News was announced recently that Barclaycard and Uber are teaming up to introduce a new Barclaycard Uber credit card. This Uber credit card is not available for signups yet, but will be available starting November 2nd, reportedly only on the Uber website.

Barclaycard Uber credit card signup bonus and redemptions

The Barclaycard Uber credit card is reported to come with a signup bonus of 10,000 points after you spend $500 in net purchases within the first 90 days of having the Uber credit card. These points can be redeemed for $100 value in Uber credits, $100 in cash back, or $100 in gift cards.

Redemptions for Uber credits start at 500 points for $5 and all other redemptions start at 2,500 points for $25.

Barclaycard Uber credit card category bonuses

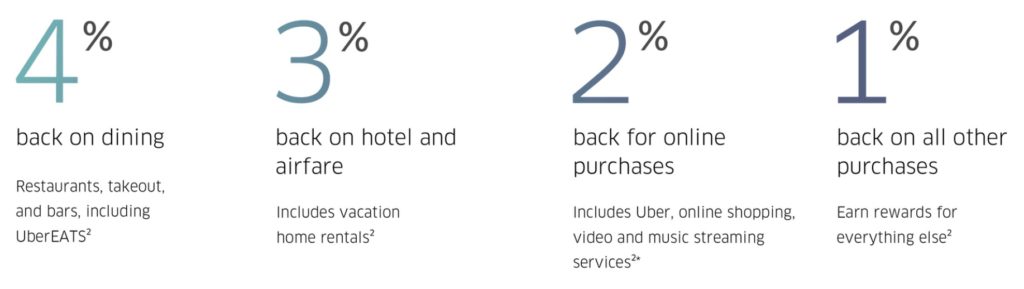

The Barclaycard Uber credit card comes with a variety of category bonuses for ongoing spend, arrayed in a 4-3-2-1 pattern

- 4% back on dining including restaurants, takeout, bars and UberEATS

- 3% back on hotel and airfare including vacation home rentals / airbnb

- 2% back on online purchases including Uber and online shoppint

- 1% back on all other purchases

4% back on dining is pretty competitive compared with other cards. Other than periodic 5% category bonuses that might have restaurants, 3% is the highest category bonus on dining that I’ve seen

Other benefits of the Uber credit card

There are a few other benefits of the Uber credit card

- Cell phone protection up to $600 per claim as long as you pay your cell phone with the Uber card. It comes with a $25 deductible and you can use the protection twice per year ($1200 max)

- No foreign transaction fees (rare for a no-fee card)

- $50 credit towards online streaming services after spending $5000 on the card. Eligible services include Apple Music, Pandora, Spotify, Amazon Music, Google Music, Audible, Sirius XM, Netflix, Hulu, HBO NOW, DirecTV NOW, the membership fee for Amazon Prime, and Shoprunner.

- Cardmembers will have the option to attend special events which Uber anticipates primarily in cities such as New York, San Francisco, Los Angeles, Chicago, and D.C.

My take on the Uber Barclaycard partnership

The new Uber card is definitely intriguing for a certain set of people. It feels like they are going after recurring monthly purchases (wireless phone, Amazon Prime, etc) that people are likely to set up on autopay and then forget. The cell phone protection is nice but only comes if you are charging your monthly bill to the Uber card. I personally use the Chase Ink Plus for mine (5x points) but the new Chase Ink Preferred (available on our top credit card offers page) gives 3x on cell phone purchases and has cell phone protection. It also comes with a $95 annual fee of course.

Frequent diners would definitely want to look at this card due to the 4% dining credit

I’m not sure I’d spend $5000 on the card to get the $50 online streaming credit – the opportunity cost of putting that spend on a 2% cashback card would be $100 – twice as much as the credit would be worth

While we haven’t seen a hard and fast rule, Barclaycard has definitely been making it harder for people with lots of new account inquiries to get their cards lately.

What do you think? Will you be signing up for the new Barclaycard Uber credit card when it comes out?

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as thepointsguy.com. This may impact how and where links appear on this site. Responses are not provided or commissioned by the bank advertiser. Some or all of the card offers that appear on the website are from advertisers and that compensation may impact on how and where card products appear on the site. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners and I do not include all card companies, or all available card offers. Terms apply to American Express benefits and offers and other offers and benefits listed on this page. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Other links on this page may also pay me a commission - as always, thanks for your support if you use them

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

Dan Miller travels with his wife and 6 (SIX!) children. He loves to help families travel for free / cheap, especially larger families. If you are looking for help, drop him an email at

User Generated Content Disclosure: Points With a Crew encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.