Another one bites the dust. The 10% rebate on American Airlines redemptions will end on April 30th, 2019. We heard rumors floating around last week. Now both Citi and Barclay have confirmed the removal of this card benefit from the AAdvantage Platinum Select and Aviator Red cards.

What is the 10% rebate?

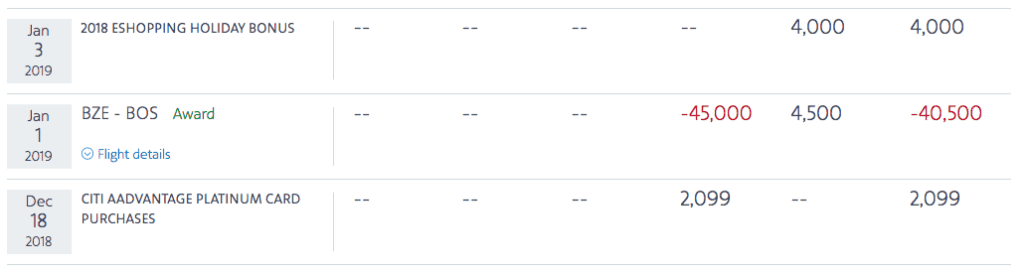

Both the AAdvantage Aviator Red World Elite Mastercard and Citi AAdvantage Platinum Select World Elite Mastercard previously had a 10% rebate on mileage redemptions. Book a flight for 25,000 AAdvantage miles, and you’ll get 2,500 miles back. This is a great benefit for anyone using lots of AAdvantage miles! The rebate is maxed out at 10,000 annually, so you’d need to book 100,000 AAdvantage miles of flights to get the maximum value.

Unfortunately, you’ve only got until April 30th to take advantage of your 10% rebate! So far this year I’ve already spent 60,000 American Airlines miles on flights, qualifying me for 6,000 miles back. I don’t think I’ll have enough time (or flights to book) by April to max this benefit out, but I’m sure going to try!

The 10% rebate was the only reason for me to keep my Citi AAdvantage Platinum card. Sorry Citi, the other benefits just aren’t worth the annual fee in my opinion. Free checked bag on domestic itineraries? I typically fly carry-on only. Priority boarding? It’s cool, my patience could use some practice anyway. From now on, the only American Airlines card in my wallet will be the Citi AAdvantage MileUp card. No annual fee and double miles on groceries? Yes, please!

H/T – Doctor of Credit and View From the Wing

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

I’ll be canceling my Citi AAdvantage cards and keeping my Barclay Aviator Silver card despite losing the 10% mileage rebate. The added $25 per day inflight food and beverage credit, $50 annual inflight Wifi credit, the new “Flight Cents” benefit, plus the 2 $99 companion certificates per year for the new lower spending requirement of $20,000 vs. $30,000 before makes it a keeper for me.

Agreed Ed, the Aviator Silver is the clear leader IMO, unless you

needwant lounge access from the Citi AAdvantage ExecutiveIf Barclay ever adds Priority Pass membership, it’ll be the only card I carry – I’d drop my Chase Sapphire Reserve in a heartbeat. I’d love to have Admiral’s Club membership, but not enough for the price of the Executive Card. I’ll just have to be satisfied with Admiral’s Club access when I fly up front.

Honestly, I hadn’t been impress with the Admiral clubs, thus I got rid of my $450/yr AA Executive CC, I really don’t see the value for just the Admiral club access now. The Executive is overrated.

I have the aviator red, maybe I should look at the silver,,,if Barclays will let me get it, they turned me down for the Hawaiian card.

I’ll miss the 10% miles rebate and have received the 10,000 most years. However, for now, we will be keeping it. Most our travel now is vacation with my husband and the luggage benefit more than offsets the annual fee for us.