So with the big hotness of the new Chase Sapphire Reserve application link going live, everyone has been all aflutter with talk over this new car, and it’s hard to fault them.

With a signup bonus of 100,000 Ultimate Rewards and a $300 travel credit

(SEE ALSO: Chase Sapphire Reserve vs Amex Platinum vs Citi Prestige)

Calling for an American Express Platinum retention offer

So I decided to call up Amex and see if we could get an American Express Platinum retention offer. I had a bit of a problem with the automated system because I couldn’t remember my “security code”, but eventually I was able to get to a live person and work through that.

I talked about the new Chase Sapphire Reserve card, and how its benefits compared to the existing Platinum Card® from American Express, especially the 1.5 cpp value on travel redemptions and $300 travel credit

His comment was “It looks like they just took our Platinum card and copied it”, which I thought was hilarious. After putting me on a brief hold, he gave me the following Amex Platinum retention offer

- 5,000 Membership Rewards immediately

- 10,000 Membership Rewards after spending $2000 in the next 3 months

I took the offer. He mentioned that this offer may not be available for everyone, though I do know at least one other person who got the same offer.

Calling for a Citi Prestige retention offer

Calling Citi was just as painless. I once again told the initial representative that I was not sure if I wanted to keep my card, given the benefits of the new Chase Sapphire Reserve credit card. This time I actually remembered my security word, so it went a little smoother 🙂

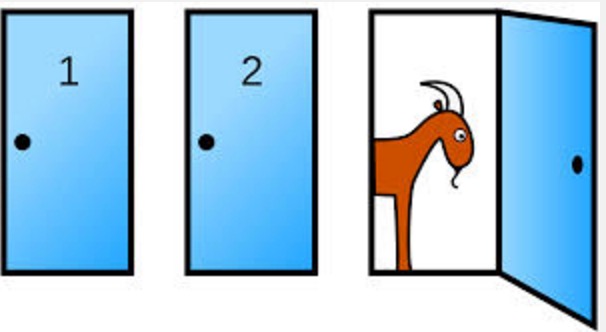

The initial representative transferred me to an account specialist who was very friendly. She checked into things and came back with 3 different offers. I kind of felt like I was on Let’s Make a Deal with Door #1, Door #2 and Door #3 🙂

- Door #1 – $200 statement credit if I spent $4000 in each of the next 3 months

- Door #2 – 4x bonus ThankYou points on spend at airlines, hotels, travel agencies and car rentals over the next 6 months, up to a maximum of 35,000 bonus TYP

- Door #3 – 10,000 bonus ThankYou points if I spent $3000 total over the next 6 months

I could see value in any of the 3 different offers, depending on your specific spending patterns. I ended up taking the 3rd option (10K ThankYou points).

If you have either of these 2 cards, I’d recommend calling to see if you can get an Amex Platinum retention offer or Citi Prestige offer.

If you’ve called for an American Express Platinum retention offer or Citi Prestige retention offer, let us know what you got in the comments

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Interesting. I called up Amex plat retention awhile back… Apparently the only thing they won’t offer is reduction on annual membership. Wondering if anyone else has experience on that?

Not true. Early summer my wife was given a lowered annual fee of $200. There was something else too – but I can’t remember what.

Just got the Citi 10k points offer for $3k spend for 6months.

We just called Amex & were offered, $400. Credit or 40,000 points. We selected the points. They also offered & we accepted the Global Entry free of charge.

How long ago did you sign up for the AMEX Platinum? Think they will offer it for those who just got it a few months ago?

I got it with the 100,000 point offer a few months ago. Can’t hurt to call and ask

Thank you! Called and received the same offer.

How much do you spend per year on Amex Platinum card?

My annual fee will post in 4 months and am thinking about just waiting until then since I’ve always received better retention offers just about as my manual fee is about to post.

I’d say not a ton – I have “a lot” of credit cards, so usually spread the spend around

When you got Citi Prestige card, is AF due? I got this card 2 months back, wondering if I should call? I am still in period when I can cancel and get my AF back.

I got my Prestige card back in December 2015 (which was part of the reason I screwed up my Citi Prestige airline credit)

Thanks for posting. Just tried and only got the 5000 point offer and canceled with $337 back from fee recently paid. Want to cancel my husband’s card but still have $185 to use for airline. Will buy gift card tonight and cancel after credit posts

Thanks for the suggestion. I was offered:

– $200 account credit; OR

– 20,000 points after $4k spend in 3 months

I took the case since I’m not sure about my spend

So does this mean you committed to another annual fee payment on each card?

No I don’t think so.

so your point is ? does it make you proud that you did this?

My point is to alert other people that may have the Citi Prestige or Amex Platinum that they may also be eligible for retention offers. Judging by other people’s comments, it sounds like it was successful

Don’t be an ass. People like myself read this newsletter for tips. This tip is helpful. Not sure what YOUR point is?

My point was to let all readers know that based on the original posting of the Amex retention possibilities, we called & were offered points or dollars! I guess I should have said THANK YOU too!

I was given a choice of two offers.

1) a $100 statement credit.

2) 5K MR and another 10K MR after 2K spend in 90 days

Took the second offer which will get me 15K points total

I got $200 credit for Amex Plat last year. This year… nada. But when i called, it was 5 days short of 1 full year since the last credit. That was 2 weeks ago. Retention suggested I try again once a year has passed. Thanks for the reminder.

He didnt give me any retention offer, he directly went ahead and cancelled my card. I was with them for 15 months, it was weird.

Interesting! Smart of them to do it…especially in light of the Admirals Club access going away for Prestige. JUST got the Amex Plat and my Prestige AF JUST hit last month so I kinda missed the boat, it seems. I’ll try next year.

I called and received the choice of 40k MR (no spend required) or $400 statement credit. Took statement credit. $230k spend last year

Wow – they really don’t want to lose you!

I got 5,000 points immediately and 15,000 with $3000 spend in 90 days.

Did your MR not get frozen from the May offer?

That is correct – mine seem fine

Did you threaten to cancel first or just ask for referral offers?

I didn’t threaten to cancel but I was hinting around ;-).

I was given 40,000 or $400 credit. Blown away! I took the points!

Was offered:

1. $200

2. 20,000: 5,000 immediately and 15,000 points for spending $3000 in 90 days. (to post in 6-8 weeks).

Chose #2

I opened a Plat mercedes in April and a regular one in May. I use the Platinum for my everyday spend and I had no retention offers. Maybe I was too nice, “there’s a new awesome card out and I was wondering if you have any retention offers to keep me as a customer.”

I was given options 1 and 2 and turned them down. Then offered an extra thank you point across the board for the different categories for 6 months. I took that one.

No retention offer for Amex Platinum, citing my 100K sign up bonus, which was not supposed to be publicly available, CSR said.

Prestige, offered:

1. $200 statement credit if I spent $4000 in each of the next 3 months

2. 4 additional bonus ThankYou points on spend at airlines, hotels, travel agencies and car rentals over the next 6 months, up to a maximum of 35,000 bonus TYP

3. 1 additional bonus ThankYou point on all spending for the next 6 months.

Took option 2.