 Global Entry/TSA PreCheck credit

- $100 hotel credit for paid Ritz-Carlton stays of 2 nights or more

The gold is now silver. Much classier. The luxury card for the Marriott/Ritz/Starwood brand is now firmly in AmEx’s court, as planned.

New Chase Marriott Card Coming in Summer 2019!

We don’t know much about the new option so far. Chase is going to offer another personal Marriott Bonvoy card, to be released this summer. This new option will have no annual fee. Hopefully we’ll see some more details soon! Hopefully the name will be just as cool as the others…Bonvouy Bodacious? Bonvoy Breathtaking? Bonvoy Bountiful? Wait wait, I’ve got it…the Bonvoy Bliss Credit Card from Chase! (You heard it here first!)

Chase is obviously trying to cut out some of these cards. I’m sure as part of the deal between them and American Express, they have to close down quite a few of the Marriott cards. It doesn’t make sense to add exciting new benefits to cards that can no longer be applied for.

I suppose you could make a case for elite status with some serious manufactured spending. 1 Elite night per $3,000 spent on some of these cards? But still, there are easier ways to hit status, and so much more points to be had with that level of MS.

I’m not particularly excited about these changes…what do you think?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

The only real reason to keep the older chase marriott cards is if you are close to achieving lifetime status at the new rates, since you can still “buy” the nights, albeit at a lousy rate. There is no ability with the current portfolio of cards.