With tonight’s games we’re officially onto Round 3, and halfway through the tournament. American Express and Chase have some great cards heading into Round 3, and Barclays manages to hang on by a thread! Keep reading in on the action, and don’t forget to vote below!

Loving the Card Madness 2019 series? Follow along here:

- Pick the Best Credit Card of the Year with Card Madness 2019!

- Card Madness 2019 Bracket is up! Check the 64 Cards and Vote Now

- Card Madness 2019 – Vote for Your Favorite Round 1 Cards!

- Card Madness 2019 – AmEx and Chase Dominate the Competition!

- Card Madness 2019 – Two Games go into Overtime!

- Card Madness 2019 – Ultimate Rewards are Undefeated in Round 1!

- Card Madness 2019 – Flexible Points Lead the Pack, Goodbye Airline Cards!

- Card Madness 2019 – Hotel Cards for the Win, and Ultimate Rewards Finally Lose!

- Card Madness 2019 – PWaC Readers Must Like Paying Annual Fees!

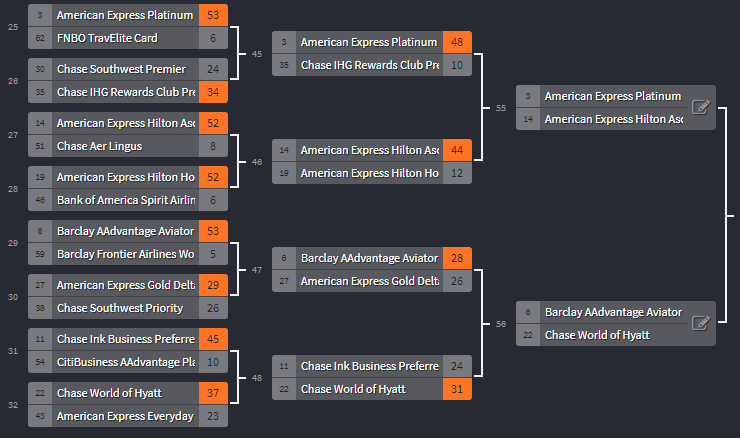

Game 45: American Express Platinum (48 votes) vs. Chase IHG Rewards Club Premier Credit Card (10 votes)

The American Express Platinum moves onto Round 3, defeating the Chase IHG card by a wide margin! With a 48 to 10 victory, this only further proves out point – high annual fees are ok, as long as the banks offer some great benefits to match. This is another game that I thought would be a bit closer, since the IHG card beat the Southwest Premier (another personal favorite) 34-24 in Round 1. The Platinum will move onto the next round and face…

Game 46: American Express Hilton Ascend Card (44) vs. American Express Hilton Honors Card (12)

…the Hilton Ascend card! The Ascend defeated the basic Hilton Honors card by 32 votes. You guys didn’t mind the annual fee of $95, and favored the increased earning structure, free weekend night, and complimentary Gold status. The outcome of this game didn’t surprise me. Not only have PWaC readers continually picked cards with benefits over low fee cards, but the Ascend in particular offers many advantages over the lower tier Hilton Honors Card.

Game 47: Barclay AAdvantage Aviator Red (28) vs. American Express Gold Delta SkyMiles (26)

Games 47 and 48 were much closer. The Aviator Red and Gold Delta SkyMiles seem to have been evenly matched, but the Aviator pulled ahead in the end. Both cards offer double miles, discounts, and benefits on their partner airlines. I can’t help but wonder if Barclay’s great welcome offer for the AAdvantage Aviator Red helped the card garner a few extra votes.

(SEE ALSO – Book Your Next American Airlines Flight by April 30th!)

Game 48: Chase Ink Business Preferred (24) vs. Chase World of Hyatt (31)

Another close game, the Hyatt barely defeated the Ink Business Preferred card. Hotel cards have done pretty well in the tournament so far: the Hilton Aspire, Bonvoy Brilliant, Hilton Ascend, and World of Hyatt are into Round 3! As a reminder, the Hyatt card offers double Hyatt points on gyms and fitness, travel, mass transit, ride-sharing, and restaurants, and quadruple points on Hyatt hotel stays.

Follow the Challonge bracket here!

We’re Officially onto Round 3!

Vote for your favorite Round 3 games below! This is where it really gets tough.

Game 49: American Express Gold vs. Chase Freedom

The American Express Gold is our number 1 seed in this tournament, and it shows! The Gold defeated both its Round 1 and Round 2 competitors be a margin of 60 votes or more. This matchup might be a little tougher for our fan favorite. With a $250 annual fee, the Gold card is in the middle of the pack, and has some fantastic benefits. American Express recently introduced a new $10 monthly dining credit for select restaurants and bumped the earning rate up to 4x Membership Rewards on restaurants and groceries (up to $25k in purchases annually), and triple points on airlines and AmEx Travel. Plus, you’ll still get your $100 annual airline credit, immediately offsetting at least a third of the annual fee (if you travel).

The Freedom on the other hand, is a bit simpler of a card, with less benefits, but also no annual fee. You’ll earn 5x Ultimate Rewards on quarterly rotating categories, and 1x on everything else. Having a Chase Freedom in your wallet can mean easy access to Chase Ultimate Rewards, but you’ll need to have one of the higher end cards as well to extract the highest value. Only the higher tiered Ultimate Rewards cards give holders access to Chase’s strong list of transfer partners and the Ultimate Rewards Travel Portal.

I think this match might be a close call, but I know where I’m casting my vote…

Game 50: Chase Ink Business Cash vs. Citi ThankYou Premier

The Chase Ink Business Cash earns 5% back on up to $25,000 spent annually on office supply stores, internet, phone, and cable, and another 2% back on up to $25,000 spent annually at gas stations and restaurants. Here’s the thing though: the Ink Cash really earns Ultimate Rewards points, not just cashback. There’s also no annual fee! The Ink Cash is definitely a great card for spending in those categories, even with the annual cap on spend.

The ThankYou Premier is a personal favorite of mine, as I’ve extracted a lot of value out of ThankYou Points’ airline partners. I always recommend folks accumulate multiple currencies, especially transferable points. For me, that means Citi ThankYou Points and Membership Rewards. (Darn you, 5/24!) The Premier earns triple points on travel and gas, double points on restaurants and entertainment. There’s a $95 annual fee (that’s usually waived the first year), but other than that, the value proposition is straightforward: Do you like Citi’s transfer partners? Do you spend on travel, restaurants, and entertainment? If both those answers were yes, you should consider the Citi ThankYou Premier.

ThankYou Points give you access to 3 unique transfer partners: Garuda Indonesia, Malaysia Airlines, and EVA Air.

Game 51: American Express Hilton Aspire vs. Chase Sapphire Preferred

The Hilton Aspire has seen some great support in Rounds 1 and 2, knocking out the Wells Fargo Propel Card and the Chase Freedom Unlimited. For a hefty $450 annual fee, cardholders get 14x Hilton points on stays at Hilton hotels, 7x on airfare, amextravel.com, car rentals, and U.S. restaurants, and 3x on everything else. That 3x sounds high, but keep in mind that Hilton points don’t typically garner a high cpp (cents per point) value. You’ll also get the following annual benefits: a $250 hotel credit, $100 credit on each stay of at least 2 nights at Waldorf and Conrad hotels, a $250 airline credit, a free weekend night, complimentary Diamond status, and Priority Pass Select membership.

Still, I think the Aspire is the underdog in this match. The Chase Sapphire Preferred is one of the most talked about cards in the game. Whether you have one or not, you know what the Preferred is, and let’s be real – you probably do have it. The Sapphire Preferred gives cardholders double points on travel and dining, and grants access to the Chase Travel Portal and their transfer partners. As explained above, many people runa 2 or 3 card Chase strategy – with the Freedom and Freedom Unlimited for points accumulation, and the Preferred or Reserve for the benefits and transfer partners.

I think the Aspire might be able to take down the OG Sapphire Preferred…let’s see!

Game 52: Bank of America Alaska Airlines Visa vs. American Express Marriott Bonvoy Brilliant

This is Bank of America’s last chance! BoA started the tournament with 6 cards, and everything has been knocked out so far, save the Alaska Airlines Visa. Though it isn’t a particularly amazing card in its own right, the Alaska cards conjure up images of first class Cathay seats, due to Alaska Airlines’ great partner awards.

The Bonvoy Brilliant is a fairly new addition to the travel scene, a BLANK of the Marriott-Starwood merger, the card has some serious fans here at Points With a Crew. You guys voted for the Bonvoy Brilliant over the MileagePlus Club card in Round 1, and then it went on to defeat the Citi AAdvantage Platinum Select in Round 2. Earn 6x on Marriott, 3x on airfare, and 2x on everything else, plus complimentary Gold status, a free night annually, and an annual resort credit of $300.

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.